Question: PLEASE ANSWER ASAP Question 18 (3.5 points) ABC Co wants to purchase a equipment worth $24,000. It will be worthless in three years. ABC Co

PLEASE ANSWER ASAP

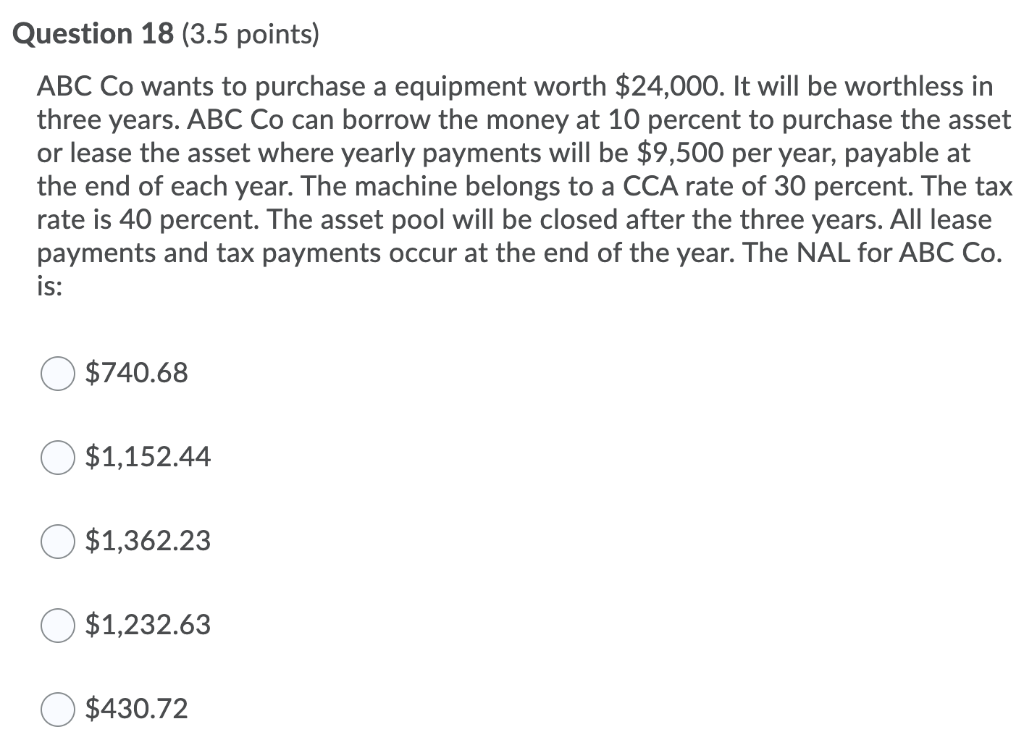

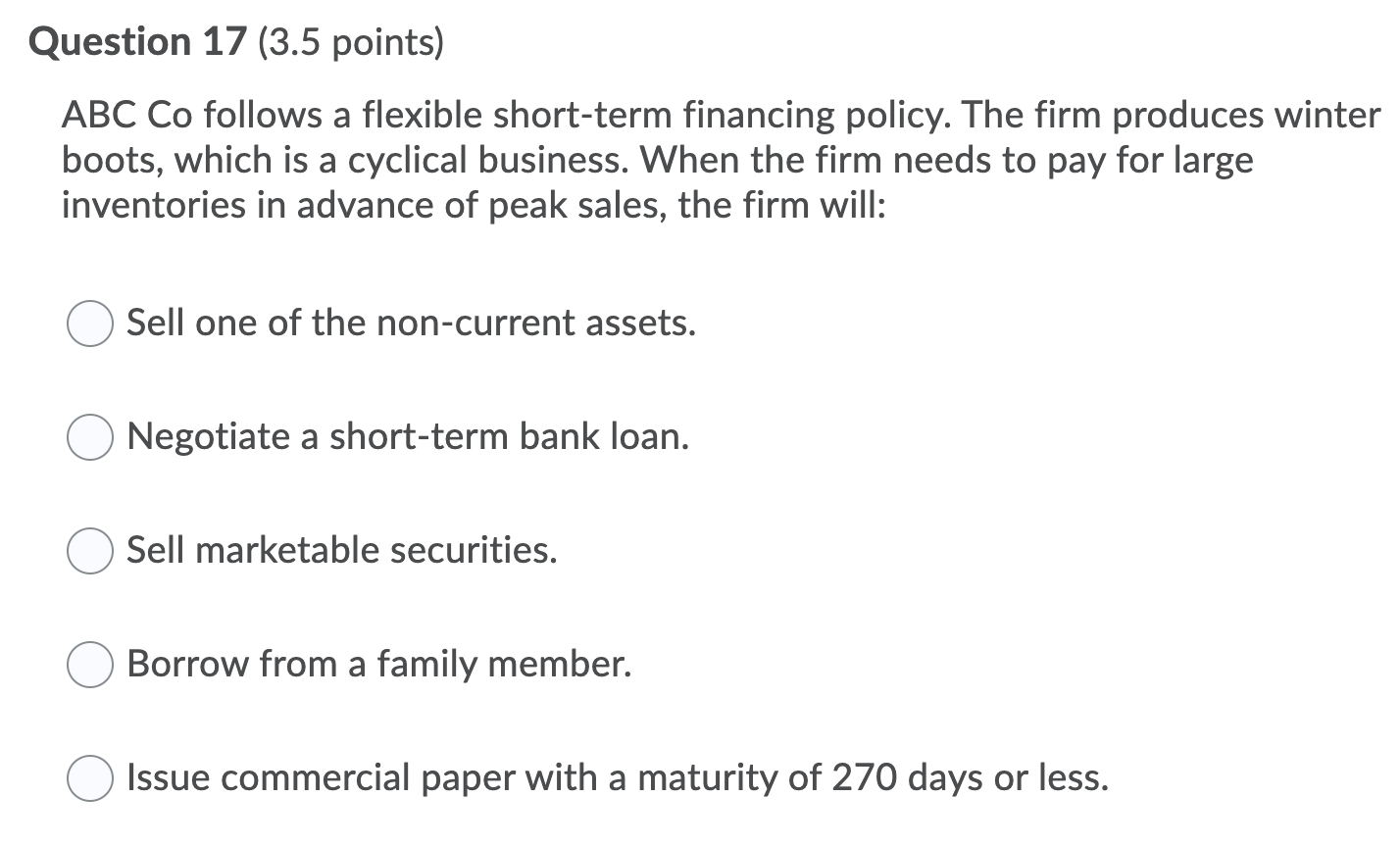

Question 18 (3.5 points) ABC Co wants to purchase a equipment worth $24,000. It will be worthless in three years. ABC Co can borrow the money at 10 percent to purchase the asset or lease the asset where yearly payments will be $9,500 per year, payable at the end of each year. The machine belongs to a CCA rate of 30 percent. The tax rate is 40 percent. The asset pool will be closed after the three years. All lease payments and tax payments occur at the end of the year. The NAL for ABC Co. is: $740.68 $1,152.44 $1,362.23 $1,232.63 $430.72 Question 17 (3.5 points) ABC Co follows a flexible short-term financing policy. The firm produces winter boots, which is a cyclical business. When the firm needs to pay for large inventories in advance of peak sales, the firm will: Sell one of the non-current assets. Negotiate a short-term bank loan. Sell marketable securities. Borrow from a family member. Issue commercial paper with a maturity of 270 days or less. Question 18 (3.5 points) ABC Co wants to purchase a equipment worth $24,000. It will be worthless in three years. ABC Co can borrow the money at 10 percent to purchase the asset or lease the asset where yearly payments will be $9,500 per year, payable at the end of each year. The machine belongs to a CCA rate of 30 percent. The tax rate is 40 percent. The asset pool will be closed after the three years. All lease payments and tax payments occur at the end of the year. The NAL for ABC Co. is: $740.68 $1,152.44 $1,362.23 $1,232.63 $430.72 Question 17 (3.5 points) ABC Co follows a flexible short-term financing policy. The firm produces winter boots, which is a cyclical business. When the firm needs to pay for large inventories in advance of peak sales, the firm will: Sell one of the non-current assets. Negotiate a short-term bank loan. Sell marketable securities. Borrow from a family member. Issue commercial paper with a maturity of 270 days or less

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts