Question: PLEASE ANSWER ASAP I GIVE THUMBS UP (NPV, PI, and IRR calculations) Fijisawa Inc. is considering a major expansion of its product line and has

PLEASE ANSWER ASAP I GIVE THUMBS UP

PLEASE ANSWER ASAP I GIVE THUMBS UP

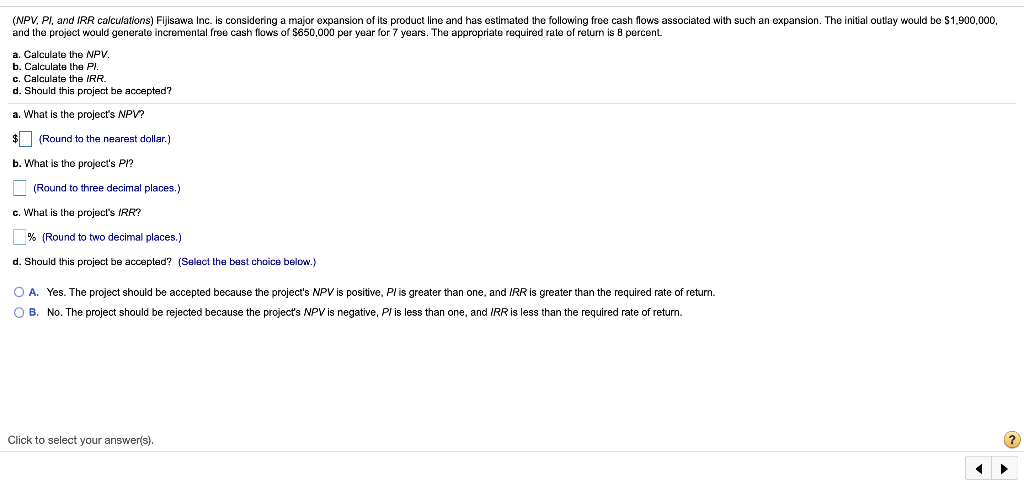

(NPV, PI, and IRR calculations) Fijisawa Inc. is considering a major expansion of its product line and has estimated the following free cash flows associated with such an expansion. The initial outlay would be $1,900,000. and the project would generate incremental free cash flows of $650,000 per year for 7 years. The appropriate required rate of return is 8 percent a. Calculate the NPV. b. Calculate the PI. c. Calculate the IRR. d. Should this project be accepted? a. What is the project's NPV? $(Round to the nearest dollar.) b. What is the project's P/? (Round to three decimal places.) c. What is the project's IRR? % (Round to two decimal places.) d. Should this project be accepted? (Select the best choice below.) O A. Yes. The project should be accepted because the project's NPV is positive. Pl is greater than one, and IRR is greater than the required rate of return. OB. No. The project should be rejected because the project's NPV is negative, Pl is less than one, and IRR is less than the required rate of return. Click to select your answer(s)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts