Question: Please answer asap I 8. (a) Explain how bonds and stocks are valued and discuss the problems with valuing both types of securities. (6 marks)

Please answer asap

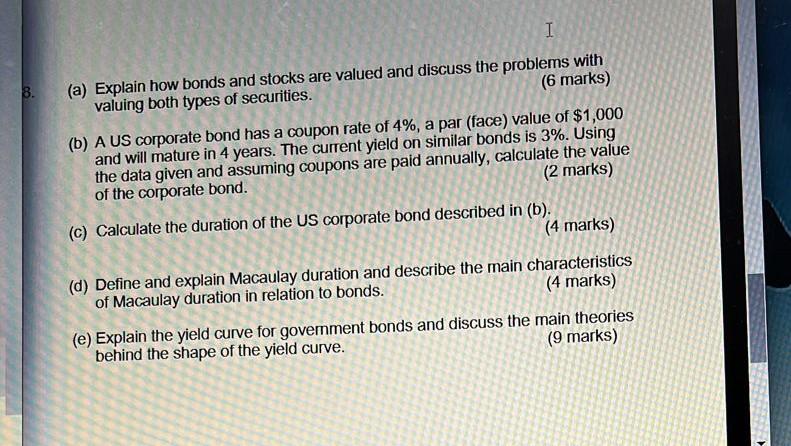

I 8. (a) Explain how bonds and stocks are valued and discuss the problems with valuing both types of securities. (6 marks) (b) A US corporate bond has a coupon rate of 4%, a par (face) value of $1,000 and will mature in 4 years. The current yield on similar bonds is 3%. Using the data given and assuming coupons are paid annually, calculate the value of the corporate bond. (2 marks) (c) Calculate the duration of the US corporate bond described in (b). (4 marks) (d) Define and explain Macaulay duration and describe the main characteristics (4 marks) of Macaulay duration in relation to bonds. (e) Explain the yield curve for government bonds and discuss the main theories (9 marks) behind the shape of the yield curve

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts