Question: Please answer B only accurately using the values of A. Thank you and will upvote! Problem 020 Points: Boulder, Inc. is computing its inventory at

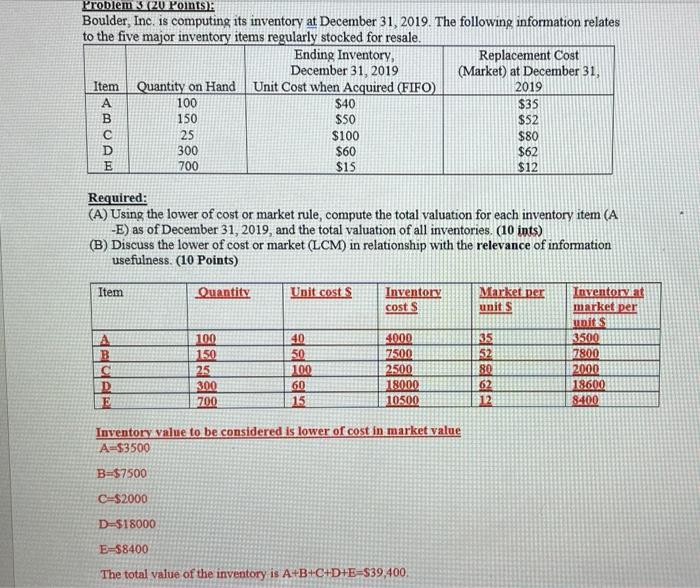

Problem 020 Points: Boulder, Inc. is computing its inventory at December 31, 2019. The following information relates to the five major inventory items regularly stocked for resale. Ending Inventory, Replacement Cost December 31, 2019 (Market) at December 31, Item Quantity on Hand Unit Cost when Acquired (FIFO) 2019 100 $40 $35 150 $50 $52 25 $100 $80 300 $60 $62 700 $15 $12 SMOA Required: (A) Using the lower of cost or market rule, compute the total valuation for each inventory item (A -E) as of December 31, 2019, and the total valuation of all inventories. (10 ints) (B) Discuss the lower of cost or market (LCM) in relationship with the relevance of information usefulness. (10 Points) Item Quantity Unit costs Inventory cost $ Market per units A B c D E 100 150 25 300 700 40 50 100 60 15 4000 7500 2500 18000 10500 35 52 80 62 12 Inventory at market per units 3500 7800 2000 18600 8400 Inventory value to be considered is lower of cost in market value A=$3500 B=$7500 C-S2000 D-$18000 E=58400 The total value of the inventory is A+B+C+D+E=$39,400

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts