Question: Please answer ASAP. Question 7 Cotham plc constructs flats for rent. It is considering buying a plot of land and has provided you with the

Please answer ASAP.

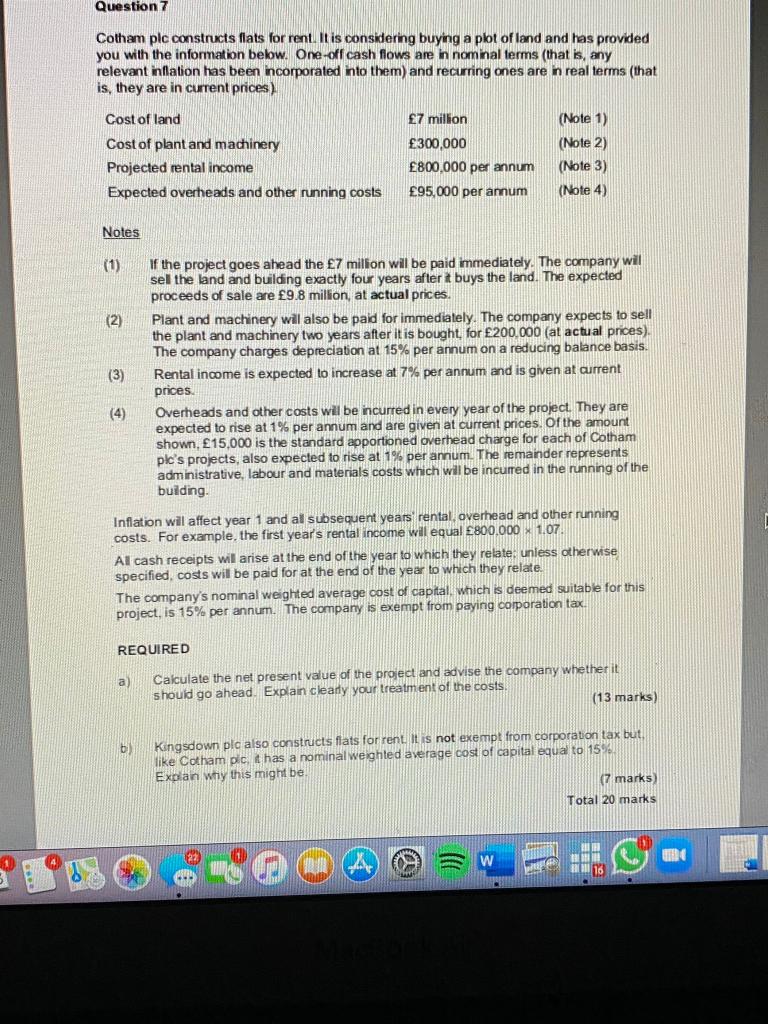

Question 7 Cotham plc constructs flats for rent. It is considering buying a plot of land and has provided you with the information below. One-off cash flows are in nominal terms (that is, any relevant inflation has been ncorporated into them) and recurring ones are n real terms (that is, they are in current prices) 7 million Cost of land Cost of plant and machinery Projected rental income Expected overheads and other running costs 300,000 800,000 per annum 95,000 per annum (Note 1) (Note 2) (Note 3) (Note 4) Notes (2) (3) If the project goes ahead the 7 million will be paid immediately. The company wil sel the land and building exactly four years after it buys the land. The expected proceeds of sale are 9.8 million, at actual prices. Plant and machinery will also be paid for immediately. The company expects to sell the plant and machinery two years after it is bought, for 200,000 (at actual prices). The company charges depreciation at 15% per annum on a reducing balance basis. Rental income is expected to increase at 7% per annum and is given at current prices Overheads and other costs will be incurred in every year of the project. They are expected to rise at 1% per annum and are given at current prices of the amount shown, 15,000 is the standard apportioned overhead charge for each of Cotham ple's projects, also expected to rise at 1% per annum. The remainder represents administrative, labour and materials costs which will be incurred the running of the building (4) Inflation will affect year 1 and al subsequent years rental, overhead and other running costs. For example, the first year's rental income will equal 800.000 X 1.07 Al cash receipts will arise at the end of the year to which they relate unless otherwise specified, costs will be paid for at the end of the year to which they relate. The company's nominal weighted average cost of capital, which is deemed suitable for this project, is 15% per annum. The company is exempt from paying corporation tax REQUIRED a) Calculate the net present value of the project and advise the company whether it should go ahead. Explain clearly your treatment of the costs (13 marks) Kingsdown plc also constructs flats for rent. It is not exempt from corporation tax but like Cotham plc, has a nominal weighted average cost of capital equal to 15 Explan why this might be (7 marks) Total 20 marks AL 16 Question 7 Cotham plc constructs flats for rent. It is considering buying a plot of land and has provided you with the information below. One-off cash flows are in nominal terms (that is, any relevant inflation has been ncorporated into them) and recurring ones are n real terms (that is, they are in current prices) 7 million Cost of land Cost of plant and machinery Projected rental income Expected overheads and other running costs 300,000 800,000 per annum 95,000 per annum (Note 1) (Note 2) (Note 3) (Note 4) Notes (2) (3) If the project goes ahead the 7 million will be paid immediately. The company wil sel the land and building exactly four years after it buys the land. The expected proceeds of sale are 9.8 million, at actual prices. Plant and machinery will also be paid for immediately. The company expects to sell the plant and machinery two years after it is bought, for 200,000 (at actual prices). The company charges depreciation at 15% per annum on a reducing balance basis. Rental income is expected to increase at 7% per annum and is given at current prices Overheads and other costs will be incurred in every year of the project. They are expected to rise at 1% per annum and are given at current prices of the amount shown, 15,000 is the standard apportioned overhead charge for each of Cotham ple's projects, also expected to rise at 1% per annum. The remainder represents administrative, labour and materials costs which will be incurred the running of the building (4) Inflation will affect year 1 and al subsequent years rental, overhead and other running costs. For example, the first year's rental income will equal 800.000 X 1.07 Al cash receipts will arise at the end of the year to which they relate unless otherwise specified, costs will be paid for at the end of the year to which they relate. The company's nominal weighted average cost of capital, which is deemed suitable for this project, is 15% per annum. The company is exempt from paying corporation tax REQUIRED a) Calculate the net present value of the project and advise the company whether it should go ahead. Explain clearly your treatment of the costs (13 marks) Kingsdown plc also constructs flats for rent. It is not exempt from corporation tax but like Cotham plc, has a nominal weighted average cost of capital equal to 15 Explan why this might be (7 marks) Total 20 marks AL 16

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts