Question: please answer asap please Job-Order Cost Sheets, Balance in Work in Process and Finished Goods Prull Company, a job-order costing firm, worked on three jobs

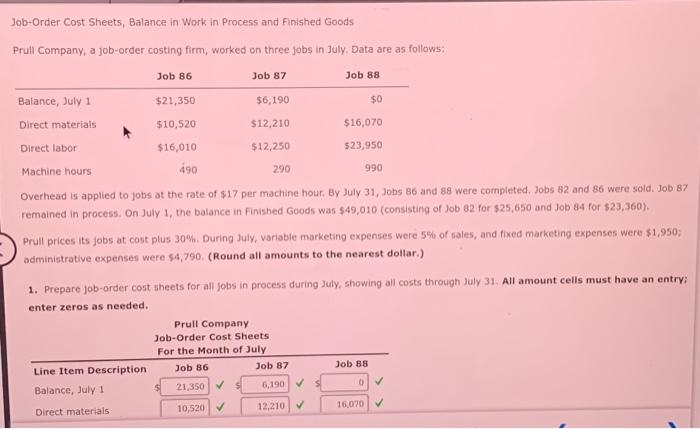

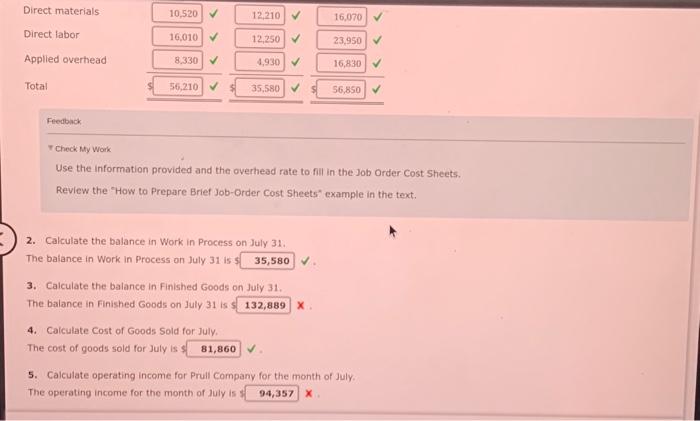

Job-Order Cost Sheets, Balance in Work in Process and Finished Goods Prull Company, a job-order costing firm, worked on three jobs in July. Data are as follows: Overhead is applied to jobs at the rate of $17 per machine hour, By July 31, Jobs 86 and 88 were completed, Jobs 82 and 86 were sold. Job 87 remained in process. On July 1, the balance in Finished Goods was $49,010 (consisting of Job 82 for $25,650 and Job 84 for $23,360 ). Prull prices its jobs at cost plus 30%. During July, variable marketing expenses were 5% of sales, and fixed marketing expenses were \$1,950; administrative expenses were $4,790. (Round all amounts to the nearest dollar.) 1. Prepare job-order cost sheets for all Jobs in process during July, showing ail costs through July 31 , All amount cells must have an entry; enter zeros as needed. T Check My Work Use the information provided and the overhead rate to fill in the Job Order Cost Sheets. Review the "How to Prepare Brief Job-Order Cost Sheets" example in the text. 2. Calculate the balance in Work in Process on July 31. The balance in Work in Process on July 31 is 9 3. Calculate the balance in Finished Goods on July 31. The balance in Finished Goods on July 31 is 5 x 4. Caiculate Cost of Goods Sold for July. The cost of goods sold for July is $ 5. Calculate operating income for Prull Company for the month of July. The operating income for the month of July is 3 x

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts