Question: please answer asap for a thumbs up Alex, a 66 years old worker, is deciding between retirement either this year or the next year. His

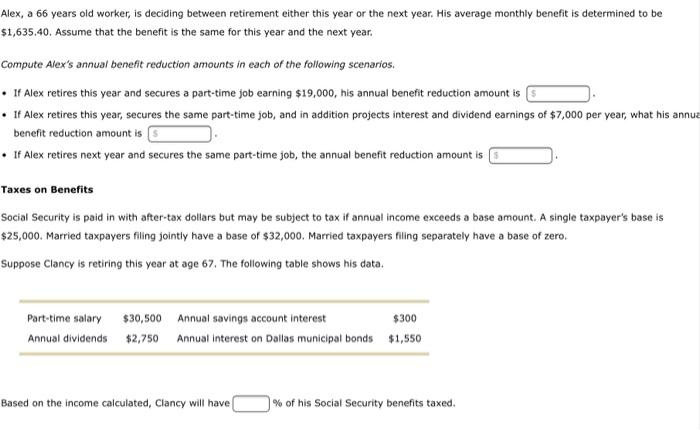

Alex, a 66 years old worker, is deciding between retirement either this year or the next year. His average monthly benefit is determined to be $1,635.40. Assume that the benefit is the same for this year and the next year. Compute Alex's annual benefit reduction amounts in each of the following scenarios. If Alex retires this year and secures a part-time job earning $19,000, his annual benefit reduction amount is If Alex retires this year, secures the same part-time job, and in addition projects interest and dividend earnings of $7,000 per year, what his annua benefit reduction amount is 5 If Alex retires next year and secures the same part-time job, the annual benefit reduction amount is Taxes on Benefits Social Security is paid in with after-tax dollars but may be subject to tax if annual income exceeds a base amount. A single taxpayer's base is $25,000. Married taxpayers filing jointly have a base of $32,000. Married taxpayers filing separately have a base of zero. Suppose Clancy is retiring this year at age 67. The following table shows his data. Part-time salary $30,500 Annual savings account interest $300 Annual dividends $2,750 Annual Interest on Dallas municipal bonds $1,550 Based on the income calculated, Clancy will have % of his Social Security benefits taxed

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts