Question: Please answer B (no need to answer A) Problem 4-19 Two-stage DCF model Company Q's current return on equity (ROE) is 15%. It pays out

Please answer B (no need to answer A)

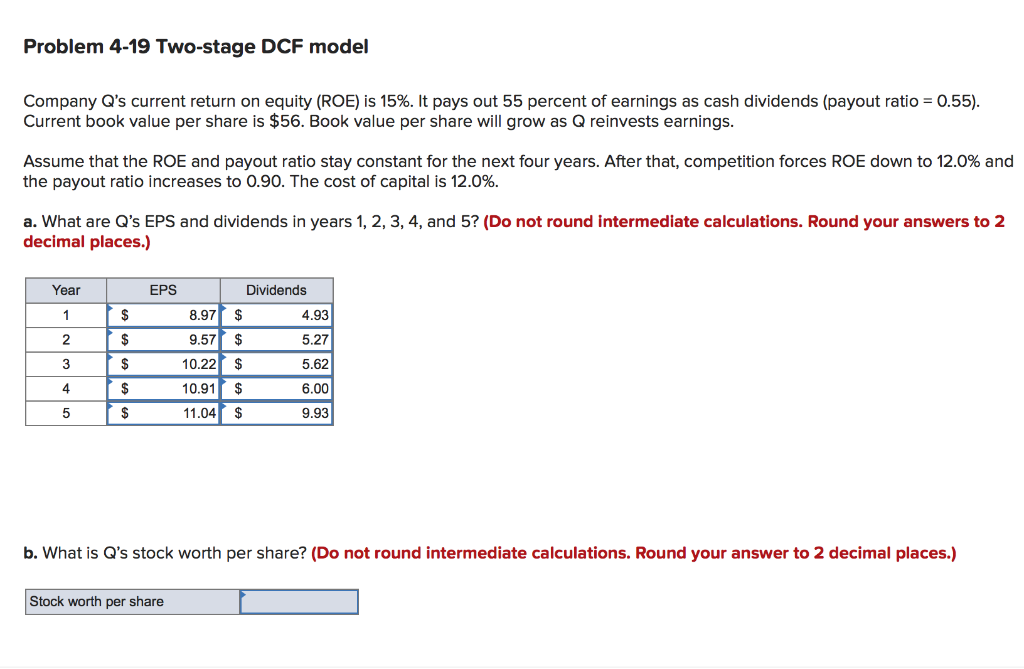

Problem 4-19 Two-stage DCF model Company Q's current return on equity (ROE) is 15%. It pays out 55 percent of earnings as cash dividends (payout ratio = 0.55). Current book value per share is $56. Book value per share will grow as Q reinvests earnings. Assume that the ROE and payout ratio stay constant for the next four years. After that, competition forces ROE down to 12.0% and the payout ratio increases to 0.90. The cost of capital is 12.0%. a. What are Q's EPS and dividends in years 1, 2, 3, 4, and 5? (Do not round intermediate calculations. Round your answers to 2 decimal places.) Year EPS Dividends 1 $ 8.97 $ 4.93 2 $ 9.57 $ 5.27 3 $ 5.62 4 $ 10.22 $ 10.91 $ 11.04 $ 6.00 5 $ 9.93 b. What is Q's stock worth per share? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Stock worth per share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts