Question: PLEASE ANSWER ASAP . During an interview with an IRS official on Fox & Friends, the interviewer asks, So how do you decide which Forms

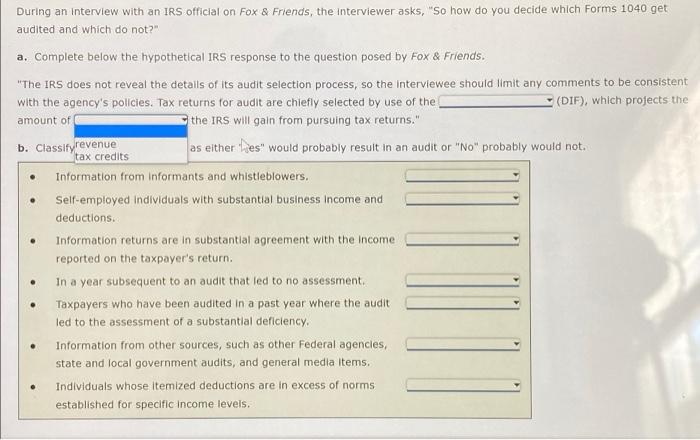

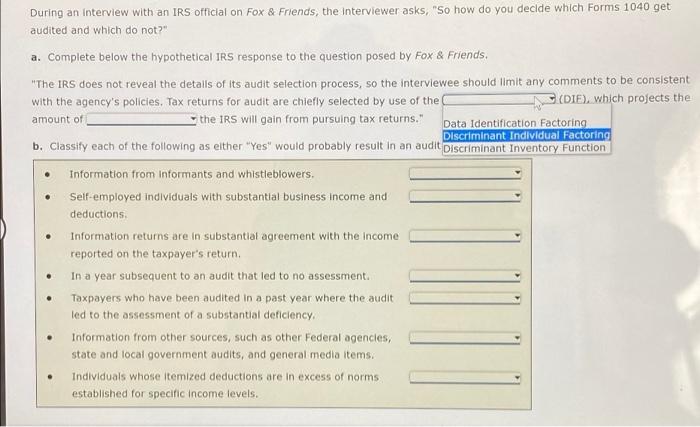

. During an interview with an IRS official on Fox & Friends, the interviewer asks, "So how do you decide which Forms 1040 get audited and which do not?" a. Complete below the hypothetical IRS response to the question posed by Fox & Friends. "The IRS does not reveal the details of its audit selection process, so the interviewee should limit any comments to be consistent with the agency's policies. Tax returns for audit are chiefly selected by use of the (DIF), which projects the amount of the IRS will gain from pursuing tax returns." b. Classify revenue as either hes" would probably result in an audit or "No" probably would not. tax credits Information from informants and whistleblowers. Self-employed individuals with substantial business Income and deductions. Information returns are in substantial agreement with the income reported on the taxpayer's return In a year subsequent to an audit that led to no assessment. Taxpayers who have been audited in a past year where the audit led to the assessment of a substantial deficiency Information from other sources, such as other Federal agencies, state and local government audits, and general media items, Individuals whose itemized deductions are in excess of norms established for specific income levels. . During an interview with an IRS official on Fox & Friends, the interviewer asks, "So how do you decide which Forms 1040 get audited and which do not?" a. Complete below the hypothetical IRS response to the question posed by Fox & Friends, "The IRS does not reveal the details of its audit selection process, so the interviewee should Ilmit any comments to be consistent with the agency's policies, Tax returns for audit are chiefly selected by use of the (DIE), which projects the amount of the IRS will gain from pursuing tax returns." Data Identification Factoring Discriminant Individual Factoring b. Classify each of the following as either "Yes" would probably result in an audit Discriminant Inventory Function Information from Informants and whistleblowers. Self-employed individuals with substantial business income and deductions . Information returns are in substantial agreement with the income reported on the taxpayer's return In a year subsequent to an audit that led to no assessment. Taxpayers who have been audited in a past year where the audit led to the assessment of a substantial deficiency. Information from other sources, such as other Federal agencies, state and local government audits, and general media items. Individuals whose itemized deductions are in excess of norms established for specific income levels

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts