Question: please answer ASAPPP Teal Construction had a contract starting January 2025, to construct a $4,000,000 building that is expected to be completed in December 2023,

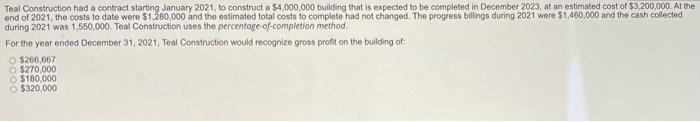

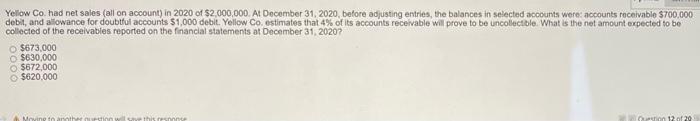

Teal Construction had a contract starting January 2025, to construct a $4,000,000 building that is expected to be completed in December 2023, at an estimated cost of $3,200,000. At the end of 2021, the costs to date were $1,280,000 and the estimated total costs to complete had not changed. The progress bilings during 2021 were $1.460,000 and the cash collected during 2021 was 1,550,000. Teal Construction uses the percentage of completion method For the year ended December 31, 2021, Teal Construction would recognize gross profit on the building of $266,667 $270,000 $180.000 $320,000 Yellow Co. had net sales (all on account) in 2020 of $2,000,000. At December 31, 2020, before adjusting entries, the balances in selected accounts were accounts receivable $700,000 debit, and allowance for doubtful accounts $1.000 debit. Yellow Co estimates that 4% of its accounts receivable will prove to be uncollectible. What is the net amount expected to be collected of the receivables reported on the financial statements at December 31, 2020? $673,000 $630,000 $672,000 $620.000 12 of 20

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts