Question: PLEASE ANSWER ASAP! Income Statement Balance Sheet Jim's Espresso expects sales to grow by 9.9% next year and interest expense will remain constant. Jim's changes

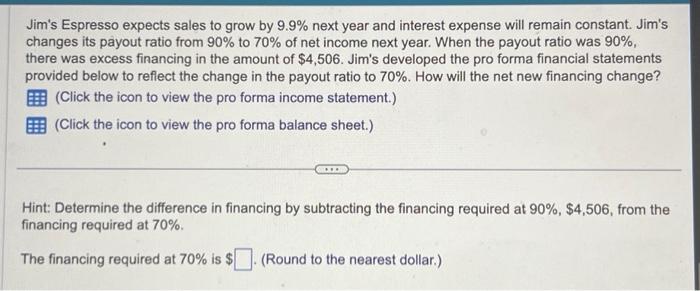

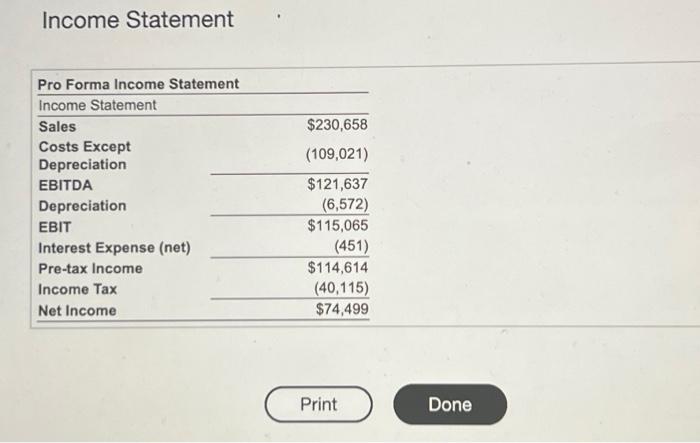

Income Statement Balance Sheet Jim's Espresso expects sales to grow by 9.9% next year and interest expense will remain constant. Jim's changes its payout ratio from 90% to 70% of net income next year. When the payout ratio was 90%, there was excess financing in the amount of $4,506. Jim's developed the pro forma financial statements provided below to reflect the change in the payout ratio to 70%. How will the net new financing change? (Click the icon to view the pro forma income statement.) (Click the icon to view the pro forma balance sheet.) Hint: Determine the difference in financing by subtracting the financing required at 90%,$4,506, from the financing required at 70%. The financing required at 70% is $ (Round to the nearest dollar.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts