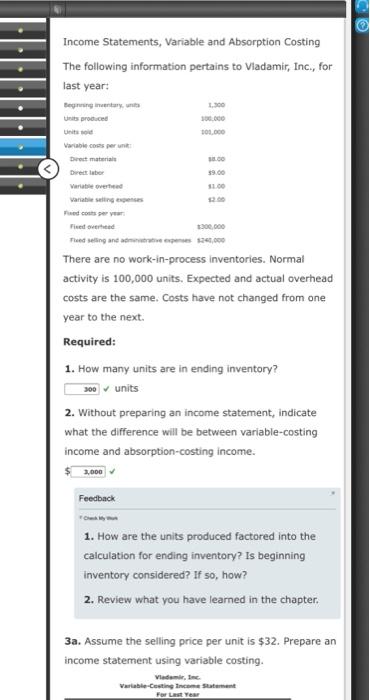

Question: please answer ASAP. will rate Income Statements, Variable and Absorption Costing The following information pertains to Vladamir, Inc., for last year: tegory 1.300 Un produced

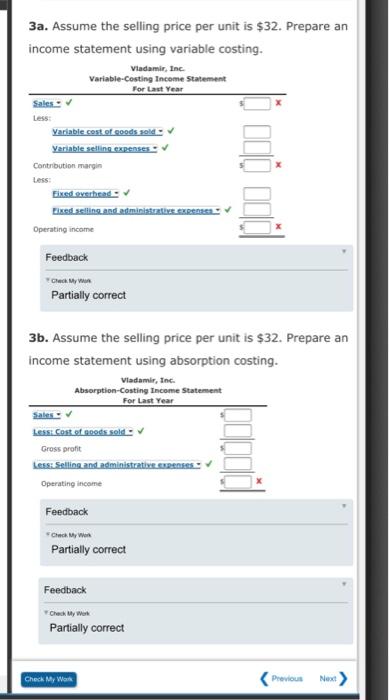

Income Statements, Variable and Absorption Costing The following information pertains to Vladamir, Inc., for last year: tegory 1.300 Un produced Unitsid 100.000 Variables per un Direct materiale Direct labor Verteve 11.00 Variable sing expenses 300,000 Five Theedelling and mees 2000 There are no work-in-process inventories. Normal activity is 100,000 units. Expected and actual overhead costs are the same. Costs have not changed from one year to the next Required: 1. How many units are in ending inventory? 300 units 2. Without preparing an income statement, indicate what the difference will be between variable-costing income and absorption-costing income. 3.000 Feedback 1. How are the units produced factored into the calculation for ending inventory? Is beginning Inventory considered? If so, how? 2. Review what you have learned in the chapter. 3a. Assume the selling price per unit is $32. Prepare an income statement using variable costing. Vladimir, Inc. For Last Year 3a. Assume the selling price per unit is $32. Prepare an income statement using variable costing. Vladamir Inc Variable-Costing Income Statement For Last Year Sales Less Variable cost of goods Variable selling expenses Contribution margin Fixed shead Fixed selling and administrative expense Operating income Feedback Check My W Partially correct 3b. Assume the selling price per unit is $32. Prepare an income statement using absorption costing. Vladamir, Inc. Absorption-Costing Income Statement For Last Year Sales LESSE Cost of goods sold Gross profit Less: Selling and Administrative Rese Operating income Feedback Check My Wor Partially correct Feedback Check My Wor Partially correct Check My Work Previous Next > Income Statements, Variable and Absorption Costing The following information pertains to Vladamir, Inc., for last year: tegory 1.300 Un produced Unitsid 100.000 Variables per un Direct materiale Direct labor Verteve 11.00 Variable sing expenses 300,000 Five Theedelling and mees 2000 There are no work-in-process inventories. Normal activity is 100,000 units. Expected and actual overhead costs are the same. Costs have not changed from one year to the next Required: 1. How many units are in ending inventory? 300 units 2. Without preparing an income statement, indicate what the difference will be between variable-costing income and absorption-costing income. 3.000 Feedback 1. How are the units produced factored into the calculation for ending inventory? Is beginning Inventory considered? If so, how? 2. Review what you have learned in the chapter. 3a. Assume the selling price per unit is $32. Prepare an income statement using variable costing. Vladimir, Inc. For Last Year 3a. Assume the selling price per unit is $32. Prepare an income statement using variable costing. Vladamir Inc Variable-Costing Income Statement For Last Year Sales Less Variable cost of goods Variable selling expenses Contribution margin Fixed shead Fixed selling and administrative expense Operating income Feedback Check My W Partially correct 3b. Assume the selling price per unit is $32. Prepare an income statement using absorption costing. Vladamir, Inc. Absorption-Costing Income Statement For Last Year Sales LESSE Cost of goods sold Gross profit Less: Selling and Administrative Rese Operating income Feedback Check My Wor Partially correct Feedback Check My Wor Partially correct Check My Work Previous Next >

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts