Question: please answer ASAP Gonzalez Company is considering two new projects with the following net cash flows. The company's required rate of return on Investments is

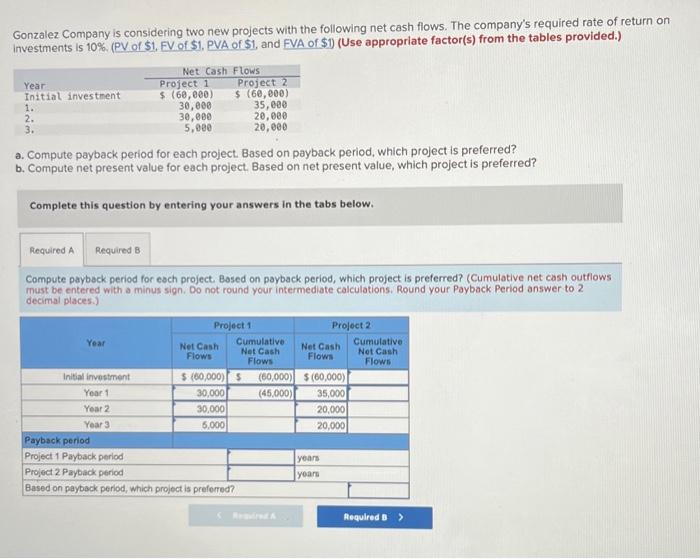

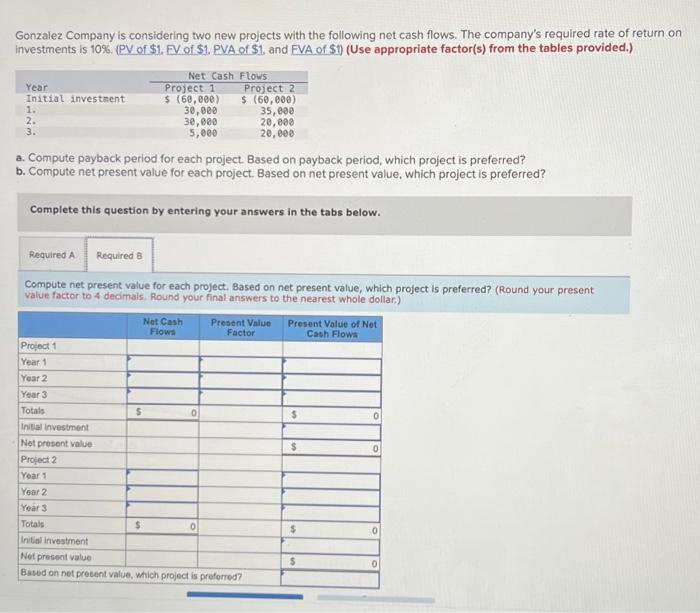

Gonzalez Company is considering two new projects with the following net cash flows. The company's required rate of return on Investments is 10% (PV of $1. FV of $1. PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.) Net Cash Flows Year Project 1 Project 2 Initial investment $ (68,600) $ (60,000) 1. 30,000 35,000 2. 30,000 20,000 3. 5,000 20,000 a. Compute payback period for each project. Based on payback period, which project is preferred? b. Compute net present value for each project. Based on net present value, which project is preferred? Complete this question by entering your answers in the tabs below. Net Cash Cumulative Required A Required B Compute payback period for each project. Based on payback period, which project is preferred? (Cumulative net cash outflows must be entered with a minus sign. Do not round your intermediate calculations. Round your Payback period answer to 2 decimal places.) Project 1 Project 2 Year Net Cash Cumulative Flows Net Cash Flows Not Cash Flows Flows Initial investment $ 60,000) 5 (60,000) $ (60,000) Year 1 30,000 (45.000) 35,000 Year 2 30,000 20,000 Year 3 5.000 20,000 Payback period Project 1 Payback period years Project 2 Payback period yoans Based on payback period, which project is preferred? Required 3 > Gonzalez Company is considering two new projects with the following net cash flows. The company's required rate of return on investments is 10% (PV of $1. FV of $1. PVA of S1, and FVA of $1 (Use appropriate factor(s) from the tables provided.) Net Cash Flows Year Project 1 Project 2 Initial investment $ (60,000) $ (60,000) 1. 30,000 35,000 2. 30,000 20,000 3. 5,000 20, eee a. Compute payback period for each project. Based on payback period, which project is preferred? b. Compute net present value for each project. Based on net present value, which project is preferred? Complete this question by entering your answers in the tabs below. Required A Required B Compute net present value for each project. Based on net present value, which project is preferred? (Round your present value factor to 4 decimals. Round your final answers to the nearest whole dollar) Net Cash Present Value Present Value of Net Flows Factor Cash Flows Project 1 Year 1 Year 2 Year 3 Totals $ 0 $ 0 Initial investment Not present value $ 0 Project 2 Year 1 Year 2 Year 3 Totais $ 0 $ 0 Initial investment Net present value $ Based on not present value, which project is preferred

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts