Question: Please ANSWER ASAP Question 2 Assume you are a US company that exports computer and electronic products to Europe and expects to receive 500 million

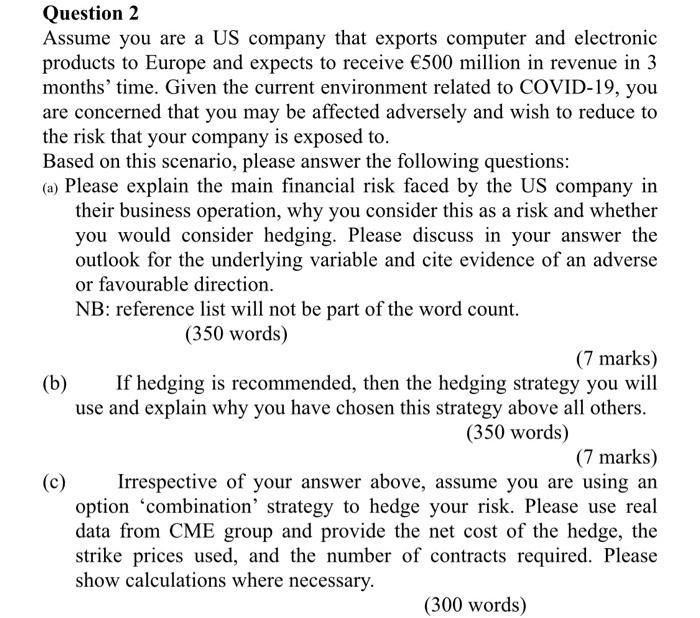

Question 2 Assume you are a US company that exports computer and electronic products to Europe and expects to receive 500 million in revenue in 3 months' time. Given the current environment related to COVID-19, you are concerned that you may be affected adversely and wish to reduce to the risk that your company is exposed to. Based on this scenario, please answer the following questions: (a) Please explain the main financial risk faced by the US company in their business operation, why you consider this as a risk and whether you would consider hedging. Please discuss in your answer the outlook for the underlying variable and cite evidence of an adverse or favourable direction. NB: reference list will not be part of the word count. (350 words) (7 marks) (b) If hedging is recommended, then the hedging strategy you will use and explain why you have chosen this strategy above all others. (350 words) (7 marks) Irrespective of your answer above, assume you are using an option "combination strategy to hedge your risk. Please use real data from CME group and provide the net cost of the hedge, the strike prices used, and the number of contracts required. Please show calculations where necessary. (300 words) Question 2 Assume you are a US company that exports computer and electronic products to Europe and expects to receive 500 million in revenue in 3 months' time. Given the current environment related to COVID-19, you are concerned that you may be affected adversely and wish to reduce to the risk that your company is exposed to. Based on this scenario, please answer the following questions: (a) Please explain the main financial risk faced by the US company in their business operation, why you consider this as a risk and whether you would consider hedging. Please discuss in your answer the outlook for the underlying variable and cite evidence of an adverse or favourable direction. NB: reference list will not be part of the word count. (350 words) (7 marks) (b) If hedging is recommended, then the hedging strategy you will use and explain why you have chosen this strategy above all others. (350 words) (7 marks) Irrespective of your answer above, assume you are using an option "combination strategy to hedge your risk. Please use real data from CME group and provide the net cost of the hedge, the strike prices used, and the number of contracts required. Please show calculations where necessary. (300 words)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts