Question: Please answer b and c. (Related to Checkpoint 15.1) (Calculating debt ratio) Webb Solutions, Inc. has the following financial structure: a. Compute Webb's debt ratio

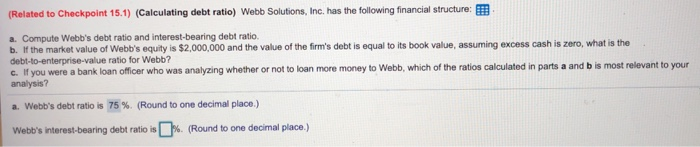

(Related to Checkpoint 15.1) (Calculating debt ratio) Webb Solutions, Inc. has the following financial structure: a. Compute Webb's debt ratio and interest-bearing debt ratio. b. If the market value of Webb's equity is $2.000.000 and the value of the fim's debt is equal to its book value, assuming excess cash is zero, what is the c. If you were a bank loan officer who was analyzing whether or not to loan more money to Webb, which of the ratios calculated in parts a and b is most relevant to your debt-to-enterprise-value ratio for Webb? .lf analysis? a. Webb's debt ratio is 75 % (Round to one decimal place.) Webt's interest-bearing debt ratio is% (Round to one decimal place.) (Related to Checkpoint 15.1) (Calculating debt ratio) Webb Solutions, Inc. has the following financial structure: a. Compute Webb's debt ratio and interest-bearing debt ratio. b. If the market value of Webb's equity is $2.000.000 and the value of the fim's debt is equal to its book value, assuming excess cash is zero, what is the c. If you were a bank loan officer who was analyzing whether or not to loan more money to Webb, which of the ratios calculated in parts a and b is most relevant to your debt-to-enterprise-value ratio for Webb? .lf analysis? a. Webb's debt ratio is 75 % (Round to one decimal place.) Webt's interest-bearing debt ratio is% (Round to one decimal place.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts