Question: please answer b, c, d 5-5 21. Mrs. Kirk withdrew $30,000 from a retirement account and used the money to furnish her new home. Her

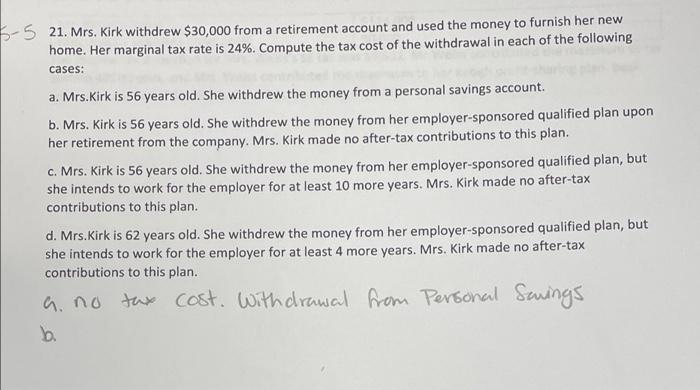

5-5 21. Mrs. Kirk withdrew $30,000 from a retirement account and used the money to furnish her new home. Her marginal tax rate is 24%. Compute the tax cost of the withdrawal in each of the following cases: a. Mrs.Kirk is 56 years old. She withdrew the money from a personal savings account. b. Mrs. Kirk is 56 years old. She withdrew the money from her employer-sponsored qualified plan upon her retirement from the company. Mrs. Kirk made no after-tax contributions to this plan. c. Mrs. Kirk is 56 years old. She withdrew the money from her employer-sponsored qualified plan, but she intends to work for the employer for at least 10 more years. Mrs. Kirk made no after-tax contributions to this plan. d. Mrs.Kirk is 62 years old. She withdrew the money from her employer-sponsored qualified plan, but she intends to work for the employer for at least 4 more years. Mrs. Kirk made no after-tax contributions to this plan. a no tax cost. Withdrawal from Personal Swings b

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts