Question: Please answer b, c and d. (Individual or component costs of capital) You have just been hired to compute the cost of capital for debt,

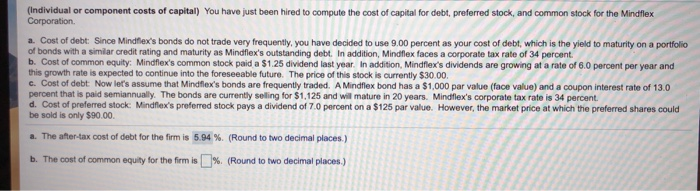

(Individual or component costs of capital) You have just been hired to compute the cost of capital for debt, preferred stock, and common stock for the Mindflex a. Cost of debt: Since Mindflex's bonds do not trade very frequently, you have decided to use 9.00 percent as your cost of debt, which is the yield to maturity on a portfolio of bonds with a similar credit rating and maturity as Mindflex's outstanding debt. In addition, Mindflex faces a corporate tax rate of 34 percent b. Cost of common equity: Mindflex's common stock paid a $1.25 dividend last year In addition, Mindflex's dividends are growing at a rate of 6.0 percent per year and this growth rate is expected to continue into the foreseeable future. The price of this stock is currently $30.00 c. Cost of debt Now let's assume that Mindfiex's bonds are frequently traded. A Mindflex bond has a $1,000 par value (face value) and a coupon interest rate of 13.0 percent that is paid semiannually. The bonds are currently selling for $1,125 and wil mature in 20 years. Mindflex's corporate tax rate is 34 percent. d. Cost of preferred stock: Mindflex's preferred stock pays a dividend of 7.0 percent on a $125 par value. However, the market price at which the preferred shares could be sold is only $90.00. a. The after-tax cost of debt for the firm is 5.94 % (Round to two decimal places) b. The cost of common equity for the firm is %. (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts