Question: Please answer ASAP. SECTIONB There are four questions in this section. You must answer three of them. Question 6 Blue plc owns a chain of

Please answer ASAP.

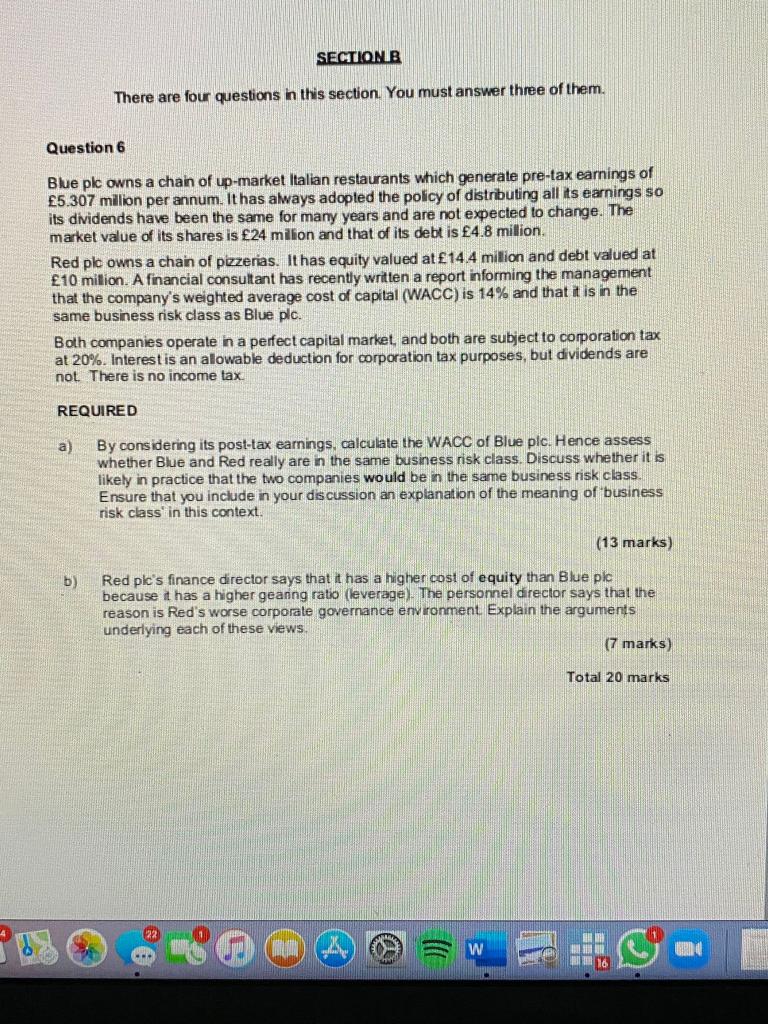

SECTIONB There are four questions in this section. You must answer three of them. Question 6 Blue plc owns a chain of up-market Italian restaurants which generate pre-tax earnings of 5.307 million per annum. It has always adopted the policy of distributing all its earnings so its dividends have been the same for many years and are not expected to change. The market value of its shares is 24 million and that of its debt is 4.8 million. Red plc owns a chain of pizzerias. It has equity valued at 14.4 million and debt valued at 10 million. A financial consultant has recently written a report informing the management that the company's weighted average cost of capital (WACC) is 14% and that it is in the same business risk class as Blue plc. Both companies operate in a perfect capital market, and both are subject to corporation tax at 20%. Interest is an alowable deduction for corporation tax purposes, but dividends are not. There is no income tax REQUIRED a By considering its post-tax earnings, calculate the WACC of Blue plc. Hence assess whether Blue and Red really are in the same business risk class. Discuss whether it is likely in practice that the two companies would be in the same business risk class. Ensure that you include in your discussion an explanation of the meaning of business risk class in this context. (13 marks b) Red plc's finance director says that it has a higher cost of equity than Blue plc because it has a higher geanng ratio (leverage). The personnel director says that the reason is Red's worse corporate governance environment Explain the arguments underlying each of these views (7 marks) Total 20 marks W URO CO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts