Question: Please answer ASAP tonight, thank you so much for help in advance. Required information (The following information applies to the questions displayed below.] Daily Driver,

![advance. Required information (The following information applies to the questions displayed below.]](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/67160e7d08b15_74867160e7c69581.jpg)

Please answer ASAP tonight, thank you so much for help in advance.

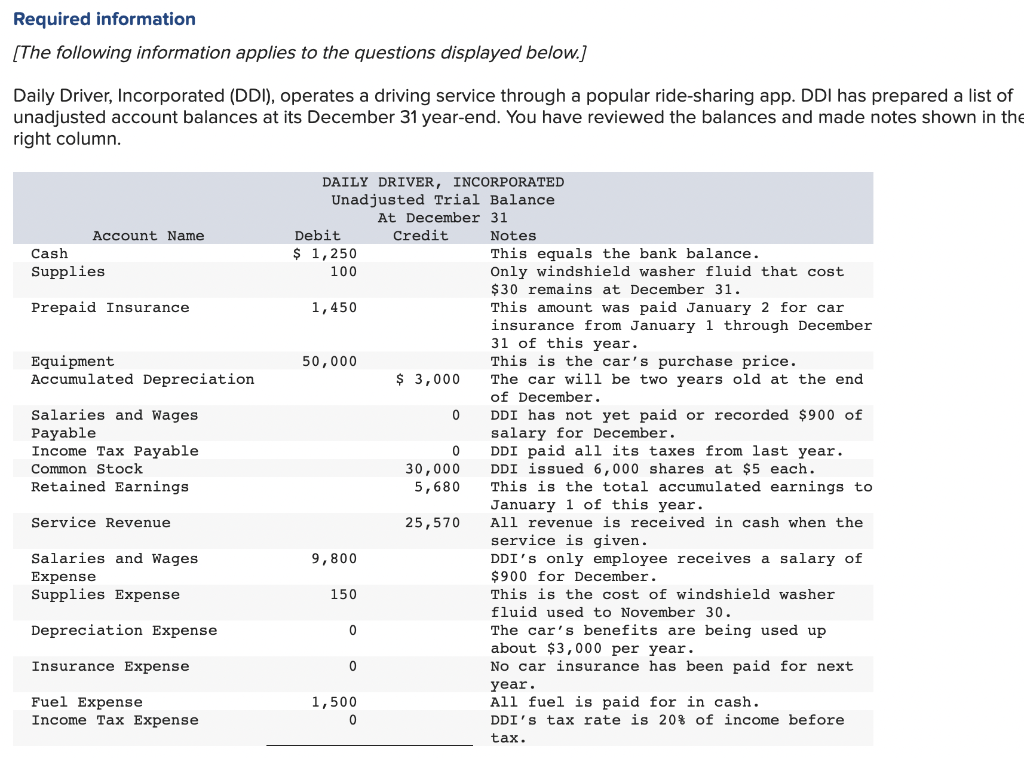

Required information (The following information applies to the questions displayed below.] Daily Driver, Incorporated (DDI), operates a driving service through a popular ride-sharing app. DDI has prepared a list of unadjusted account balances at its December 31 year-end. You have reviewed the balances and made notes shown in the right column. Account Name Cash Supplies Prepaid Insurance Equipment Accumulated Depreciation Salaries and Wages Payable Income Tax Payable Common Stock Retained Earnings DAILY DRIVER, INCORPORATED Unadjusted Trial Balance At December 31 Debit Credit Notes $ 1,250 This equals the bank balance. 100 Only windshield washer fluid that cost $30 remains at December 31. 1,450 This amount was paid January 2 for car insurance from January 1 through December 31 of this year. 50,000 This is the car's purchase price. $ 3,000 The car will be two years old at the end of December. 0 DDI has not yet paid or recorded $900 of salary for December. 0 DDI paid all its taxes from last year. 30,000 DDI issued 6,000 shares at $5 each. 5,680 This is the total accumulated earnings to January 1 of this year. 25,570 All revenue is received in cash when the service is given. 9,800 DDI's only employee receives a salary of $900 for December. 150 This is the cost of windshield washer fluid used to November 30. 0 The car's benefits are being used up about $3,000 per year. 0 No car insurance has been paid for next year. 1,500 All fuel is paid for in cash. 0 DDI's tax rate is 20% of income before tax. Service Revenue Salaries and Wages Expense Supplies Expense Depreciation Expense Insurance Expense Fuel Expense Income Tax Expense Depreciation Expense 0 Insurance Expense 0 The car's benefits are being used up about $3,000 per year. No car insurance has been paid for next year. All fuel is paid for in cash. DDI's tax rate is 20% of income before tax. Fuel Expense Income Tax Expense 1,500 0 Totals $ 64,250 $ 64,250 epare a classified balance sheet for the year ended December 31. (Amounts to be deducted should be indicated by a minus si DAILY DRIVER, INCORPORATED Balance Sheet For the Year Ended December 31 $ 0 0 0 0 $ $ 0 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts