Question: please answer asap in format provided A. Monthly sales Jan 100 Feb 300 March 500 April May 1,000 500 June 300 B. 60% of sales

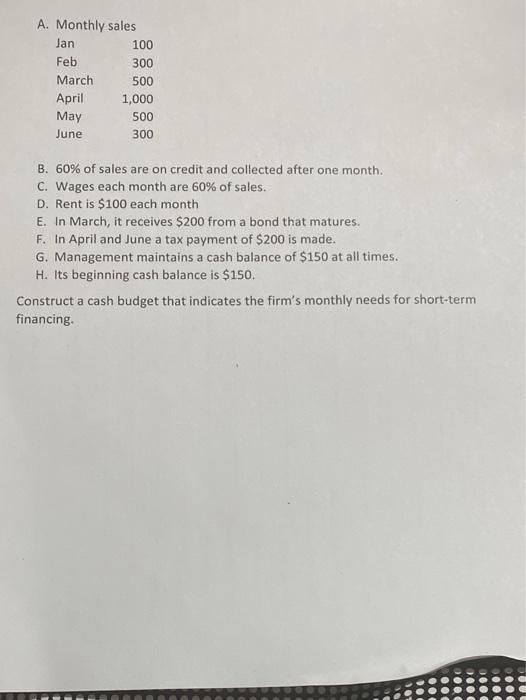

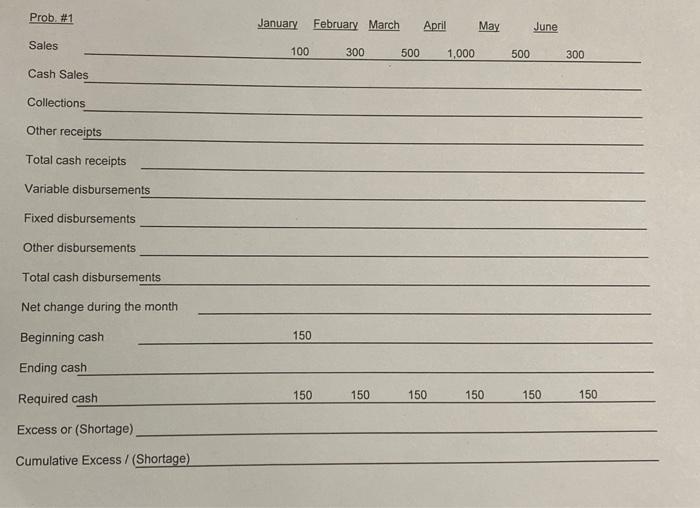

A. Monthly sales Jan 100 Feb 300 March 500 April May 1,000 500 June 300 B. 60% of sales are on credit and collected after one month. C. Wages each month are 60% of sales. D. Rent is $100 each month E. In March, it receives $200 from a bond that matures. F. In April and June a tax payment of $200 is made. G. Management maintains a cash balance of $150 at all times. H. Its beginning cash balance is $150. Construct a cash budget that indicates the firm's monthly needs for short-term financing 1000 Prob #1 January February March April May June Sales 100 300 500 1,000 500 300 Cash Sales Collections Other receipts Total cash receipts Variable disbursements Fixed disbursements Other disbursements Total cash disbursements Net change during the month Beginning cash 150 Ending cash 150 150 150 150 150 150 Required cash Excess or (Shortage) Cumulative Excess/(Shortage)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts