Question: PLEASE ANSWER ASAP WITH ANSWER AND STEPS ON HOW YOU GOT TO THE ANSWER LUUOL alibi (Body -11 A A A A E 214 3

PLEASE ANSWER ASAP WITH ANSWER AND STEPS ON HOW YOU GOT TO THE ANSWER

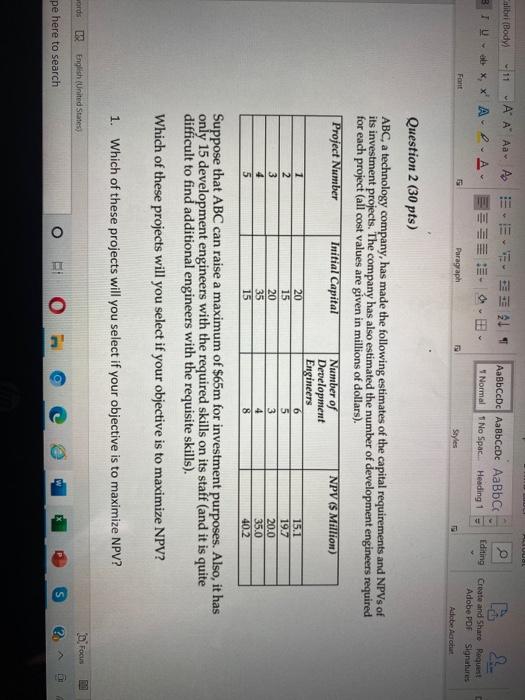

PLEASE ANSWER ASAP WITH ANSWER AND STEPS ON HOW YOU GOT TO THE ANSWERLUUOL alibi (Body -11 A A A A E 214 3 yax, x' APA. AaBbccDc AaBb CcDc AaBb C Normal 1 No Space Heading 1 Create and Share Request Adobe PDF Signatures Adebe Acrobat Fant Paragraph Styles Question 2 (30 pts) ABC a technology company, has made the following estimates of the capital requirements and NPVs of its investment projects. The company has also estimated the number of development engineers required for each project (all cost values are given in millions of dollars). Project Number Initial Capital Number of NPV (5 Million) Development Engineers 20 15.1 2 15 5 19.7 3 20 3 20.0 35 4 35.0 5 15 8 40.2 1 6 4 Suppose that ABC can raise a maximum of $65m for investment purposes. Also, it has only 15 development engineers with the required skills on its staff (and it is quite difficult to find additional engineers with the requisite skills). Which of these projects will you select if your objective is to maximize NPV? 1. Which of these projects will you select if your objective is to maximize NPV? words English (United States) D. FOCUS pe here to search O BI O

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts