Question: please answer asap? John Corporation's bank statement for April 30 showed an ending cash balance of $1,350. The company's Cash account in its general ledger

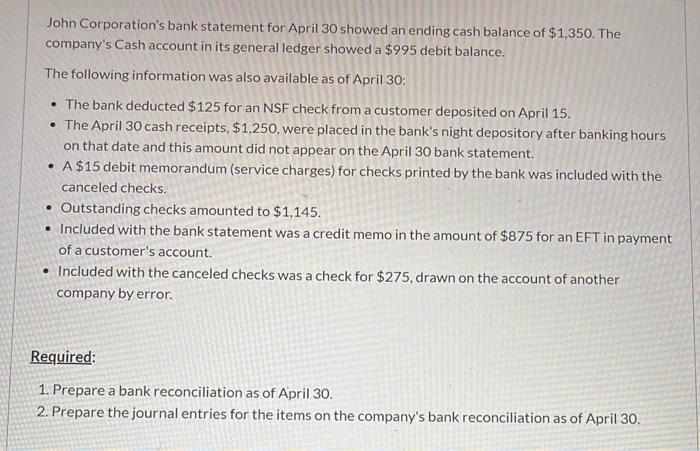

John Corporation's bank statement for April 30 showed an ending cash balance of $1,350. The company's Cash account in its general ledger showed a $995 debit balance. The following information was also available as of April 30: The bank deducted $125 for an NSF check from a customer deposited on April 15. The April 30 cash receipts, $1,250, were placed in the bank's night depository after banking hours on that date and this amount did not appear on the April 30 bank statement. A $15 debit memorandum (service charges) for checks printed by the bank was included with the canceled checks. Outstanding checks amounted to $1,145. Included with the bank statement was a credit memo in the amount of $875 for an EFT in payment of a customer's account. Included with the canceled checks was a check for $275, drawn on the account of another company by error. Required: 1. Prepare a bank reconciliation as of April 30. 2. Prepare the journal entries for the items on the company's bank reconciliation as of April 30

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts