Question: PLEASE ANSWER ASAP FOR A THUMBS UP Nick Lacoste died in 2012, leaving an estate of $24,000,000. Nick's wife died in 2009. In 2009, Nick

PLEASE ANSWER ASAP FOR A THUMBS UP

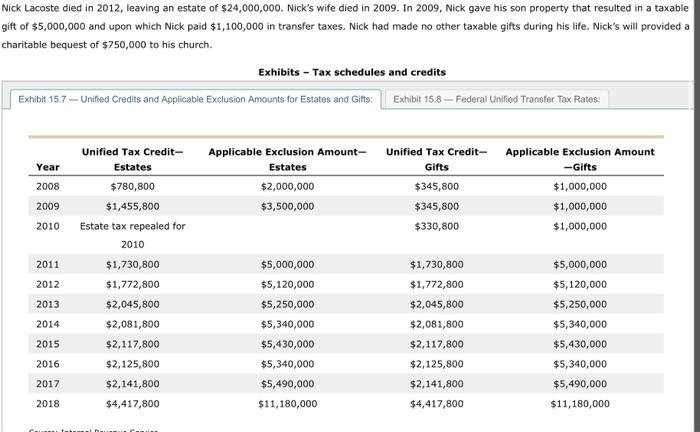

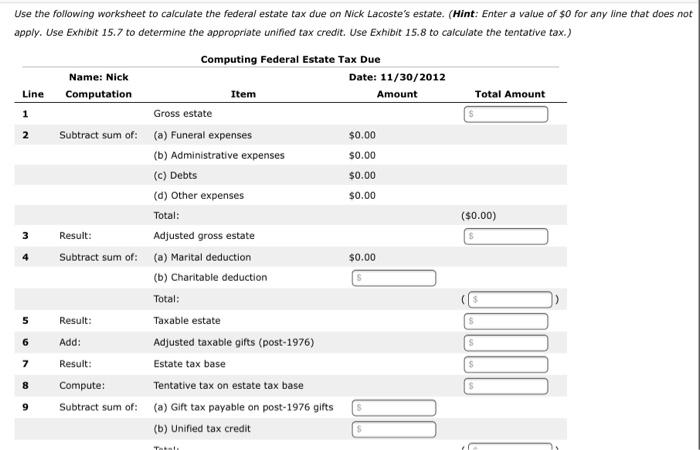

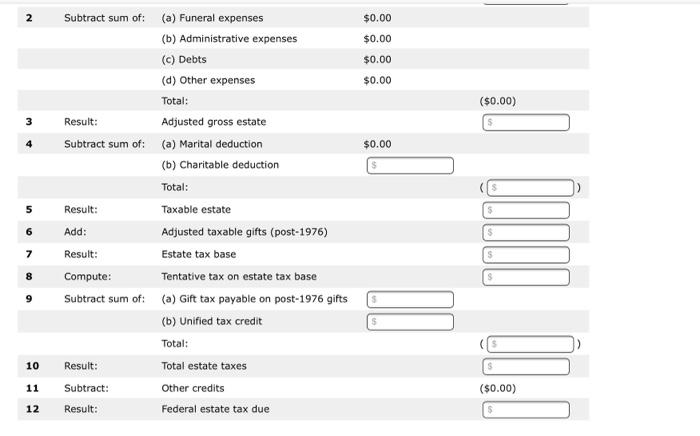

Nick Lacoste died in 2012, leaving an estate of $24,000,000. Nick's wife died in 2009. In 2009, Nick gave his son property that resulted in a taxable gift of $5,000,000 and upon which Nick paid $1,100,000 in transfer taxes. Nick had made no other taxable gifts during his life. Nick's will provided a charitable bequest of $750,000 to his church. Exhibits - Tax schedules and credits Exhibit 15.7 - Unified Credits and Applicable Exclusion Amounts for Estates and Gifts: Exhibit 15.8 Federal Unified Transfer Tax Rates: Year 2008 Applicable Exclusion Amount- Unified Tax Credit Applicable Exclusion Amount Estates Gifts -Gifts $2,000,000 $345,800 $1,000,000 $3,500,000 $345,800 $1,000,000 $330,800 $1,000,000 2009 2010 Unified Tax Credit- Estates $780,800 $1,455,800 Estate tax repealed for 2010 $1,730,800 $1,772,800 $2,045,800 $2,081,800 $2,117,800 $2,125,800 2011 $5,000,000 2012 $5,120,000 $5,000,000 $5,120,000 $5,250,000 $5,340,000 2013 $1,730,800 $1,772,800 $2,045,800 $2,081,800 $2,117,800 $5,250,000 $5,340,000 2014 2015 $5,430,000 $5,430,000 $5,340,000 2016 $5,340,000 2017 $2,141,800 $5,490,000 $2,125,800 $2,141,800 $4,417,800 $5,490,000 2018 $4,417,800 $11,180,000 $11,180,000 Line Item 1 2 $0.00 Use the following worksheet to calculate the federal estate tax due on Nick Lacoste's estate. (Hint: Enter a value of $0 for any line that does not apply. Use Exhibit 15.7 to determine the appropriate unified tax credit. Use Exhibit 15.8 to calculate the tentative tax.) Computing Federal Estate Tax Due Name: Nick Date: 11/30/2012 Computation Amount Total Amount Gross estate Subtract sum of: (a) Funeral expenses $0.00 (b) Administrative expenses (c) Debts $0.00 (d) Other expenses $0.00 Total: ($0.00) Adjusted gross estate Subtract sum of: (a) Marital deduction (b) Charitable deduction Total: Result: Taxable estate Add: Adjusted taxable gifts (post-1976) Result: Estate tax base Compute: Tentative tax on estate tax base Subtract sum of: (a) Gift tax payable on post-1976 gifts (b) Unified tax credit 3 Result: S 4 $0.00 S $ 5 $ 6 $ 7 S 8 9 S S 2 $0.00 $0.00 $0.00 $0.00 ($0.00) 3 4 $0.00 5 Subtract sum of: (a) Funeral expenses (b) Administrative expenses (c) Debts (d) Other expenses Total: Result: Adjusted gross estate Subtract sum of: (a) Marital deduction (b) Charitable deduction Total: Result: Taxable estate Add: Adjusted taxable gifts (post-1976) Result: Estate tax base Compute: Tentative tax on estate tax base Subtract sum of: (a) Gift tax payable on post-1976 gifts (b) Unified tax credit Total: Result: Total estate taxes Other credits Result: Federal estate tax due 6 7 8 9 INN. 00:0 10 11 Subtract: ($0.00) 12

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts