Question: PLEASE ANSWER ASAP!!!! I will upvote!!!! D Question 15 5 pts Leveraged Recapitalizations (Recaps) are used to adjust the capital structure of the firm and

PLEASE ANSWER ASAP!!!! I will upvote!!!!

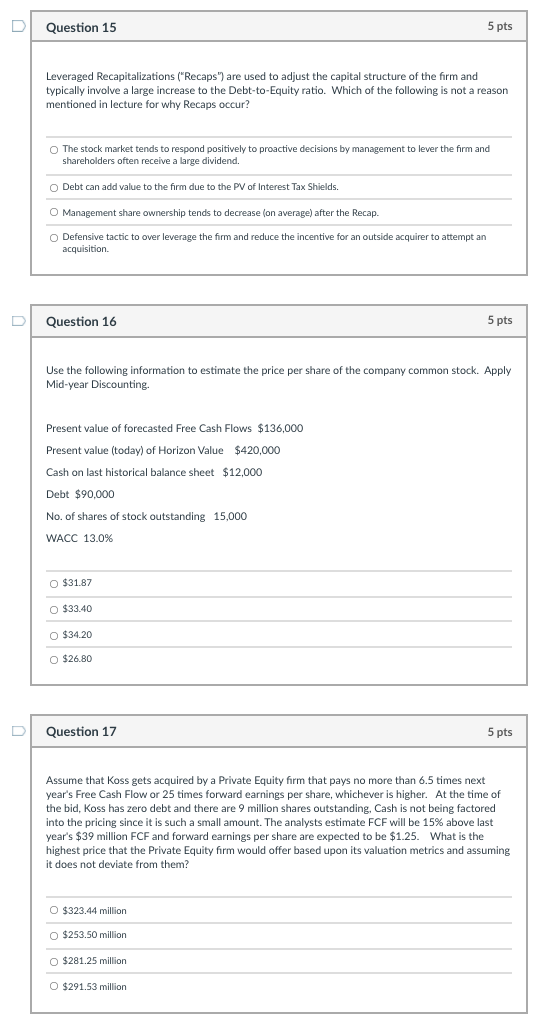

D Question 15 5 pts Leveraged Recapitalizations ("Recaps") are used to adjust the capital structure of the firm and typically involve a large increase to the Debt-to-Equity ratio. Which of the following is not a reason mentioned in lecture for why Recaps occur? The stock market tends to respond positively to proactive decisions by management to lever the firm and shareholders often receive a large dividend. Debt can add value to the firm due to the PV of Interest Tax Shields. Management share ownership tends to decrease on average) after the Recap. Defensive tactic to over leverage the firm and reduce the incentive for an outside acquirer to attempt an acquisition D Question 16 5 pts Use the following information to estimate the price per share of the company common stock. Apply Mid-year Discounting. Present value of forecasted Free Cash Flows $136,000 Present value (today) of Horizon Value $420,000 Cash on last historical balance sheet $12,000 Debt $90,000 No. of shares of stock outstanding 15,000 WACC 13.0% O $31.87 O $33.40 O $34.20 O $26.80 Question 17 5 pts Assume that Koss gets acquired by a Private Equity firm that pays no more than 6.5 times next year's Free Cash Flow or 25 times forward earnings per share, whichever is higher. At the time of the bid, Koss has zero debt and there are 9 million shares outstanding, Cash is not being factored into the pricing since it is such a small amount. The analysts estimate FCF will be 15% above last year's $39 million FCF and forward earnings per share are expected to be $1.25. What is the highest price that the Private Equity firm would offer based upon its valuation metrics and assuming it does not deviate from them? O $323.44 million O $253.50 million $281.25 million O $291.53 million D Question 15 5 pts Leveraged Recapitalizations ("Recaps") are used to adjust the capital structure of the firm and typically involve a large increase to the Debt-to-Equity ratio. Which of the following is not a reason mentioned in lecture for why Recaps occur? The stock market tends to respond positively to proactive decisions by management to lever the firm and shareholders often receive a large dividend. Debt can add value to the firm due to the PV of Interest Tax Shields. Management share ownership tends to decrease on average) after the Recap. Defensive tactic to over leverage the firm and reduce the incentive for an outside acquirer to attempt an acquisition D Question 16 5 pts Use the following information to estimate the price per share of the company common stock. Apply Mid-year Discounting. Present value of forecasted Free Cash Flows $136,000 Present value (today) of Horizon Value $420,000 Cash on last historical balance sheet $12,000 Debt $90,000 No. of shares of stock outstanding 15,000 WACC 13.0% O $31.87 O $33.40 O $34.20 O $26.80 Question 17 5 pts Assume that Koss gets acquired by a Private Equity firm that pays no more than 6.5 times next year's Free Cash Flow or 25 times forward earnings per share, whichever is higher. At the time of the bid, Koss has zero debt and there are 9 million shares outstanding, Cash is not being factored into the pricing since it is such a small amount. The analysts estimate FCF will be 15% above last year's $39 million FCF and forward earnings per share are expected to be $1.25. What is the highest price that the Private Equity firm would offer based upon its valuation metrics and assuming it does not deviate from them? O $323.44 million O $253.50 million $281.25 million O $291.53 million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts