Question: please answer b and c. also for b - round to 5 decimal places and DONT make it a % FIN 300-F2 Homework: Lab 10

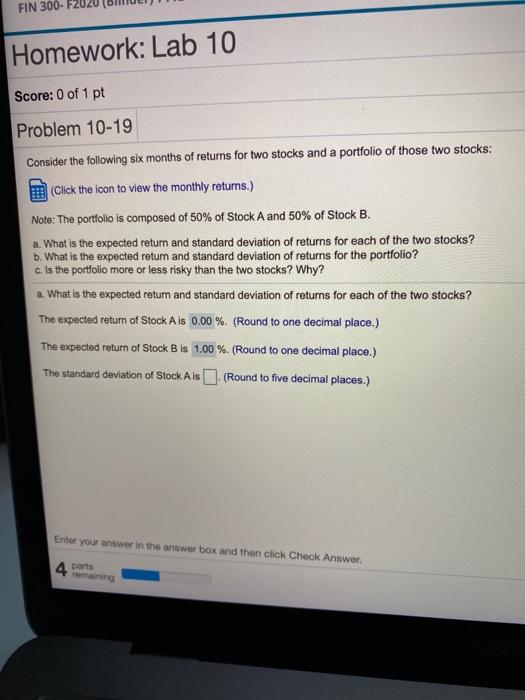

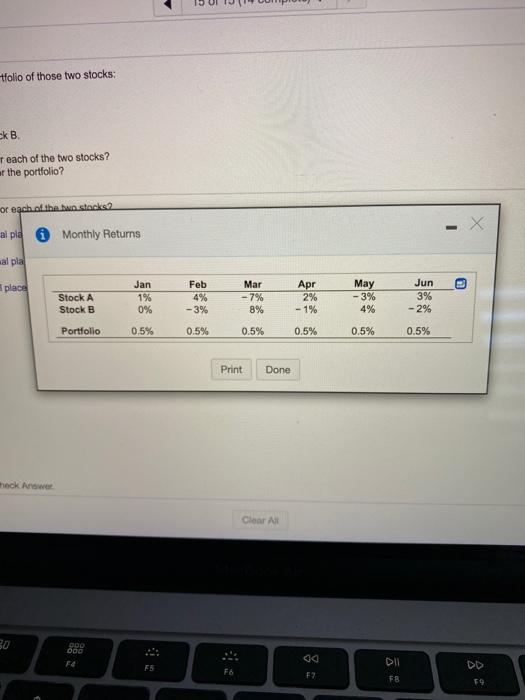

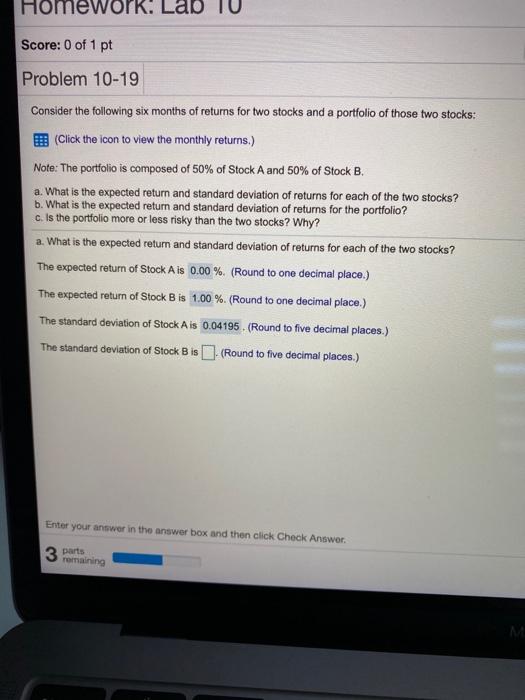

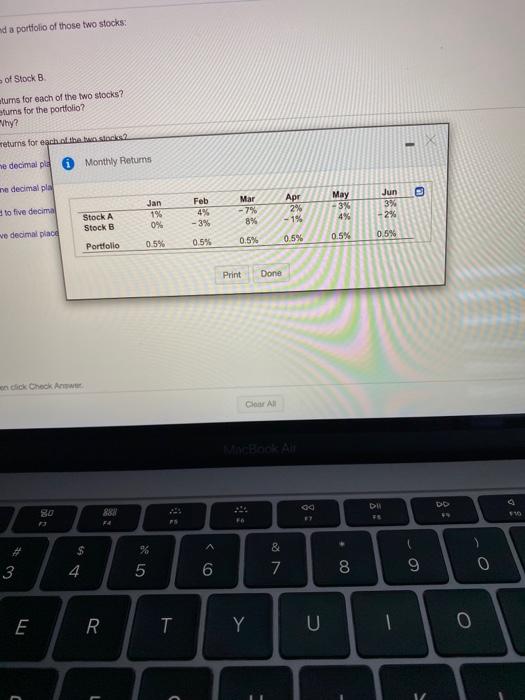

FIN 300-F2 Homework: Lab 10 Score: 0 of 1 pt Problem 10-19 Consider the following six months of returns for two stocks and a portfolio of those two stocks: (Click the icon to view the monthly returns.) Note: The portfolio is composed of 50% of Stock A and 50% of Stock B. a. What is the expected return and standard deviation of returns for each of the two stocks? b. What is the expected return and standard deviation of returns for the portfolio? c. Is the portfolio more or less risky than the two stocks? Why? a. What is the expected return and standard deviation of returns for each of the two stocks? The expected return of Stock Ais 0.00 %. (Round to one decimal place.) The expected return of Stock B is 1.00 %. (Round to one decimal place.) The standard deviation of Stock Ais (Round to five decimal places.) Enter your answer in the answer box and then click Check Answer 4 ports remaining Htfolio of those two stocks: skB reach of the two stocks? r the portfolio? or each of the hun stack 2 X al pla i Monthly Returns al pla place Stock A Stock B Jan 1% 0% Feb 4% -3% Mar -7% 8% Apr 2% - 1% May - 3% 4% Jun 3% - 2% Portfolio 0.5% 0.5% 0.5% 0.5% 0.5% 0.5% Print Done heck Answer Clear At ODD DOO DD FS F8 FY F8 59 Home k. Lao Score: 0 of 1 pt Problem 10-19 Consider the following six months of returns for two stocks and a portfolio of those two stocks: (Click the icon to view the monthly returns.) Note: The portfolio is composed of 50% of Stock A and 50% of Stock B. a. What is the expected return and standard deviation of returns for each of the two stocks? b. What is the expected return and standard deviation of returns for the portfolio? c. Is the portfolio more or less risky than the two stocks? Why? a. What is the expected return and standard deviation of returns for each of the two stocks? The expected return of Stock Ais 0.00 %. (Round to one decimal place.) The expected return of Stock Bis 1,00 %. (Round to one decimal place.) The standard deviation of Stock Ais 0.04195 (Round to five decimal places.) The standard deviation of Stock B is (Round to five decimal places.) Enter your answer in the answer box and then click Check Answer 3 parts remaining nd a portfolio of those two stocks: of Stock B turns for each of the two stocks? turns for the portfolio? Why? returns for each of the stocks 2 - he decimal pla Monthly Returns ne decimal pla Jun to five decima Feb 4% -3% Jan 1% 0% Mar -7% 8% May -3% 45 Apr 2% - 1% 3% -2% Stock A Stock ve decimal place 0.5% 0.5% 0.5% 0.5% Portfolio 0.5% 0.5% Print Done click Check CA Dll DD 80 FO % A & 3 4 5 6 7 8 9 0 E R T Y U O 0 1/

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts