Question: Please answer ASAP for a positive rating! The question has CASE A & B that needs to be solved, Thanks. CASE B as follows: In

Please answer ASAP for a positive rating! The question has CASE A & B that needs to be solved, Thanks.

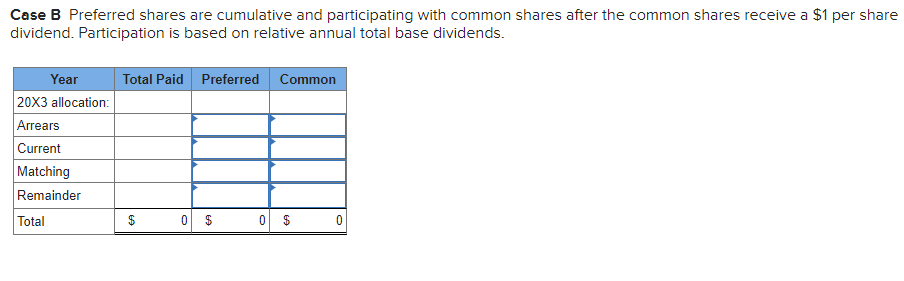

CASE B as follows:

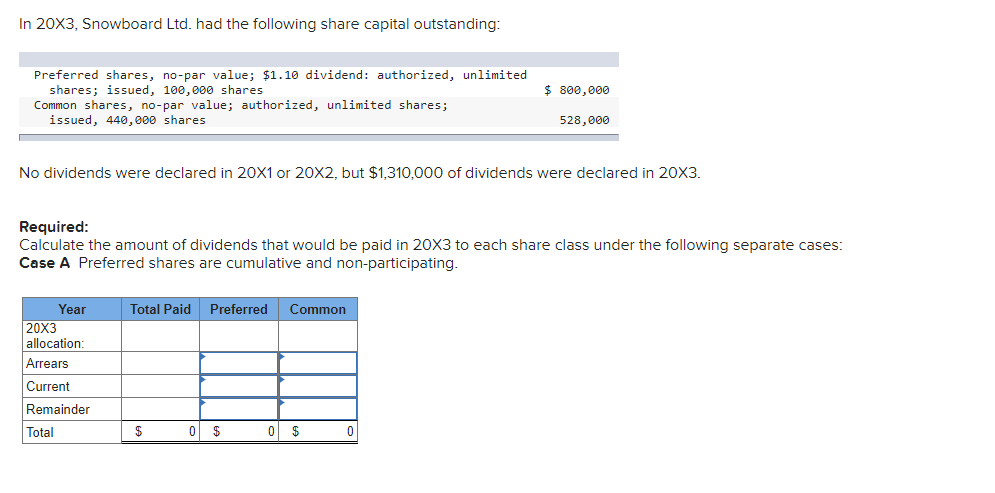

In 20X3, Snowboard Ltd. had the following share capital outstanding: $ 800,000 Preferred shares, no-par value; $1.10 dividend: authorized, unlimited shares; issued, 100,000 shares Common shares, no-par value; authorized, unlimited shares; issued, 440,000 shares 528,000 No dividends were declared in 20X1 or 20x2, but $1,310,000 of dividends were declared in 20X3. Required: Calculate the amount of dividends that would be paid in 20X3 to each share class under the following separate cases: Case A Preferred shares are cumulative and non-participating. Total Paid Preferred Common Year 20X3 allocation: Arrears Current Remainder Total $ 0 $ 0 $ 0 Case B Preferred shares are cumulative and participating with common shares after the common shares receive a $1 per share dividend. Participation is based on relative annual total base dividends. Total Paid Preferred Common Year 20x3 allocation: Arrears Current Matching Remainder Total $ $ 0 $ 0 $ 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts