Question: Please answer B and C 5. Portfolio Analysis Suppose there are two common stocks available for investment, stock A and stock B, with the following

Please answer B and C

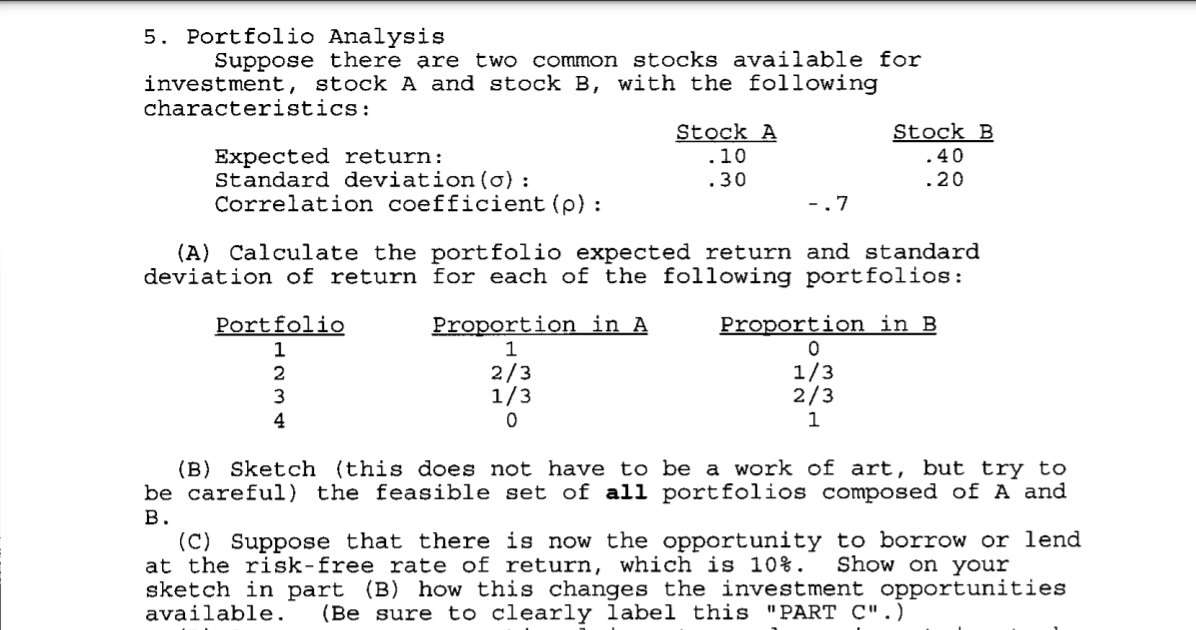

5. Portfolio Analysis Suppose there are two common stocks available for investment, stock A and stock B, with the following characteristics: Stock A Stock B Expected return: .10 .40 Standard deviation (o): .30 .20 Correlation coefficient (p): -.7 (A) Calculate the portfolio expected return and standard deviation of return for each of the following portfolios: Portfolio 1 2 3 4 Proportion in A 1 2/3 1/3 0 Proportion in B O 1/3 2/3 1 (B) Sketch (this does not have to be a work of art, but try to be careful) the feasible set of all portfolios composed of A and B. (C) Suppose that there is now the opportunity to borrow or lend at the risk-free rate of return, which is 10%. Show on your sketch in part (B) how this changes the investment opportunities available. (Be sure to clearly label this "PART C".) 5. Portfolio Analysis Suppose there are two common stocks available for investment, stock A and stock B, with the following characteristics: Stock A Stock B Expected return: .10 .40 Standard deviation (o): .30 .20 Correlation coefficient (p): -.7 (A) Calculate the portfolio expected return and standard deviation of return for each of the following portfolios: Portfolio 1 2 3 4 Proportion in A 1 2/3 1/3 0 Proportion in B O 1/3 2/3 1 (B) Sketch (this does not have to be a work of art, but try to be careful) the feasible set of all portfolios composed of A and B. (C) Suppose that there is now the opportunity to borrow or lend at the risk-free rate of return, which is 10%. Show on your sketch in part (B) how this changes the investment opportunities available. (Be sure to clearly label this "PART C".)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts