Question: PLEASE ANSWER ASAP PORTFOLIO MANAGEMENT a) Given below the information for three (3) stocks. Portfolio Beta 1,1 Beta 12 Expected return (percent) 18 14 24

PLEASE ANSWER ASAP

PORTFOLIO MANAGEMENT

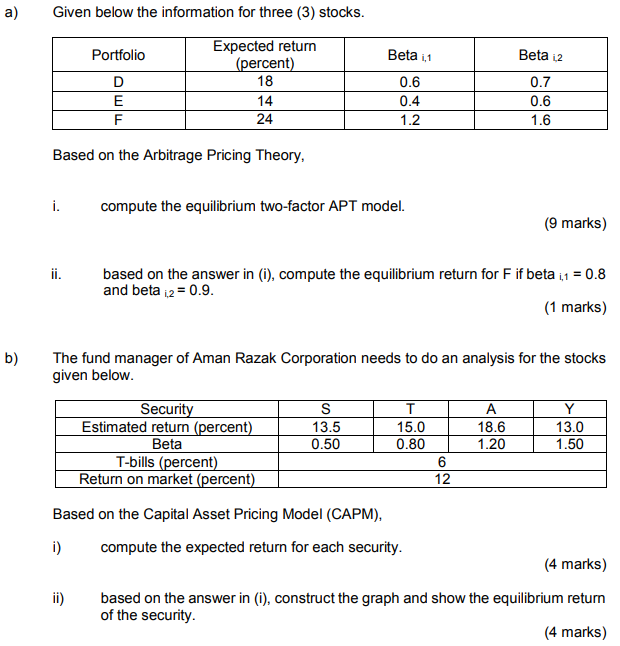

a) Given below the information for three (3) stocks. Portfolio Beta 1,1 Beta 12 Expected return (percent) 18 14 24 D E F 0.6 0.4 0.7 0.6 1.6 1.2 Based on the Arbitrage Pricing Theory, i. compute the equilibrium two-factor APT model. (9 marks) ii. based on the answer in (i), compute the equilibrium return for F if beta 1,1 = 0.8 and beta 2 = 0.9. (1 marks) b) The fund manager of Aman Razak Corporation needs to do an analysis for the stocks given below. Security Estimated return (percent) Beta T-bills (percent) Return on market (percent) S 13.5 0.50 T 15.0 0.80 6 12 . 18.6 1.20 Y 13.0 1.50 Based on the Capital Asset Pricing Model (CAPM), i) compute the expected return for each security. (4 marks) ii) based on the answer in (i), construct the graph and show the equilibrium return of the security. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts