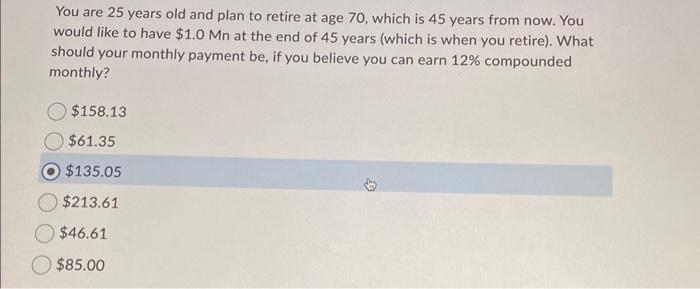

Question: please answer asap You are 25 years old and plan to retire at age 70 , which is 45 years from now. You would like

You are 25 years old and plan to retire at age 70 , which is 45 years from now. You would like to have $1.0Mn at the end of 45 years (which is when you retire). What should your monthly payment be, if you believe you can earn 12% compounded monthly? $158.13 $61.35 $135.05 $213.61 $46.61 $85.00 Jane's daughter will be going to college at the end of eight years. She wishes to have a fund that will provide her daughter $12,000 per year (end of each year) for each of her four years (which is end of years 9,10,11,12 ) in college. How much must you put into that fund today if the fund will earn 10 percent in each of the 12 years? $21,471,68 $17.745.19 $18,465,79 $13,921.62 $38,038.39 Question 18 (3.5 points) Saved After graduation, you plan to work and save for 10 years and then start your own business. You currently have $10,000 which you will invest immediately (year 0). In addition, you expect to save and deposit $10,000 a year for the first 5 years (year 1 through year 5) and \$15,000 annually for the following 5 years (year 6 through year 10). If the account earns 10% compounded annually, how much will you in your account have when you start your business 10 years from now? $338,223.00 $319,586.87 $247,442.01 $215,837,17 $208,535,87

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts