Question: PLEASE ANSWER BASED ON ANSWER COLUMM ANSWER SHEET BELOW Ratih Interior Design uses four activity pools to apply overhead to its project. Ratih Interior Design

PLEASE ANSWER BASED ON ANSWER COLUMM

ANSWER SHEET BELOW

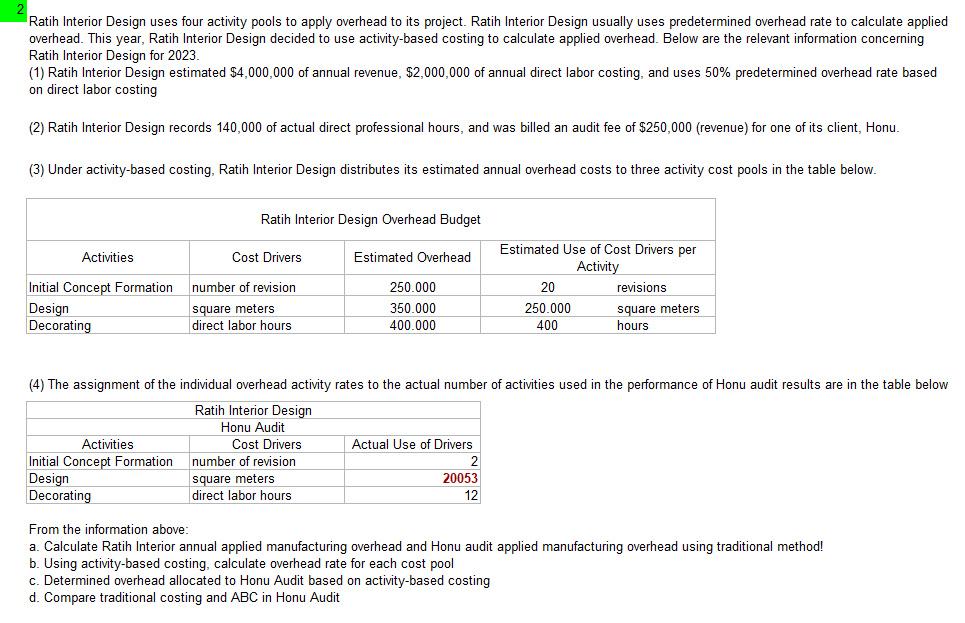

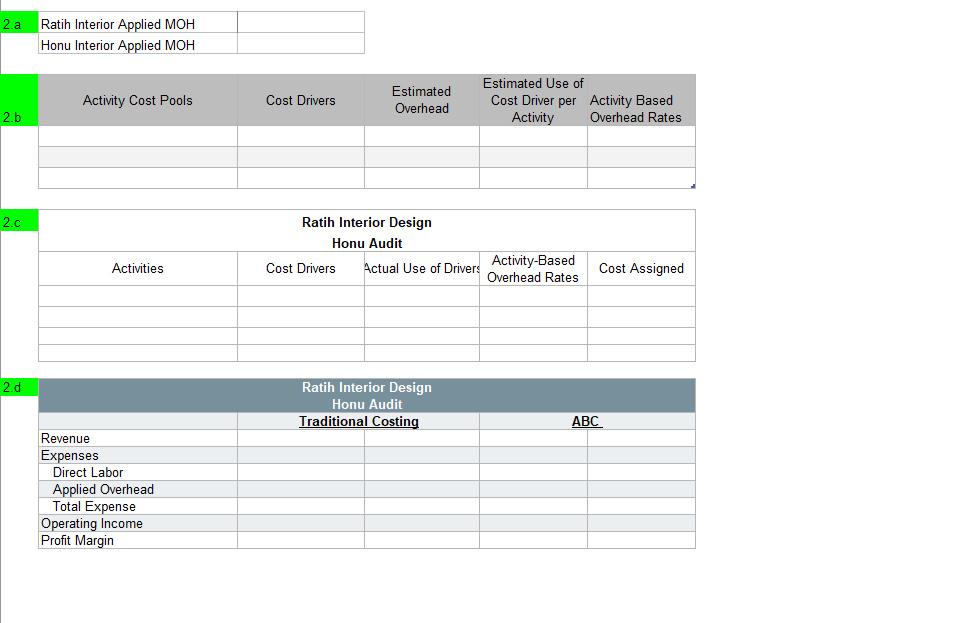

Ratih Interior Design uses four activity pools to apply overhead to its project. Ratih Interior Design usually uses predetermined overhead rate to calculate applied overhead. This year, Ratih Interior Design decided to use activity-based costing to calculate applied overhead. Below are the relevant information concerning Ratih Interior Design for 2023. (1) Ratih Interior Design estimated $4,000,000 of annual revenue, $2,000,000 of annual direct labor costing, and uses 50% predetermined overhead rate based on direct labor costing (2) Ratih Interior Design records 140,000 of actual direct professional hours, and was billed an audit fee of $250,000 (revenue) for one of its client, Honu. (3) Under activity-based costing, Ratih Interior Design distributes its estimated annual overhead costs to three activity cost pools in the table below. Ratih Interior Design Overhead Budget Activities Cost Drivers Estimated Overhead Initial Concept Formation Design number of revision square meters direct labor hours 250.000 350.000 400.000 Estimated Use of Cost Drivers per Activity 20 revisions 250.000 square meters 400 hours Decorating (4) The assignment of the individual overhead activity rates to the actual number of activities used in the performance of Honu audit results are in the table below Ratih Interior Design Honu Audit Activities Cost Drivers Actual Use of Drivers Initial Concept Formation number of revision 2 Design square meters 20053 Decorating direct labor hours 12 From the information above: a. Calculate Ratih Interior annual applied manufacturing overhead and Honu audit applied manufacturing overhead using traditional method! b. Using activity-based costing, calculate overhead rate for each cost pool c. Determined overhead allocated to Honu Audit based on activity-based costing d. Compare traditional costing and ABC in Honu Audit 2.a Ratih Interior Applied MOH Honu Interior Applied MOH Activity Cost Pools Cost Drivers Estimated Overhead Estimated Use of Cost Driver per Activity Based Activity Overhead Rates 2.b 2.0 Ratih Interior Design Honu Audit Cost Drivers Actual Use of Drivers Activity-Based Overhead Rates Activities Cost Assigned 2.d Ratih Interior Design Honu Audit Traditional Costing ABC Revenue Expenses Direct Labor Applied Overhead Total Expense Operating Income Profit Margin

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts