Question: PLEASE ANSWER ASAP! WILL GIVE FEEDBACK ASAP!! Citrus Distributors have just concluded their first year of operations. They are evaluating their approach to bad debt

PLEASE ANSWER ASAP! WILL GIVE FEEDBACK ASAP!!

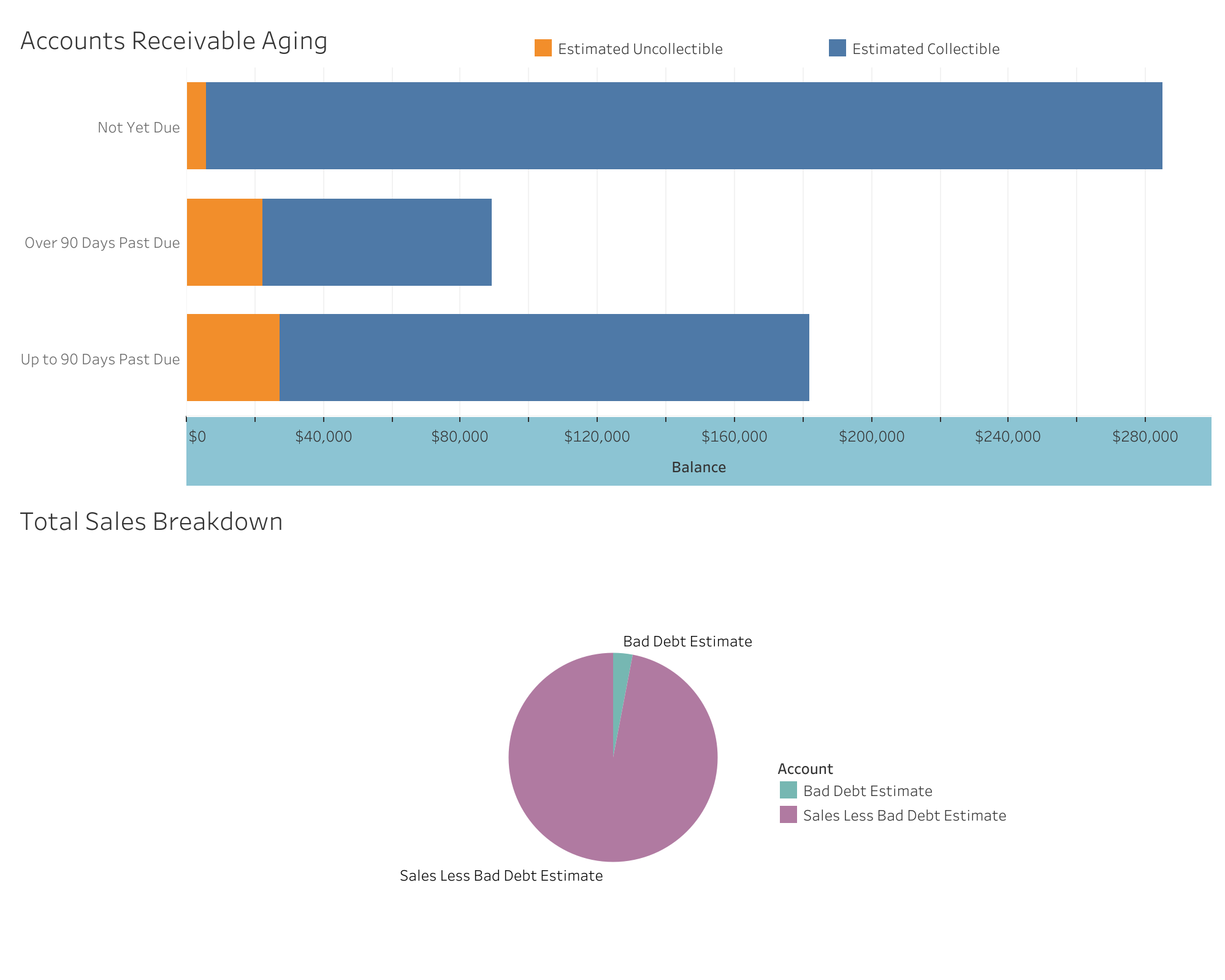

Citrus Distributors have just concluded their first year of operations. They are evaluating their approach to bad debt expense. They currently utilize the aging approach to estimate bad debt expense but would like to compare the results to the percentage of sales approach. The below dashboard presents the two different approaches:

- What was the estimated uncollected percentage used to determine the estimated uncollectible amount for each of the aging categories?

| Not yet due | |

| Up to 90 days past due | |

| Over 90 days past due |

2. What percentage of total credit sales was used to estimate bad debt using the percentage of sales approach?

3. What would be the total estimated bad debt under each approach:

| Aging Approach | |

| Percentage of sales approach |

Accounts Receivable Aging Estimated Uncollectible Estimated Collectible Not Yet Due Over 90 Days Past Due Up to 90 Days Past Due $0 $40,000 $80,000 $120,000 $160,000 $200,000 $240,000 $280,000 Balance Total Sales Breakdown Sales Less Bad Debt Estimate Bad Debt Estimate Account Bad Debt Estimate Sales Less Bad Debt Estimate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts