Question: please answer b) and c) Amazon is on a mission to be net zero carbon by 2040 . As part of that endeavor, they are

please answer b) and c)

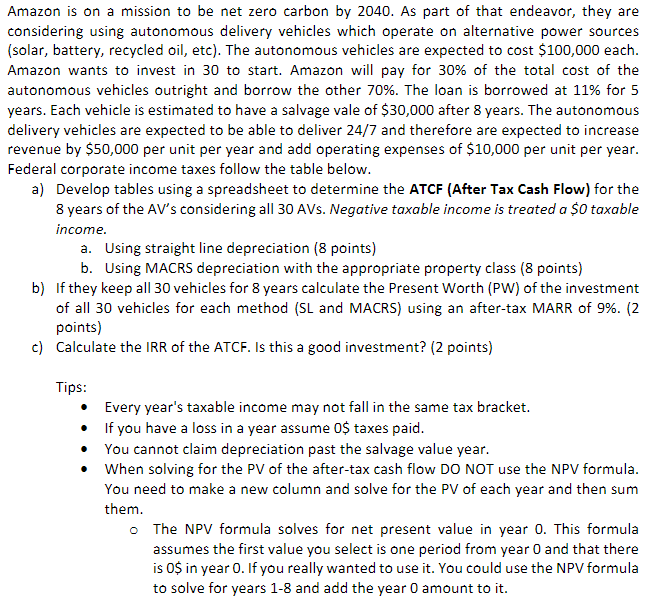

Amazon is on a mission to be net zero carbon by 2040 . As part of that endeavor, they are considering using autonomous delivery vehicles which operate on alternative power sources (solar, battery, recycled oil, etc). The autonomous vehicles are expected to cost $100,000 each. Amazon wants to invest in 30 to start. Amazon will pay for 30% of the total cost of the autonomous vehicles outright and borrow the other 70%. The loan is borrowed at 11% for 5 years. Each vehicle is estimated to have a salvage vale of $30,000 after 8 years. The autonomous delivery vehicles are expected to be able to deliver 24/7 and therefore are expected to increase revenue by $50,000 per unit per year and add operating expenses of $10,000 per unit per year. Federal corporate income taxes follow the table below. a) Develop tables using a spreadsheet to determine the ATCF (After Tax Cash Flow) for the 8 years of the AV's considering all 30AVs. Negative taxable income is treated a $0 taxable income. a. Using straight line depreciation (8 points) b. Using MACRS depreciation with the appropriate property class (8 points) b) If they keep all 30 vehicles for 8 years calculate the Present Worth (PW) of the investment of all 30 vehicles for each method (SL and MACRS) using an after-tax MARR of 9%. ( 2 points) c) Calculate the IRR of the ATCF. Is this a good investment? (2 points) Tips: - Every year's taxable income may not fall in the same tax bracket. - If you have a loss in a year assume 0\$ taxes paid. - You cannot claim depreciation past the salvage value year. - When solving for the PV of the after-tax cash flow DO NOT use the NPV formula. You need to make a new column and solve for the PV of each year and then sum them. - The NPV formula solves for net present value in year 0 . This formula assumes the first value you select is one period from year 0 and that there is 0$ in year 0 . If you really wanted to use it. You could use the NPV formula to solve for years 1-8 and add the year 0 amount to it. Amazon is on a mission to be net zero carbon by 2040 . As part of that endeavor, they are considering using autonomous delivery vehicles which operate on alternative power sources (solar, battery, recycled oil, etc). The autonomous vehicles are expected to cost $100,000 each. Amazon wants to invest in 30 to start. Amazon will pay for 30% of the total cost of the autonomous vehicles outright and borrow the other 70%. The loan is borrowed at 11% for 5 years. Each vehicle is estimated to have a salvage vale of $30,000 after 8 years. The autonomous delivery vehicles are expected to be able to deliver 24/7 and therefore are expected to increase revenue by $50,000 per unit per year and add operating expenses of $10,000 per unit per year. Federal corporate income taxes follow the table below. a) Develop tables using a spreadsheet to determine the ATCF (After Tax Cash Flow) for the 8 years of the AV's considering all 30AVs. Negative taxable income is treated a $0 taxable income. a. Using straight line depreciation (8 points) b. Using MACRS depreciation with the appropriate property class (8 points) b) If they keep all 30 vehicles for 8 years calculate the Present Worth (PW) of the investment of all 30 vehicles for each method (SL and MACRS) using an after-tax MARR of 9%. ( 2 points) c) Calculate the IRR of the ATCF. Is this a good investment? (2 points) Tips: - Every year's taxable income may not fall in the same tax bracket. - If you have a loss in a year assume 0\$ taxes paid. - You cannot claim depreciation past the salvage value year. - When solving for the PV of the after-tax cash flow DO NOT use the NPV formula. You need to make a new column and solve for the PV of each year and then sum them. - The NPV formula solves for net present value in year 0 . This formula assumes the first value you select is one period from year 0 and that there is 0$ in year 0 . If you really wanted to use it. You could use the NPV formula to solve for years 1-8 and add the year 0 amount to it

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts