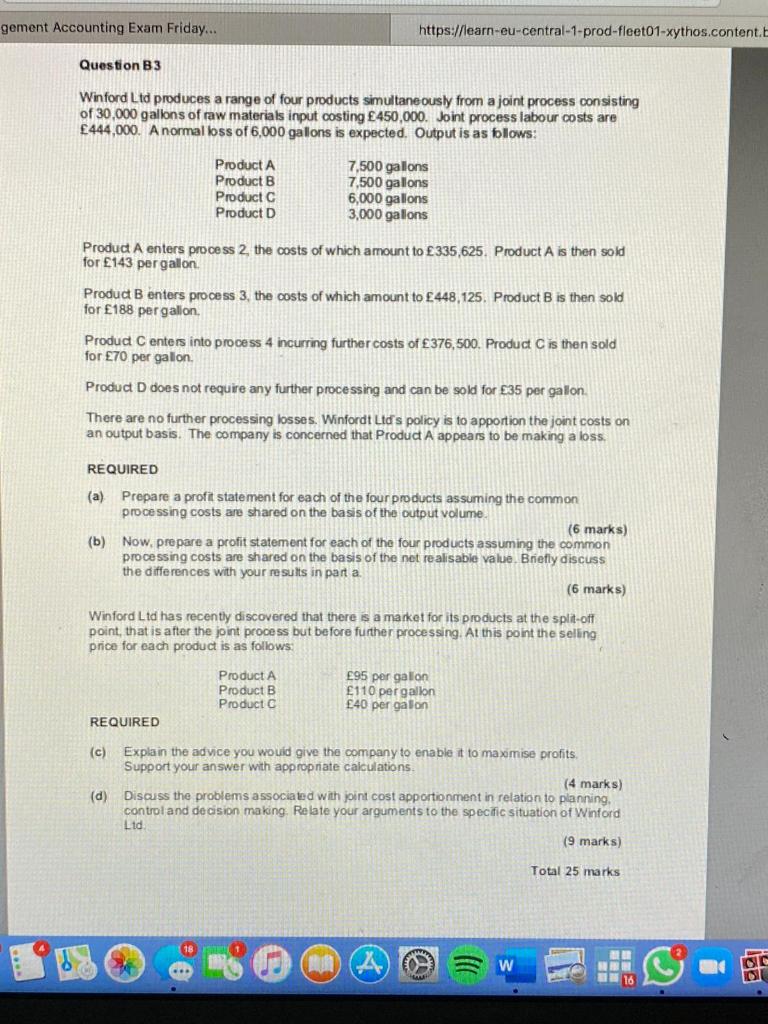

Question: Please answer ASAP gement Accounting Exam Friday... https://learn-eu-central-1-prod-fleet01-xythos.content.E Question B3 Winford Ltd produces a range of four products simultaneously from a joint process consisting of

Please answer ASAP

gement Accounting Exam Friday... https://learn-eu-central-1-prod-fleet01-xythos.content.E Question B3 Winford Ltd produces a range of four products simultaneously from a joint process consisting of 30,000 gallons of raw materials input costing 450,000. Joint process labour costs are 444,000. A normal loss of 6,000 galons is expected. Output is as follows: Product A 7,500 gallons Product B 7,500 galons Product C 6,000 galons Product D 3,000 galons Produd A enters process 2, the costs of which amount to 335,625. Product A is then sold for 143 per gallon Product B enters process 3, the costs of which amount to 448,125. Product B is then sold for 188 per gallon Produd Centers into process 4 incurring further costs of 376,500. Product C is then sold for 70 per gallon. Product D does not require any further processing and can be sold for 35 per gallon There are no further processing losses. Winfordt Lid's policy is to apportion the joint costs on an output basis. The company is concerned that Product A appears to be making a loss. REQUIRED (a) Prepare a profit statement for each of the four products assuming the common processing costs are shared on the basis of the output volume (6 marks) (b) Now, prepare a profit statement for each of the four products assuming the common processing costs are shared on the basis of the net realisable value Briefly discuss the differences with your results in part a (6 marks) Winford Ltd has recently discovered that there is a market for its products at the split-off point, that is after the joint process but before further processing. At this point the selling price for each product is as follows: Product A Product B Product 95 per gallon 110 per gallon 40 per galon REQUIRED (c) Explain the advice you would give the company to enable it to maximise profits Support your answer with appropriate calculations (4 marks) (d) Discuss the problems associated with joint cost apportionment in relation to planning, control and decision making. Relate your arguments to the specific situation of Winford Ltd (9 marks) Total 25 marks NB gement Accounting Exam Friday... https://learn-eu-central-1-prod-fleet01-xythos.content.E Question B3 Winford Ltd produces a range of four products simultaneously from a joint process consisting of 30,000 gallons of raw materials input costing 450,000. Joint process labour costs are 444,000. A normal loss of 6,000 galons is expected. Output is as follows: Product A 7,500 gallons Product B 7,500 galons Product C 6,000 galons Product D 3,000 galons Produd A enters process 2, the costs of which amount to 335,625. Product A is then sold for 143 per gallon Product B enters process 3, the costs of which amount to 448,125. Product B is then sold for 188 per gallon Produd Centers into process 4 incurring further costs of 376,500. Product C is then sold for 70 per gallon. Product D does not require any further processing and can be sold for 35 per gallon There are no further processing losses. Winfordt Lid's policy is to apportion the joint costs on an output basis. The company is concerned that Product A appears to be making a loss. REQUIRED (a) Prepare a profit statement for each of the four products assuming the common processing costs are shared on the basis of the output volume (6 marks) (b) Now, prepare a profit statement for each of the four products assuming the common processing costs are shared on the basis of the net realisable value Briefly discuss the differences with your results in part a (6 marks) Winford Ltd has recently discovered that there is a market for its products at the split-off point, that is after the joint process but before further processing. At this point the selling price for each product is as follows: Product A Product B Product 95 per gallon 110 per gallon 40 per galon REQUIRED (c) Explain the advice you would give the company to enable it to maximise profits Support your answer with appropriate calculations (4 marks) (d) Discuss the problems associated with joint cost apportionment in relation to planning, control and decision making. Relate your arguments to the specific situation of Winford Ltd (9 marks) Total 25 marks NB