Question: PLEASE ANSWER ASAP! PLEASE HELP. Suppose that you hold a piece of land in the city of London that you may want to self in

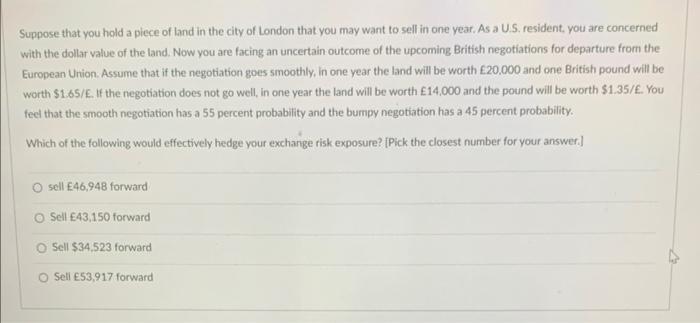

Suppose that you hold a piece of land in the city of London that you may want to self in one year, As a U.S. resident, you are concerned with the dollar value of the land. Now you are facing an uncertain outcome of the upcoming British negotiations for departure from the European Union. Assume that if the negotiation goes smoothly, in one year the land will be worth 20.000 and one British pound will be worth $1.65/E. If the negotiation does not go well, in one year the land will be worth E14,000 and the pound will be worth $1.35/. You feel that the smooth negotiation has a 55 percent probability and the bumpy negotiation has a 45 percent probability. Which of the following would effectively hedge your exchange risk exposure? [Pick the closest number for your answer.] sell E46,948 forward Sell 43,150 forward Sell \$34.523 forward Seli E53,917 forward

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts