Question: please answer ASAP thanks QUESTION 3 The following financial data were taken from the 10-K of Weiss Corporation: Selected Accounts FY 2011 FY 2010 FY

please answer ASAP thanks

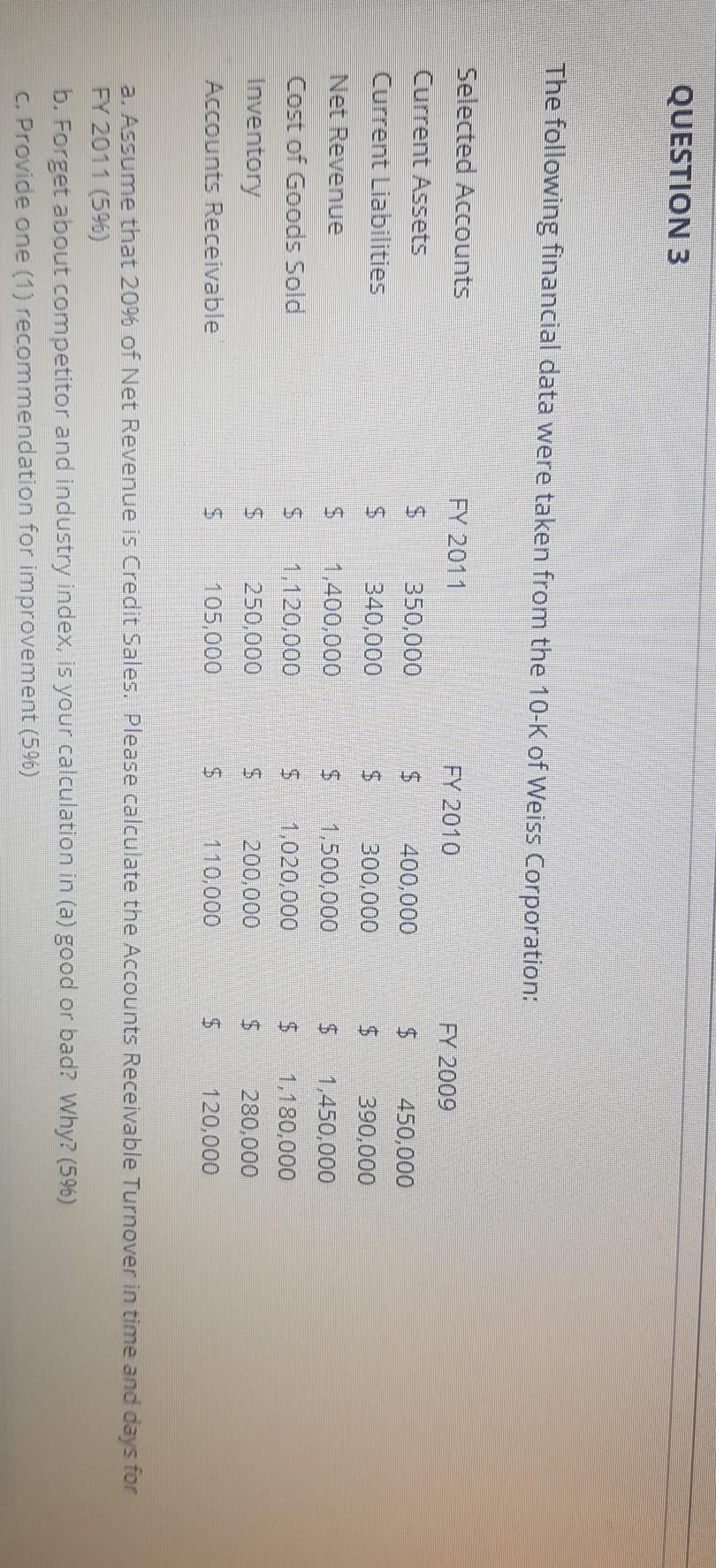

QUESTION 3 The following financial data were taken from the 10-K of Weiss Corporation: Selected Accounts FY 2011 FY 2010 FY 2009 $ UA $ $ A UA La $ Current Assets Current Liabilities Net Revenue Cost of Goods Sold Inventory Accounts Receivable 350,000 340,000 1,400,000 1,120,000 250,000 105,000 400,000 300,000 1,500,000 1,020,000 200,000 $ 450,000 390,000 1,450,000 1,180,000 280,000 120,000 $ $ A $ $ $ $ 110,000 $ a. Assume that 20% of Net Revenue is Credit Sales. Please calculate the Accounts Receivable Turnover in time and days for FY 2011 (59) b. Forget about competitor and industry index, is your calculation in (a) good or bad? Why? (596) C. Provide one (1) recommendation for improvement (5%)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts