Question: please answer asap. thank you x A - aty - A 1. AaBbCcDc AaBbCcDc AaBCD AaBbcc AaBBCc Normal 1 No Spac. Heading 1 Heading Heading

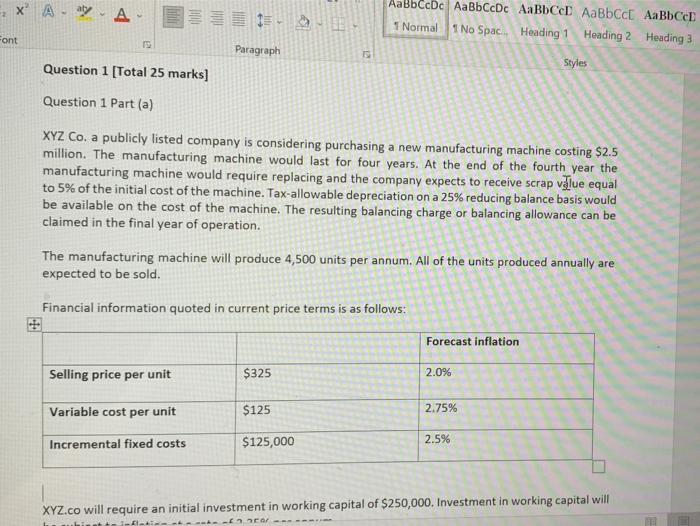

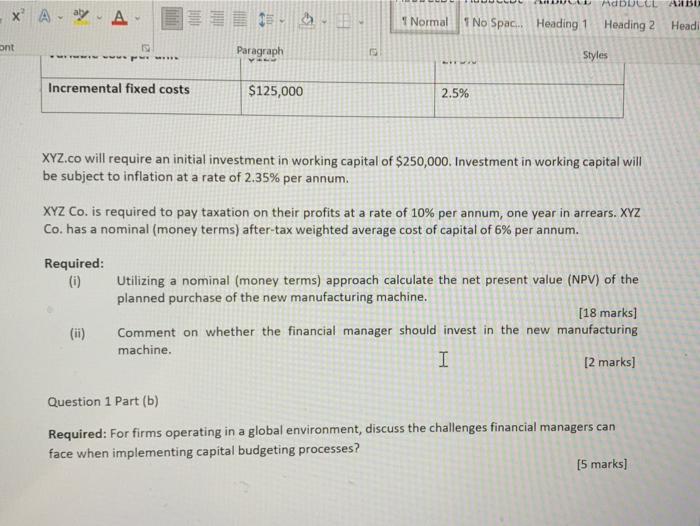

x A - aty - A 1. AaBbCcDc AaBbCcDc AaBCD AaBbcc AaBBCc Normal 1 No Spac. Heading 1 Heading Heading 3 Font Paragraph Question 1 [Total 25 marks] Styles Question 1 Part (a) XYZ Co. a publicly listed company is considering purchasing a new manufacturing machine costing $2.5 million. The manufacturing machine would last for four years. At the end of the fourth year the manufacturing machine would require replacing and the company expects to receive scrap value equal to 5% of the initial cost of the machine. Tax-allowable depreciation on a 25% reducing balance basis would be available on the cost of the machine. The resulting balancing charge or balancing allowance can be claimed in the final year of operation. The manufacturing machine will produce 4,500 units per annum. All of the units produced annually are expected to be sold. Financial information quoted in current price terms is as follows: Forecast inflation Selling price per unit $325 2.0% Variable cost per unit $125 2.75% $125,000 2.5% Incremental fixed costs XYZ.co will require an initial investment in working capital of $250,000. Investment in working capital will ho AdbuLUL ALBU x Amy A Normal 1 No Spac.. Heading 1 Heading 2 Headi ont Paragraph - wwe *** Styles Incremental fixed costs $125,000 2.5% XYZ.co will require an initial investment in working capital of $250,000. Investment in working capital will be subject to inflation at a rate of 2.35% per annum. XYZ Co. is required to pay taxation on their profits at a rate of 10% per annum, one year in arrears. XYZ Co. has a nominal (money terms) after-tax weighted average cost of capital of 6% per annum. Required: (0) Utilizing a nominal (money terms) approach calculate the net present value (NPV) of the planned purchase of the new manufacturing machine. [18 marks] Comment on whether the financial manager should invest in the new manufacturing machine I [2 marks] Question 1 Part (b) Required: For firms operating in a global environment, discuss the challenges financial managers can face when implementing capital budgeting processes? [5 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts