Question: please answer ASAP Max earned $1,019.55 during the most recent semimonthly pay period. He is single with 1 withholding allowance and has ny pre-tax deductions.

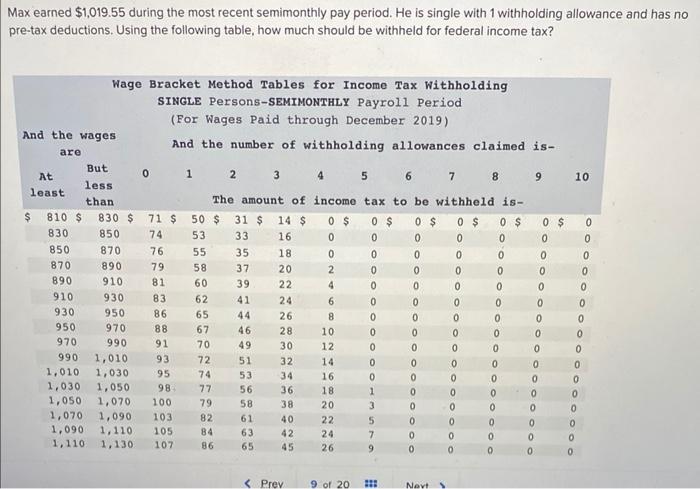

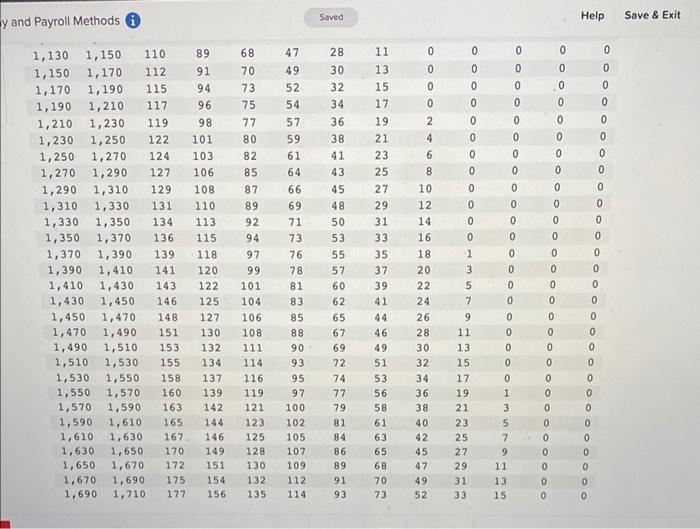

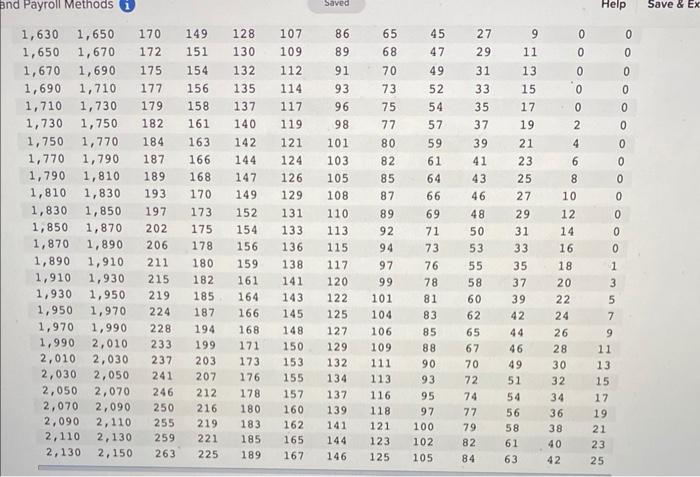

Max earned $1,019.55 during the most recent semimonthly pay period. He is single with 1 withholding allowance and has ny pre-tax deductions. Using the following table, how much should be withheld for federal income tax? 1,6301,6501,6701,6901,7101,7301,7501,7701,7901,8101,8301,8501,8701,8901,9101,9301,9501,9701,9902,0102,0302,0502,0702,0902,1102,1301,51,6501,6701,6901,7101,7301,7501,7701,7901,8101,8301,8501,8701,8901,9101,9301,9501,9701,9902,0102,0302,0502,0702,0902,1102,1302,1501701721751771791821841871891931972022062112152192242282332372412462502552592631491511541561581611631661681701731751781801821851871941992032072122162192212251281301321351371401421441471491521541561591611641661681711731761781801831851891071091121141171191211241261291311331361381411431451481501531551571601621651678689919396981011031051081101131151171201221251271291321341371391411441466568707375778082858789929497991011041061091111131161181211231254547495254575961646669717376788183858890939597100102105272931333537394143464850535558606265677072747779828491113151719212325272931333537394244464951545658616300000246810121416182022242628303234363840420000000000000135791113151719212325 $95.00 $76.00 $51.00 $74.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts