Question: PLEASE ANSWER ASAP! Will rate! A company is considering two mutually exclusive expansion plans/Plan A requires $50 million initial outlay on a large-scale integrated plant

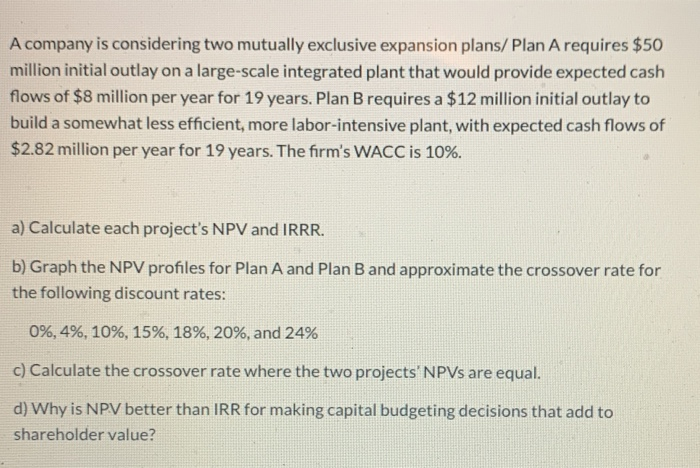

A company is considering two mutually exclusive expansion plans/Plan A requires $50 million initial outlay on a large-scale integrated plant that would provide expected cash flows of $8 million per year for 19 years. Plan B requires a $12 million initial outlay to build a somewhat less efficient, more labor-intensive plant, with expected cash flows of $2.82 million per year for 19 years. The firm's WACC is 10%. a) Calculate each project's NPV and IRRR. b) Graph the NPV profiles for Plan A and Plan B and approximate the crossover rate for the following discount rates: 0%, 4%, 10%, 15%, 18%, 20%, and 24% c) Calculate the crossover rate where the two projects' NPVs are equal. d) Why is NPV better than IRR for making capital budgeting decisions that add to shareholder value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts