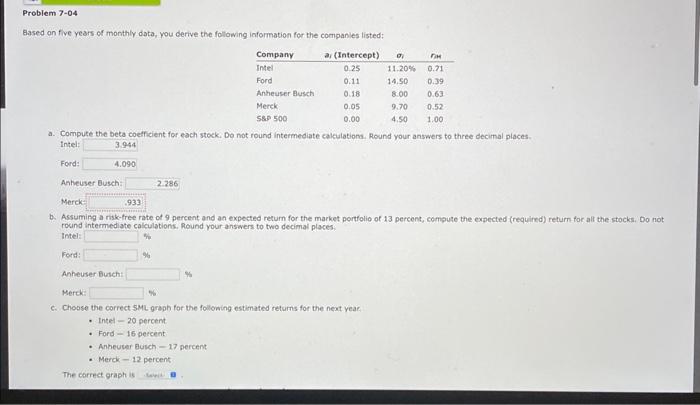

Question: Please answer B and C, thanks Based on five years of monthly data, you derive the following information for the companies listed: a. Compute the

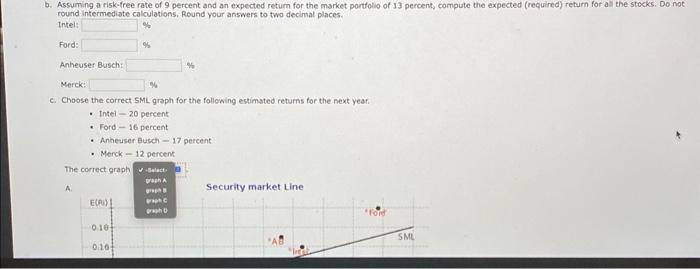

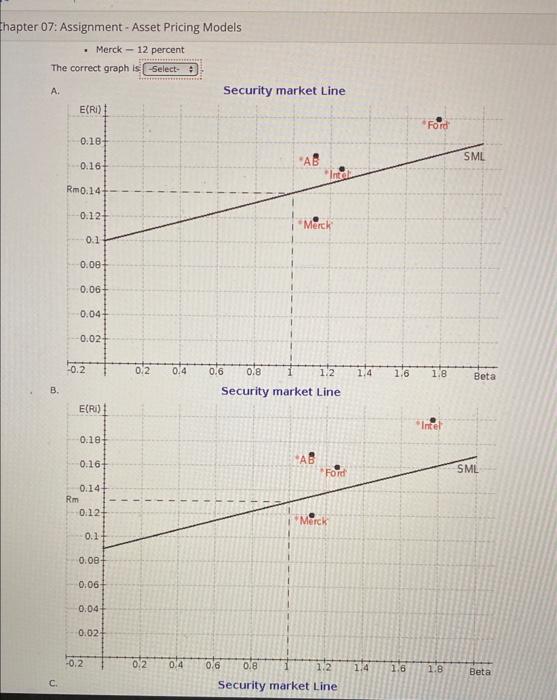

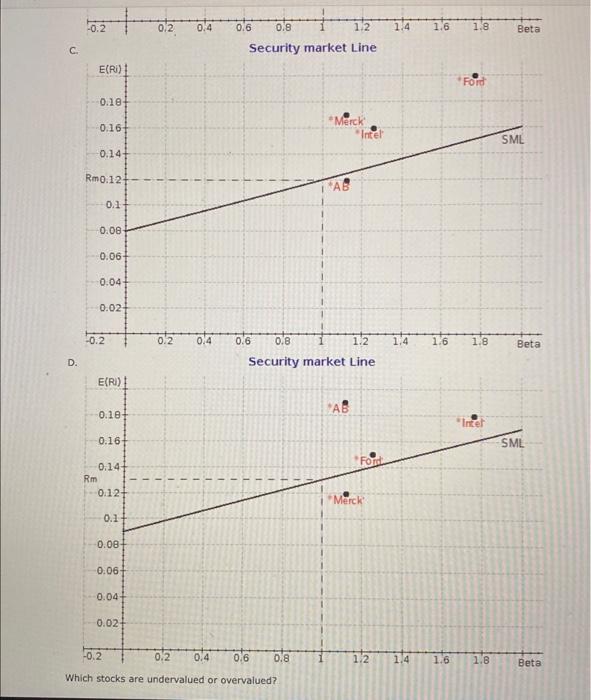

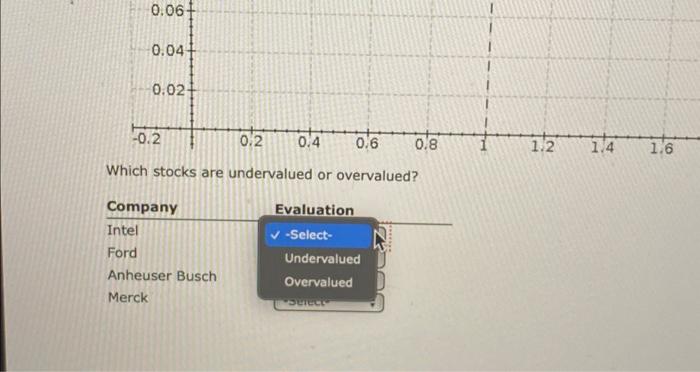

Based on five years of monthly data, you derive the following information for the companies listed: a. Compute the beta coefficient for each stock, Do not round intermediate cakulationa. Round your answers to three decimal places. intel: Ford: Anheuser Busch: Merck: b. Assumipg a risk-free rate of 9 percent and an expected retum for the market portfolio of 13 percent, compute the expected (required) return for alt the stocks. Do not round intermediate calculations. Round your answers to two decimal places. thtel: Ford: Anheuser Busch: Merck: c. Choose the correct SML graph for the following estimated returns for the next year. - intel - 20 percent - Ford -15 percent - Anheuter Busch -17 percent - Merck - 12 percent The correct graph is b. Assuming a riskifree rate of 9 percent and an expected return for the market portfolio of 13 percent, compute the expected (required) return for ali Ene stocks. Do not round intermediate calculations, Round your answers to two decimal places. Intel: Ford: Anheuser Busch: Merck: c. Choose the correct SML graph for the following entimated retums for the next year - Intei -20 percent - Ford - 16 percent - Anheuser Busch - 17 percent - Merck - 12 percent hapter 07: Assignment - Asset Pricing Models - Merck - 12 percent The correct graph is - Select- A. Security market Line B. Security market Line c. Security market Line C. Security market Line D. Security market Line Which stocks are undervalued or overvalued? Which stocks are undervalued or overvalued

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts