Question: please answer ASAP! Thank you so much (New project analysis) Raymobile Motors is considering the purchase of a new production machine for $550,000. The purchase

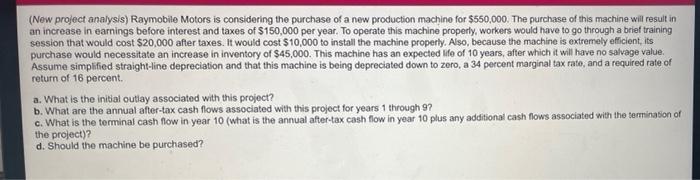

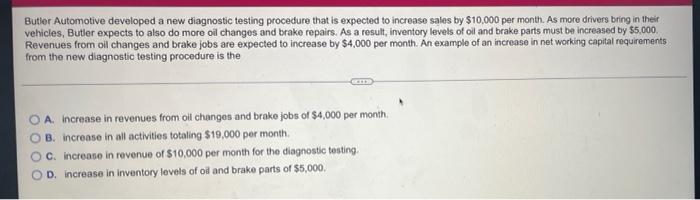

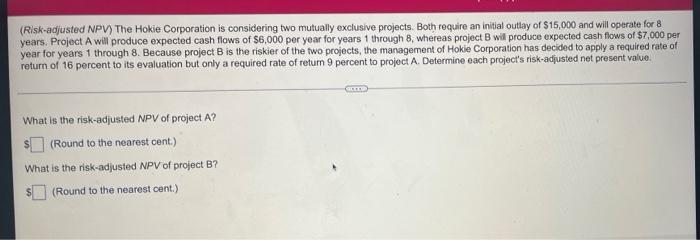

(New project analysis) Raymobile Motors is considering the purchase of a new production machine for $550,000. The purchase of this machine will result in an increase in earnings before interest and taxes of $150,000 per year. To operate this machine properly, workers would have to go through a brief training session that would cost $20,000 after taxes. It would cost $10,000 to install the machine properly. Also, because the machine is extremely efficient, its purchase would necessitate an increase in inventory of $45,000. This machine has an expected life of 10 years, after which it will have no salvage value Assume simplified straight-line depreciation and that this machine is being depreciated down to zero, a 34 percent marginal tax rato, and a required rate of return of 16 percent. a. What is the initial outlay associated with this project? b. What are the annual after-tax cash flows associated with this project for years through 97 c. What is the terminal cash flow in year 10 (what is the annual after-tax cash flow in year 10 plus any additional cash flows associated with the termination of the project)? d. Should the machine be purchased? Butler Automotive developed a new diagnostic testing procedure that is expected to increase sales by $10,000 per month. As more drivers bring in their vehicles, Butler expects to also do more oil changes and brake repairs. As a result, inventory levels of oil and brake parts must be increased by $5,000 Revenues from oil changes and brake jobs are expected to increase by $4.000 per month. An example of an increase in not working capital requirements from the new diagnostic testing procedure is the A. Increase in revenues from oil changes and brako jobs of $4,000 per month B. Increase in all activities totaling $19.000 per month OC increase in revenue of $10,000 per month for the diagnostic testing OD. increase in inventory levels of oil and brake parts of $5,000. (Risk-adjusted NPV) The Hokie Corporation is considering two mutually exclusive projects. Both require an initial outlay of $15,000 and will operate for 8 years. Project A will produce expected cash flows of $6,000 per year for years 1 through 8, whereas project will produce expected cash flows of $7,000 per year for years 1 through 8. Because project B is the riskier of the two projects, the management of Hokie Corporation has decided to apply a required rate of return of 16 percent to its evaluation but only a required rate of return 9 percent to project A. Determine each project's risk-adjusted not present value. CE What is the risk-adjusted NPV of project A? (Round to the nearest cent.) What is the risk-adjusted NPV of project B? (Round to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts