Question: please answer asap and show work 6. (Part 1- 10 Points) BUSN 331 INC. Has the following cost of capital structure: 60% After tax debt

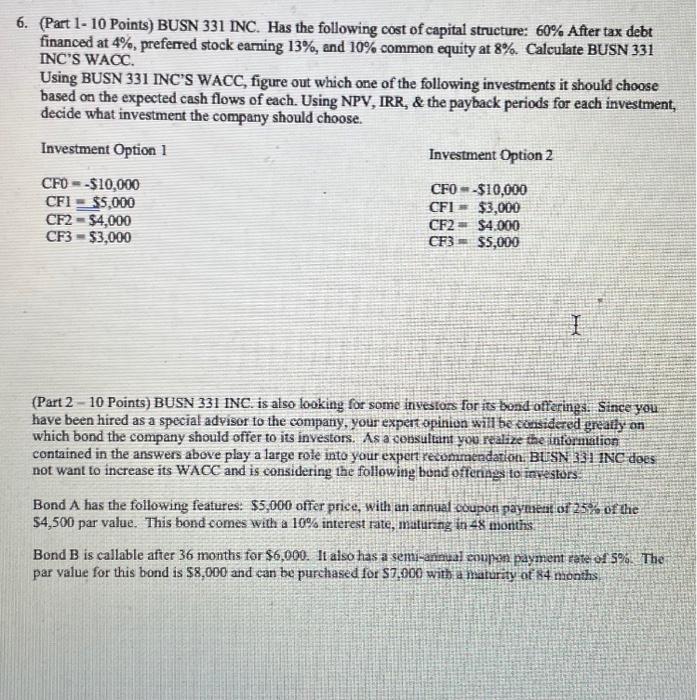

6. (Part 1- 10 Points) BUSN 331 INC. Has the following cost of capital structure: 60% After tax debt financed at 4%, preferred stock earning 13%, and 10% common equity at 8%. Calculate BUSN 331 INC'S WACC. Using BUSN 331 INC'S WACC, figure out which one of the following investments it should choose based on the expected cash flows of each. Using NPV, IRR, & the payback periods for each investment, decide what investment the company should choose. Investment Option 1 Investment Option 2 CFO $10,000 CFI = $5,000 CF2 - $4,000 CF3 = $3,000 CFO-$10,000 CFI - $3,000 CF2 - $4.000 CF3 $5,000 I (Part 2 - 10 Points) BUSN 331 INC. is also looking for some investors for its bend offerings. Since you have been hired as a special advisor to the company, your expert opinion will be considered greatly on which bond the company should offer to its investors. As a consultant you realize the information contained in the answers above play a large role into your expert recommandation BUSN 331 INC does not want to increase its WACC and is considering the following bond offerings to investors Bond A has the following features: $5,000 offer price, with an annual coupon payment of 25% of the 54,500 par value. This bond comes with a 10% interest rate, muturing in 48 montis Bond B is callable after 36 months for $6,000. It also has a semi-annual coupon payment rate of 5%. The par value for this bond is 58,000 and can be purchased for $7.000 with a maturity of 84 months

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts