Question: PLEASE ANSWER ASAP FOR A THUMBS UP Yuan and Alex have 35 years to retirement. They are taking a personal finance course and have calculated

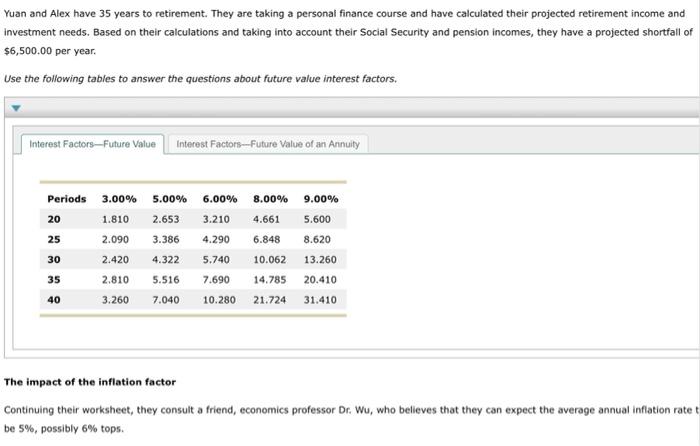

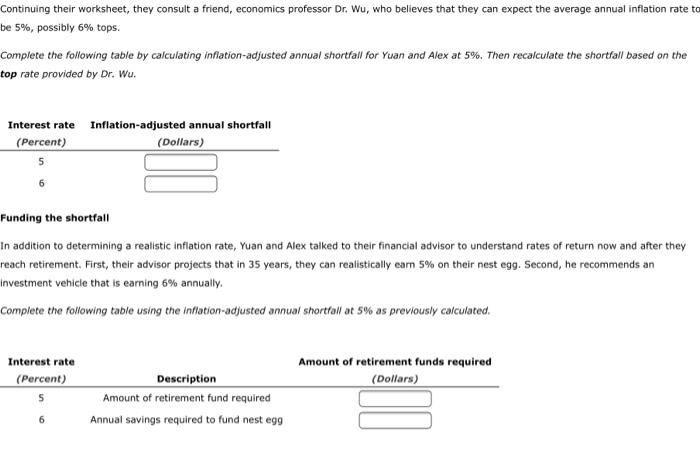

Yuan and Alex have 35 years to retirement. They are taking a personal finance course and have calculated their projected retirement income and investment needs. Based on their calculations and taking into account their Social Security and pension incomes, they have a projected shortfall of $6,500.00 per year. Use the following tables to answer the questions about future value interest factors. Interest Factors,Future Value Interest Factors--Future Value of an Annuity Periods 8.00% 3.00% 5.00% 6.00% 1.810 2.653 3.210 20 4.661 25 2.090 3.386 4.290 6.848 9.00% 5.600 8.620 13.260 20.410 31.410 30 2.420 4.322 5.740 10.062 35 2.810 5.516 7.690 14.785 40 3.260 7.040 10.280 21.724 The impact of the inflation factor Continuing their worksheet, they consult a friend, economics professor Dr. Wu, who believes that they can expect the average annual inflation ratet be 5%, possibly 6% tops. Continuing their worksheet, they consult a friend, economics professor Dr. Wu, who believes that they can expect the average annual inflation rate to be 5%, possibly 6% tops. Complete the following table by calculating inflation-adjusted annual shortfall for Yuan and Alex at 5%. Then recalculate the shortfall based on the top rate provided by Dr. Wu. Interest rate Inflation-adjusted annual shortfall (Percent) (Dollars) 5 Funding the shortfall In addition to determining a realistic inflation rate, Yuan and Alex talked to their financial advisor to understand rates of return now and after they reach retirement. First, their advisor projects that in 35 years, they can realistically earn 5% on their nest egg. Second, he recommends an Investment vehicle that is earning 6% annually. Complete the following table using the inflation-adjusted annual shortfall at 5% as previously calculated. Interest rate (Percent) Amount of retirement funds required (Dollars) S Description Amount of retirement fund required Annual savings required to fund nest egg 6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts