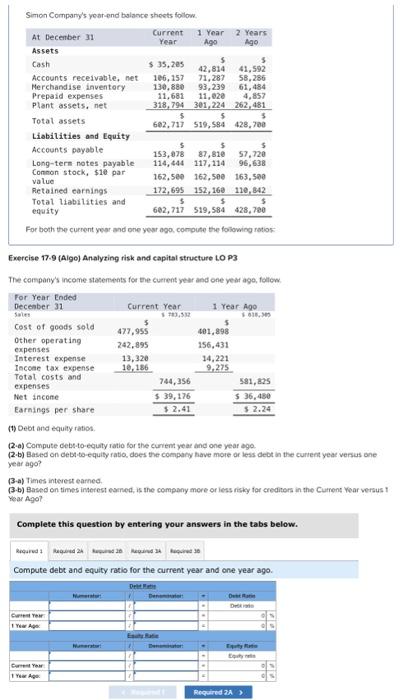

Question: please answer ASAP i will rate you! information all on first photo. all questions linked Simon Compary's yeur-end balance sheets follow. For both the curnent

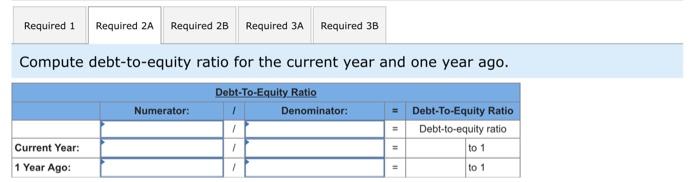

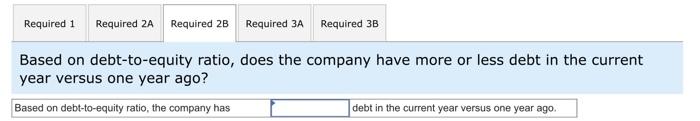

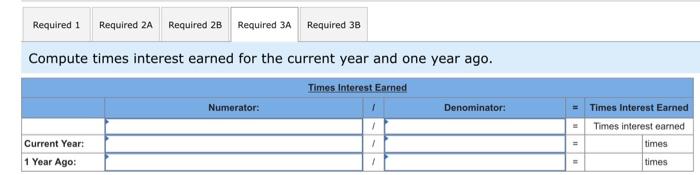

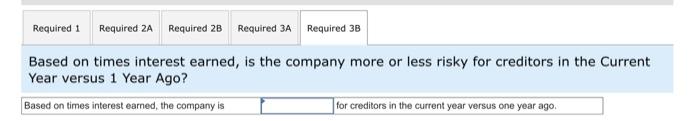

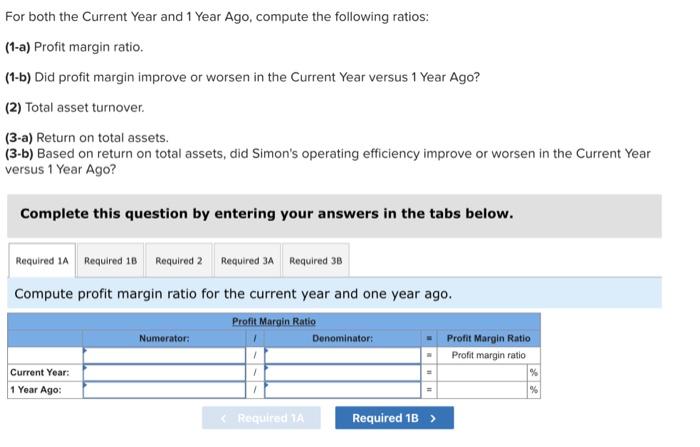

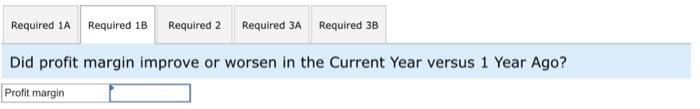

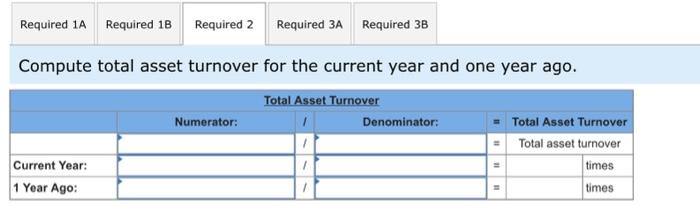

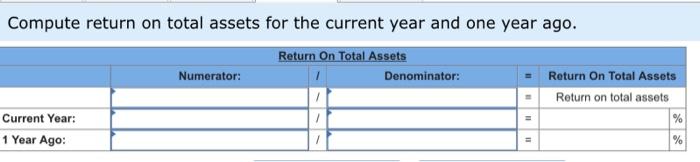

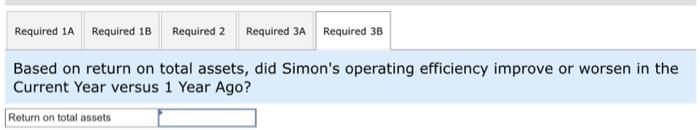

Simon Compary's yeur-end balance sheets follow. For both the curnent yer and one yesr ago, compute the following ratios: Exercise 17.9 (Alge) Aralyzing risk and capital structure Lo ps The company's income stacerments foe the cuerent yedr and one yeat aga, foltow. (1) Deot and equity ratios. (2-a) Compute debt-to-equity ratio for the curient year and one year ago. (2.b) Based on debt to-equity fatio, does the company have more or less debt in the curient yeat versus one year ago? (3-a) Times intevert earned. (3.b) Based on timbs interest earned, is the company more or less risky for creditors in the Curnent Year veraus 1 Year Ago? Complete this question by entering your answers in the tabs below. Compute debt and equity ratio for the current year and one year ago. Compute debt-to-equity ratio for the current year and one year ago. Based on debt-to-equity ratio, does the company have more or less debt in the current year versus one year ago? Compute times interest earned for the current year and one year ago. Based on times interest earned, is the company more or less risky for creditors in the Current Year versus 1 Year Ago? For both the Current Year and 1 Year Ago, compute the following ratios: (1-a) Profit margin ratio. (1-b) Did profit margin improve or worsen in the Current Year versus 1 Year Ago? (2) Total asset turnover. (3-a) Return on total assets. (3-b) Based on return on total assets, did Simon's operating efficiency improve or worsen in the Current Year versus 1 Year Ago? Complete this question by entering your answers in the tabs below. Compute profit margin ratio for the current year and one year ago. Did profit margin improve or worsen in the Current Year versus 1 Year Ago? Compute total asset turnover for the current year and one year ago. Compute return on total assets for the current year and one year ago. Based on return on total assets, did Simon's operating efficiency improve or worsen in the Current Year versus 1 Year Ago

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts