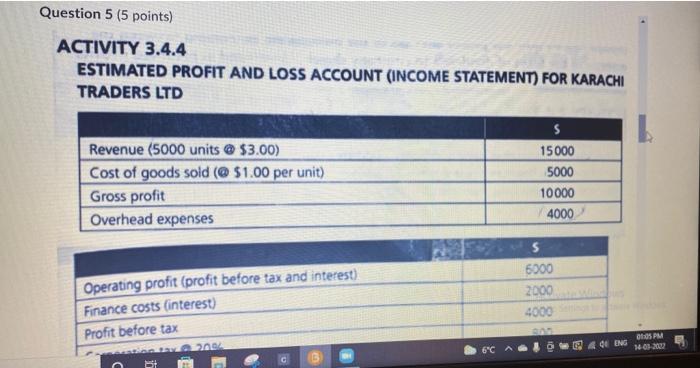

Question: please answer asap. Question 5 (5 points) ACTIVITY 3.4.4 ESTIMATED PROFIT AND LOSS ACCOUNT (INCOME STATEMENT) FOR KARACHI TRADERS LTD Revenue (5000 units @ $3.00)

please answer asap.

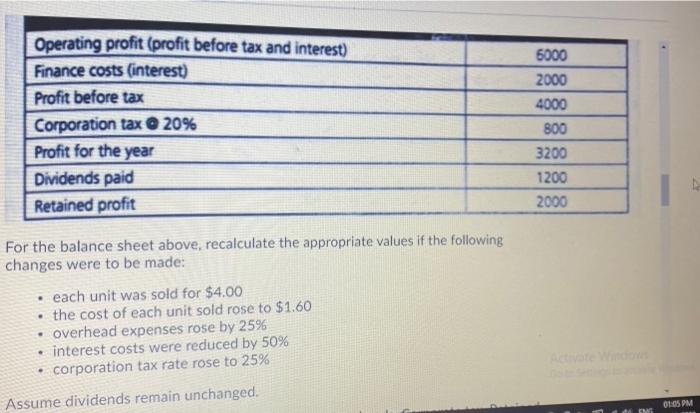

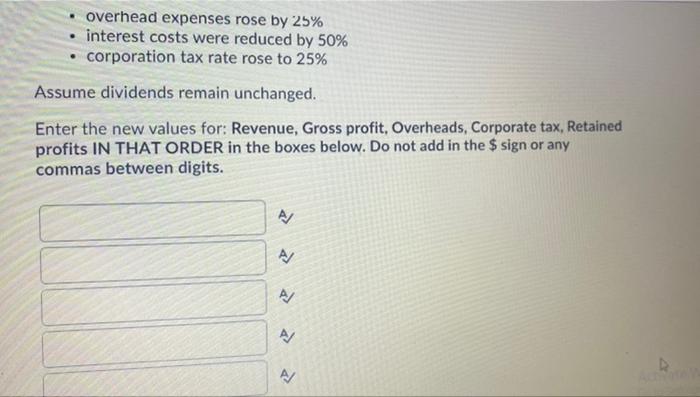

please answer asap.Question 5 (5 points) ACTIVITY 3.4.4 ESTIMATED PROFIT AND LOSS ACCOUNT (INCOME STATEMENT) FOR KARACHI TRADERS LTD Revenue (5000 units @ $3.00) Cost of goods sold (@ 51.00 per unit) Gross profit Overhead expenses S 15000 5000 10000 4000 s 6000 2000 4000 Operating profit (profit before tax and interest) Finance costs (interest) Profit before tax 2004 DOS PM 34 03 2002 6C DE ING Operating profit (profit before tax and interest) Finance costs (interest) Profit before tax Corporation tax @ 20% Profit for the year Dividends paid Retained profit 6000 2000 4000 800 3200 1200 2000 For the balance sheet above, recalculate the appropriate values if the following changes were to be made: each unit was sold for $4.00 the cost of each unit sold rose to $1.60 overhead expenses rose by 25% interest costs were reduced by 50% corporation tax rate rose to 25% Assume dividends remain unchanged. SPM EN overhead expenses rose by 25% interest costs were reduced by 50% corporation tax rate rose to 25% Assume dividends remain unchanged. Enter the new values for: Revenue, Gross profit, Overheads, Corporate tax, Retained profits IN THAT ORDER in the boxes below. Do not add in the $ sign or any commas between digits. A/ A A/ A/ A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts