Question: PLEASE ANSWER ASAP Please create a framework and grc for a company of your choice that has three business lines and operates globally and explain

PLEASE ANSWER ASAP

Please create a framework and grc for a company of your choice that has three business lines and operates globally and explain your model. Below are the examples to follow!

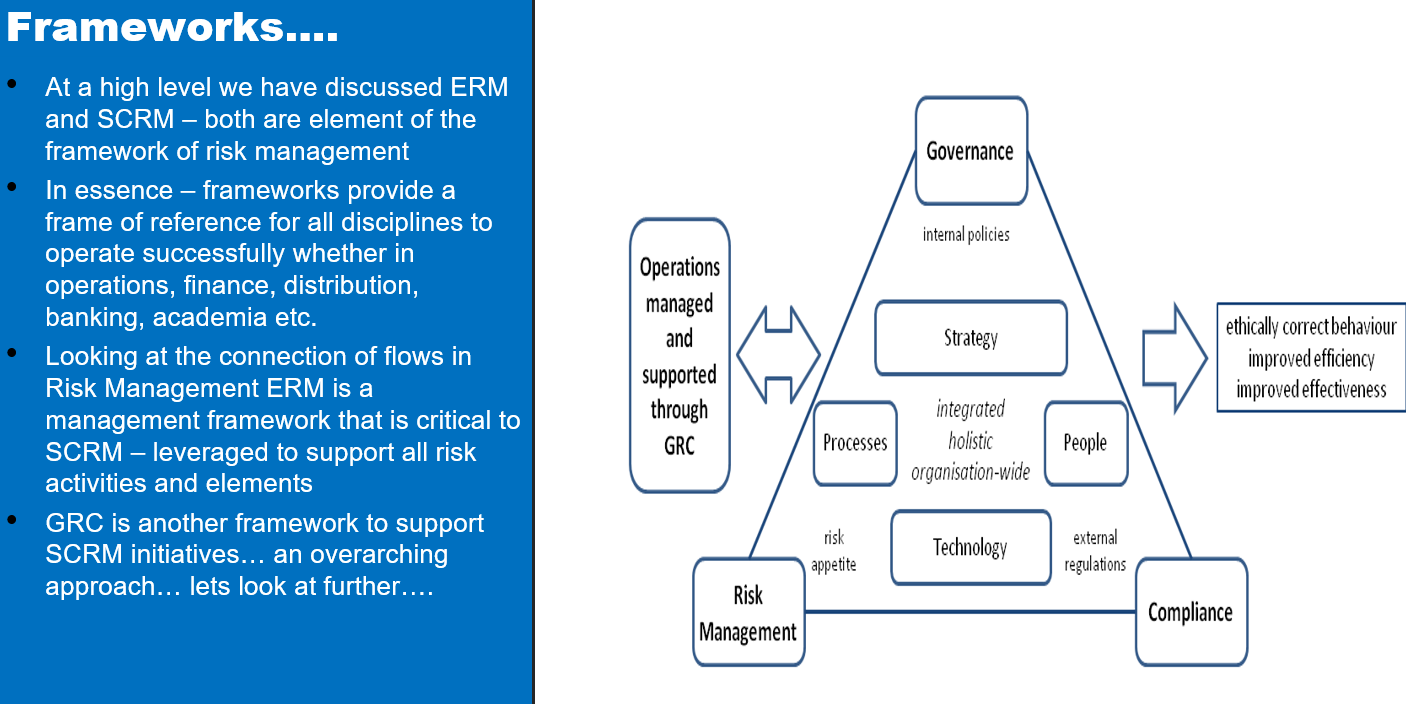

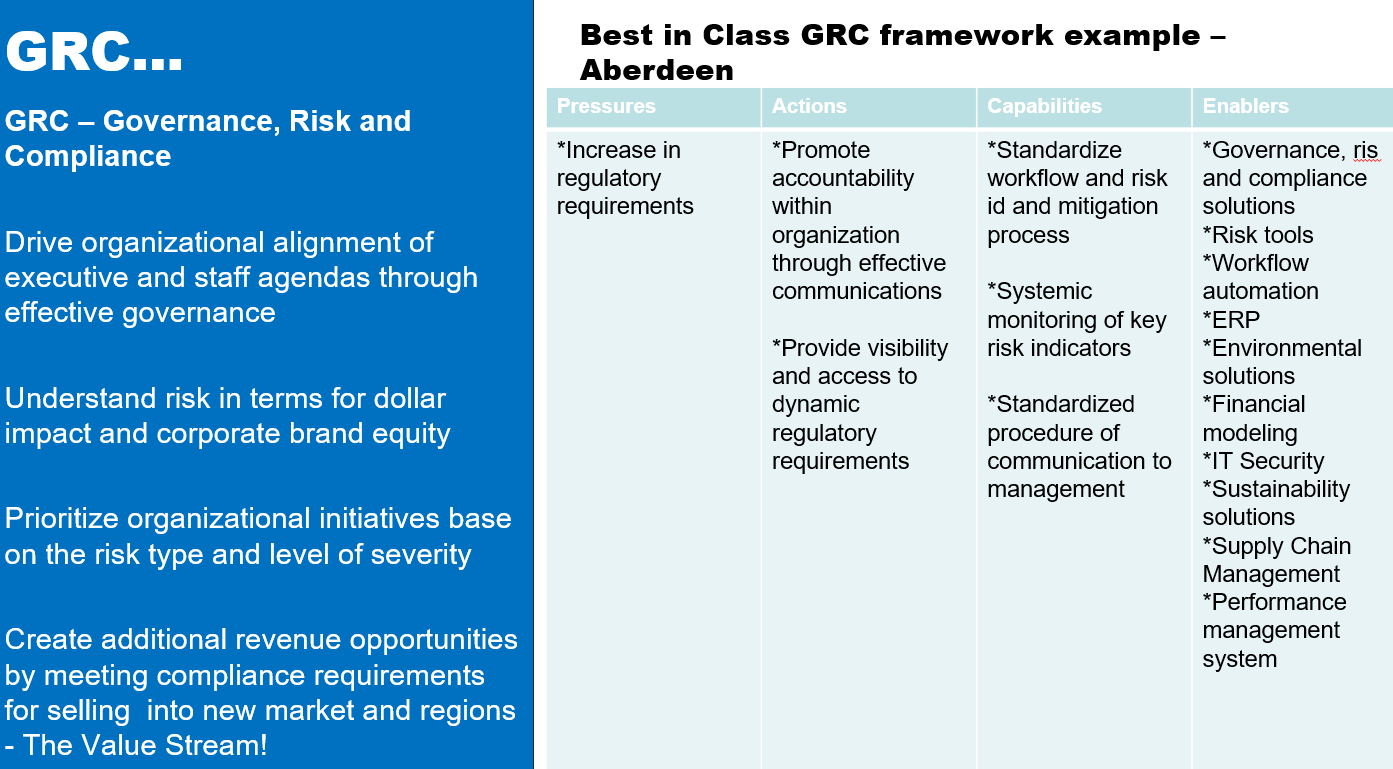

Frameworks.... Governance internal policies At a high level we have discussed ERM and SCRM - both are element of the framework of risk management In essence - frameworks provide a frame of reference for all disciplines to operate successfully whether in operations, finance, distribution, banking, academia etc. Looking at the connection of flows in Risk Management ERM is a management framework that is critical to SCRM leveraged to support all risk activities and elements GRC is another framework to support SCRM initiatives... an overarching approach... lets look at further.... Strategy Operations managed and supported through GRC ethically correct behaviour improved efficiency improved effectiveness Processes integrated holistic organisation-wide People risk Technology external regulations appetite Risk Management Compliance GRC... Best in Class GRC framework example - Aberdeen Pressures Actions Capabilities Enablers GRC - Governance, Risk and Compliance *Increase in regulatory requirements *Promote accountability within organization through effective communications *Standardize workflow and risk id and mitigation process Drive organizational alignment of executive and staff agendas through effective governance *Systemic monitoring of key risk indicators Understand risk in terms for dollar impact and corporate brand equity *Provide visibility and access to dynamic regulatory nents *Standardized procedure of communication to management *Governance, ris and compliance solutions *Risk tools *Workflow automation *ERP *Environmental solutions *Financial modeling *IT Security *Sustainability solutions *Supply Chain Management *Performance management system Prioritize organizational initiatives base on the risk type and level of severity Create additional revenue opportunities by meeting compliance requirements for selling into new market and regions The Value Stream! Frameworks.... Governance internal policies At a high level we have discussed ERM and SCRM - both are element of the framework of risk management In essence - frameworks provide a frame of reference for all disciplines to operate successfully whether in operations, finance, distribution, banking, academia etc. Looking at the connection of flows in Risk Management ERM is a management framework that is critical to SCRM leveraged to support all risk activities and elements GRC is another framework to support SCRM initiatives... an overarching approach... lets look at further.... Strategy Operations managed and supported through GRC ethically correct behaviour improved efficiency improved effectiveness Processes integrated holistic organisation-wide People risk Technology external regulations appetite Risk Management Compliance GRC... Best in Class GRC framework example - Aberdeen Pressures Actions Capabilities Enablers GRC - Governance, Risk and Compliance *Increase in regulatory requirements *Promote accountability within organization through effective communications *Standardize workflow and risk id and mitigation process Drive organizational alignment of executive and staff agendas through effective governance *Systemic monitoring of key risk indicators Understand risk in terms for dollar impact and corporate brand equity *Provide visibility and access to dynamic regulatory nents *Standardized procedure of communication to management *Governance, ris and compliance solutions *Risk tools *Workflow automation *ERP *Environmental solutions *Financial modeling *IT Security *Sustainability solutions *Supply Chain Management *Performance management system Prioritize organizational initiatives base on the risk type and level of severity Create additional revenue opportunities by meeting compliance requirements for selling into new market and regions The Value Stream

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts