Question: please answer asap drop down options are: meets or does not meet Determine the effects of S 351 for the following taxpayers. If an amount

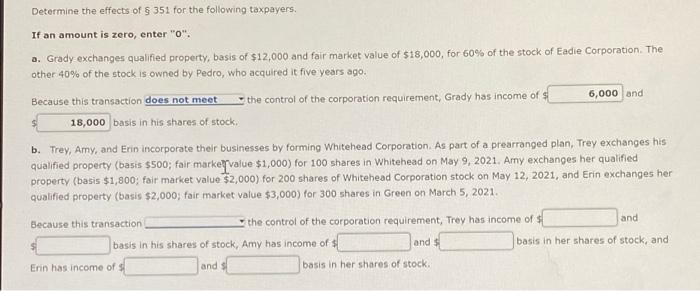

Determine the effects of S 351 for the following taxpayers. If an amount is zero, enter "0". a. Grady exchanges qualified property, basis of $12,000 and fair market value of $18,000, for 60% of the stock of Eadie Corporation. The other 40% of the stock is owned by Pedro, who acquired it five years ago. Because this transaction does not meet the control of the corporation requirement, Grady has income of $ 6,000 and 18,000 basis in his shares of stock, b. Trey, Amy, and Erin incorporate their businesses by forming Whitehead Corporation. As part of a prearranged plan, Trey exchanges his qualified property (basis $500; fair market value $1,000) for 100 shares in Whitehead on May 9, 2021. Amy exchanges her qualified property (basis $1,800; fair market value $2,000) for 200 shares of Whitehead Corporation stock on May 12, 2021, and Erin exchanges her qualified property (basis $2,000; fair market value $3,000) for 300 shares in Green on March 5, 2021. Because this transaction the control of the corporation requirement, Trey has income of $ and basis in his shares of stock, Amy has income of $ basis in her shares of stock, and and Erin has income of and basis in her shares of stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts