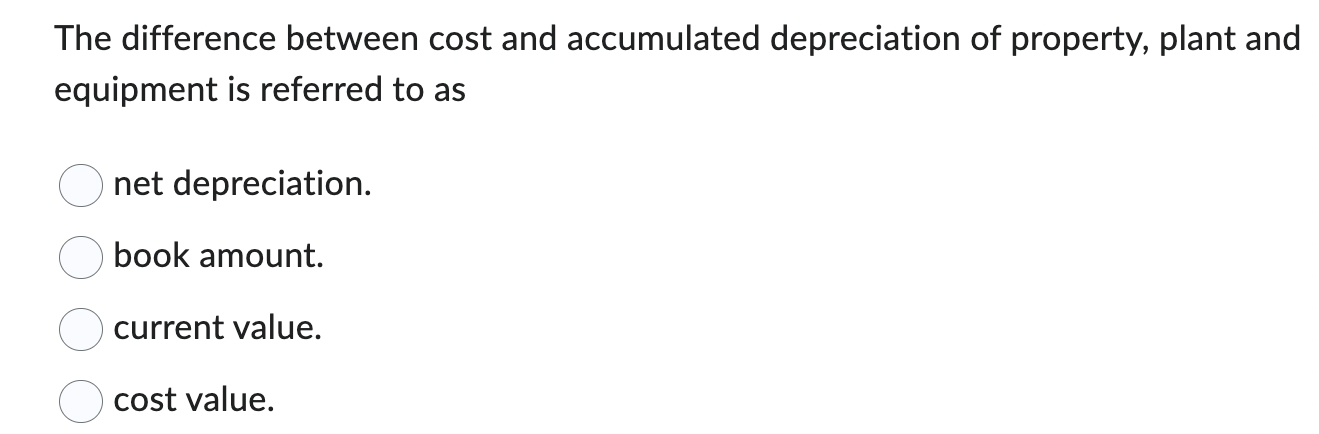

Question: PLEASE ANSWER ASAP THANK YOU The difference between cost and accumulated depreciation of property, plant and equipment is referred to as net depreciation. book amount.

PLEASE ANSWER ASAP THANK YOU

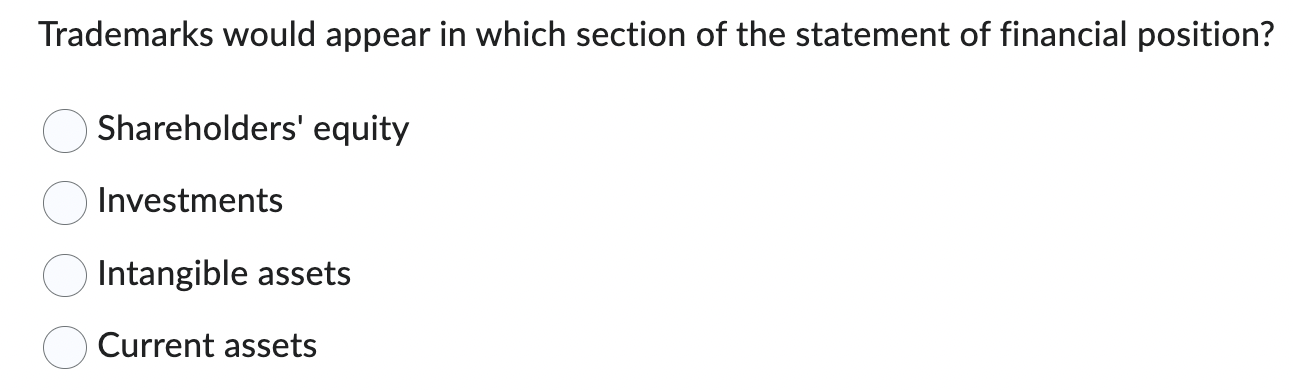

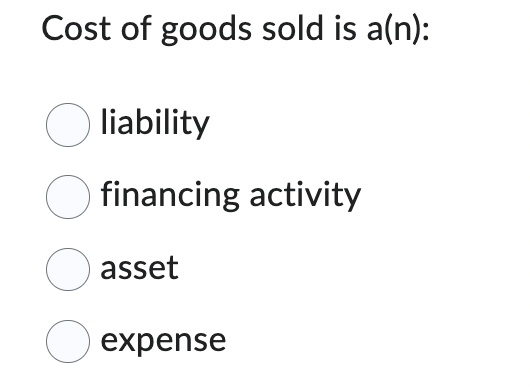

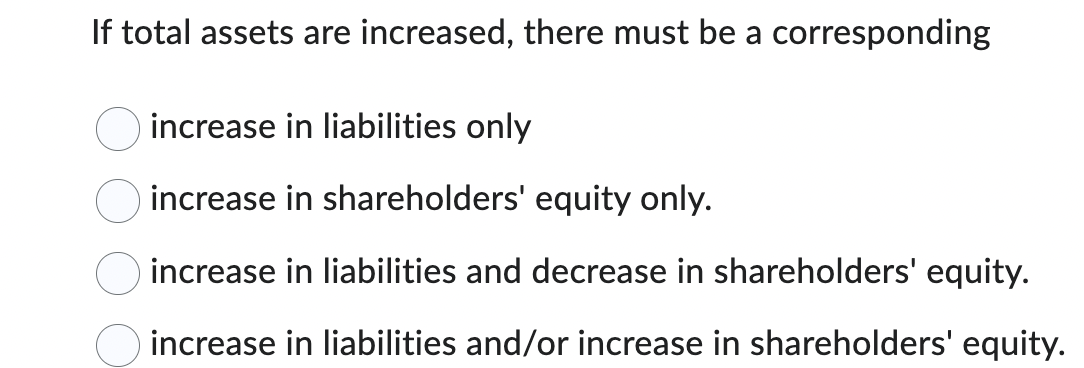

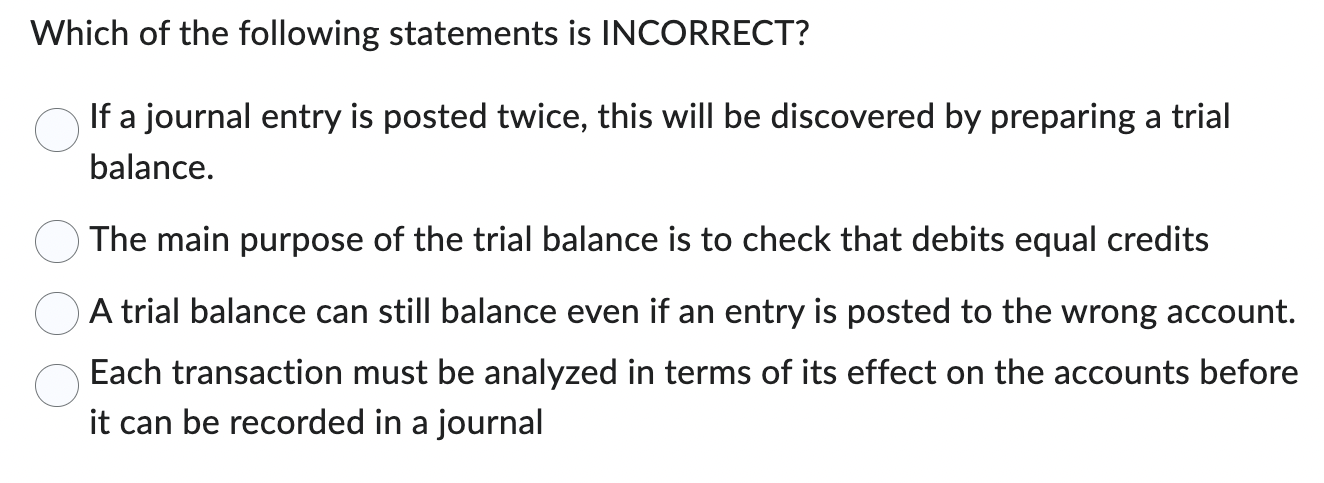

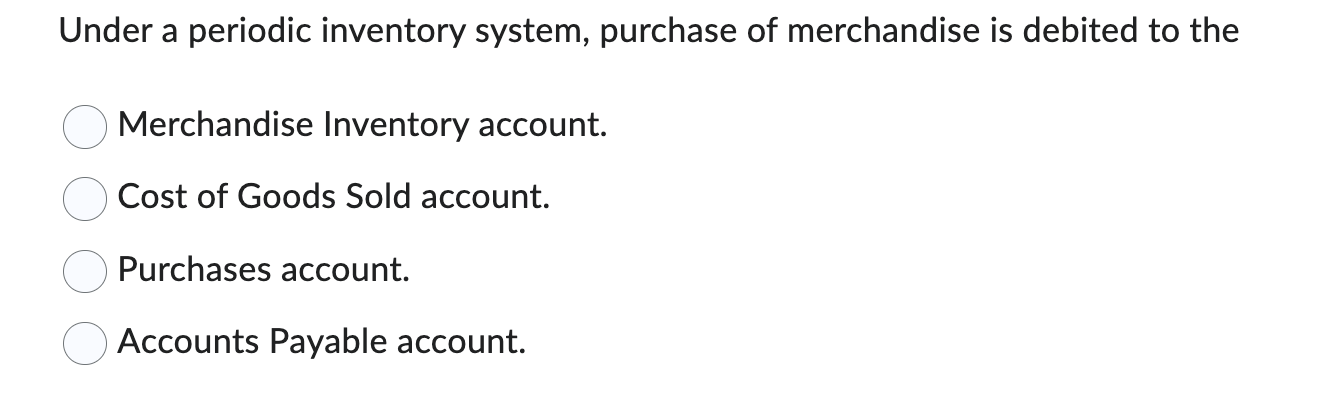

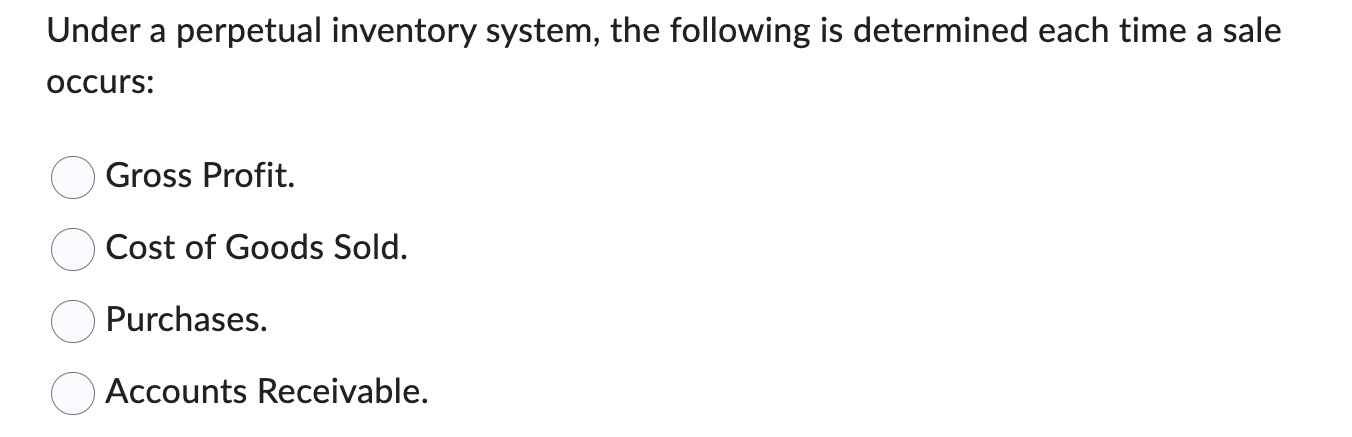

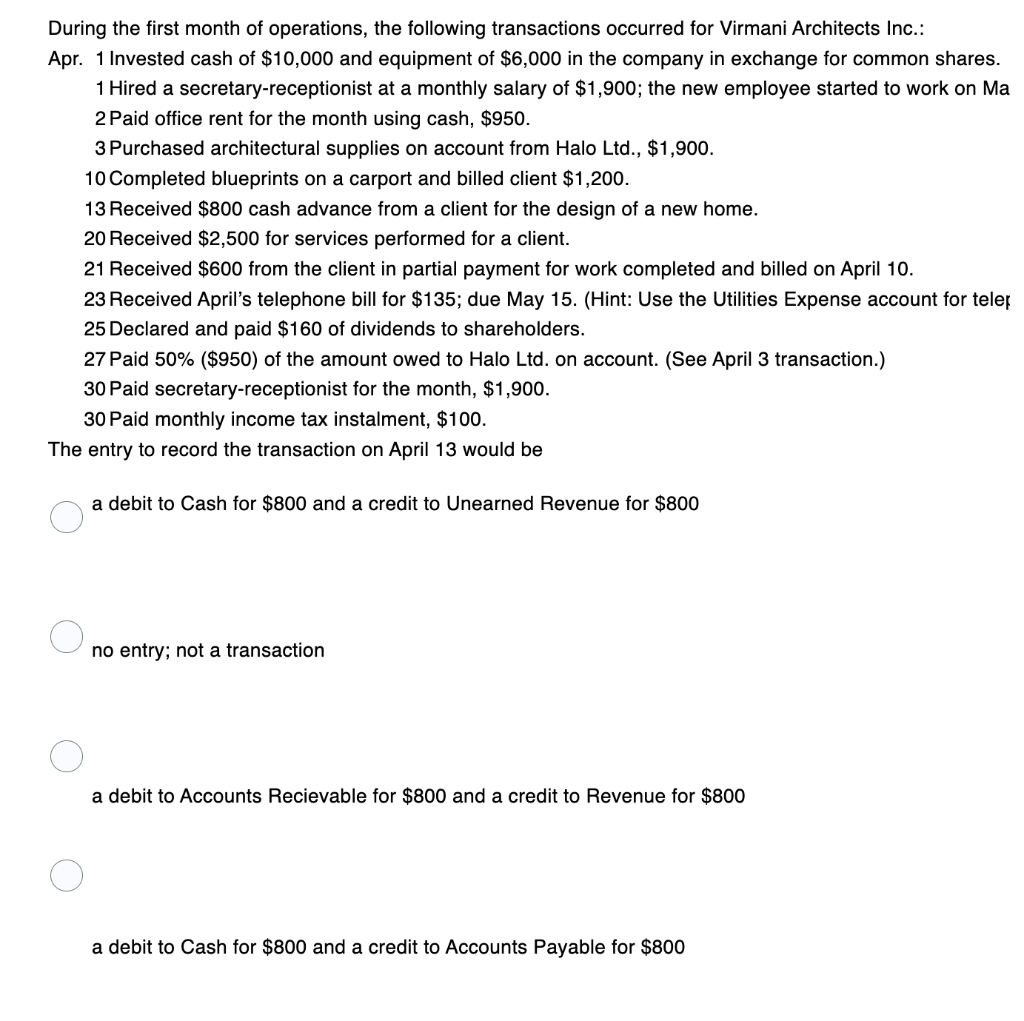

The difference between cost and accumulated depreciation of property, plant and equipment is referred to as net depreciation. book amount. current value. cost value. Trademarks would appear in which section of the statement of financial position? Shareholders' equity Investments Intangible assets Current assets Cost of goods sold is a(n): liability financing activity asset expense If total assets are increased, there must be a corresponding increase in liabilities only increase in shareholders' equity only. increase in liabilities and decrease in shareholders' equity. increase in liabilities and/or increase in shareholders' equity Which of the following statements is INCORRECT? If a journal entry is posted twice, this will be discovered by preparing a trial balance. The main purpose of the trial balance is to check that debits equal credits A trial balance can still balance even if an entry is posted to the wrong account. Each transaction must be analyzed in terms of its effect on the accounts before it can be recorded in a journal Under a periodic inventory system, purchase of merchandise is debited to the Merchandise Inventory account. Cost of Goods Sold account. Purchases account. Accounts Payable account. Under a perpetual inventory system, the following is determined each time a sale occurs: Gross Profit. Cost of Goods Sold. Purchases. Accounts Receivable. During the first month of operations, the following transactions occurred for Virmani Architects Inc.: Apr. 1 Invested cash of $10,000 and equipment of $6,000 in the company in exchange for common shares. 1 Hired a secretary-receptionist at a monthly salary of $1,900; the new employee started to work on Ma 2 Paid office rent for the month using cash, $950. 3Purchased architectural supplies on account from Halo Ltd., \$1,900. 10 Completed blueprints on a carport and billed client $1,200. 13 Received $800 cash advance from a client for the design of a new home. 20 Received $2,500 for services performed for a client. 21 Received $600 from the client in partial payment for work completed and billed on April 10. 23 Received April's telephone bill for $135; due May 15. (Hint: Use the Utilities Expense account for teler 25 Declared and paid $160 of dividends to shareholders. 27 Paid 50% (\$950) of the amount owed to Halo Ltd. on account. (See April 3 transaction.) 30 Paid secretary-receptionist for the month, $1,900. 30 Paid monthly income tax instalment, $100. The entry to record the transaction on April 13 would be a debit to Cash for $800 and a credit to Unearned Revenue for $800 no entry; not a transaction a debit to Accounts Recievable for $800 and a credit to Revenue for $800 a debit to Cash for $800 and a credit to Accounts Payable for $800

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts