Question: **Please Answer BCD, A is included for reference** Consider the following 3-year projections for Boston Turkey Inc.: Actual Forecast Year 2007 2008 2009 2010 EBIT

**Please Answer BCD, A is included for reference**

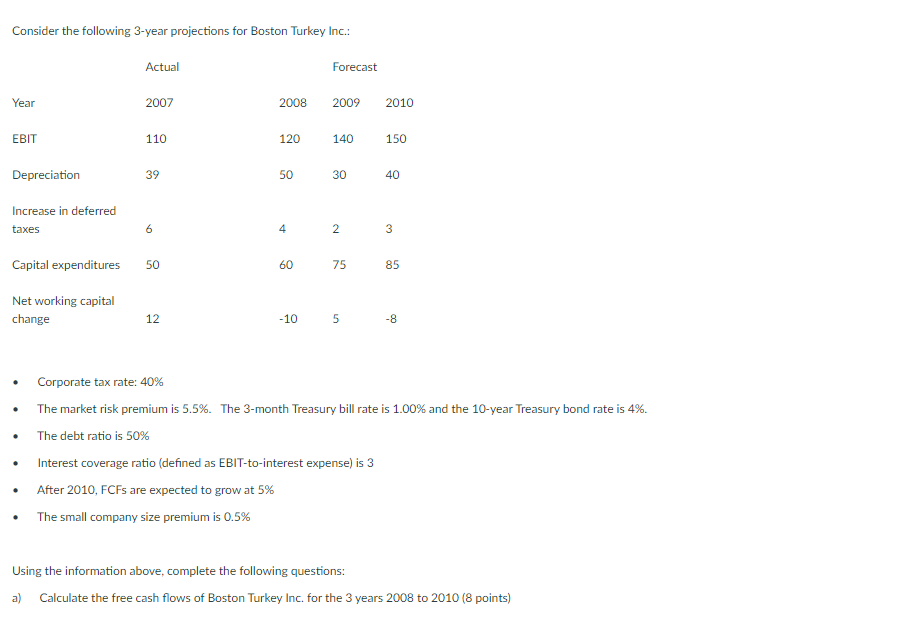

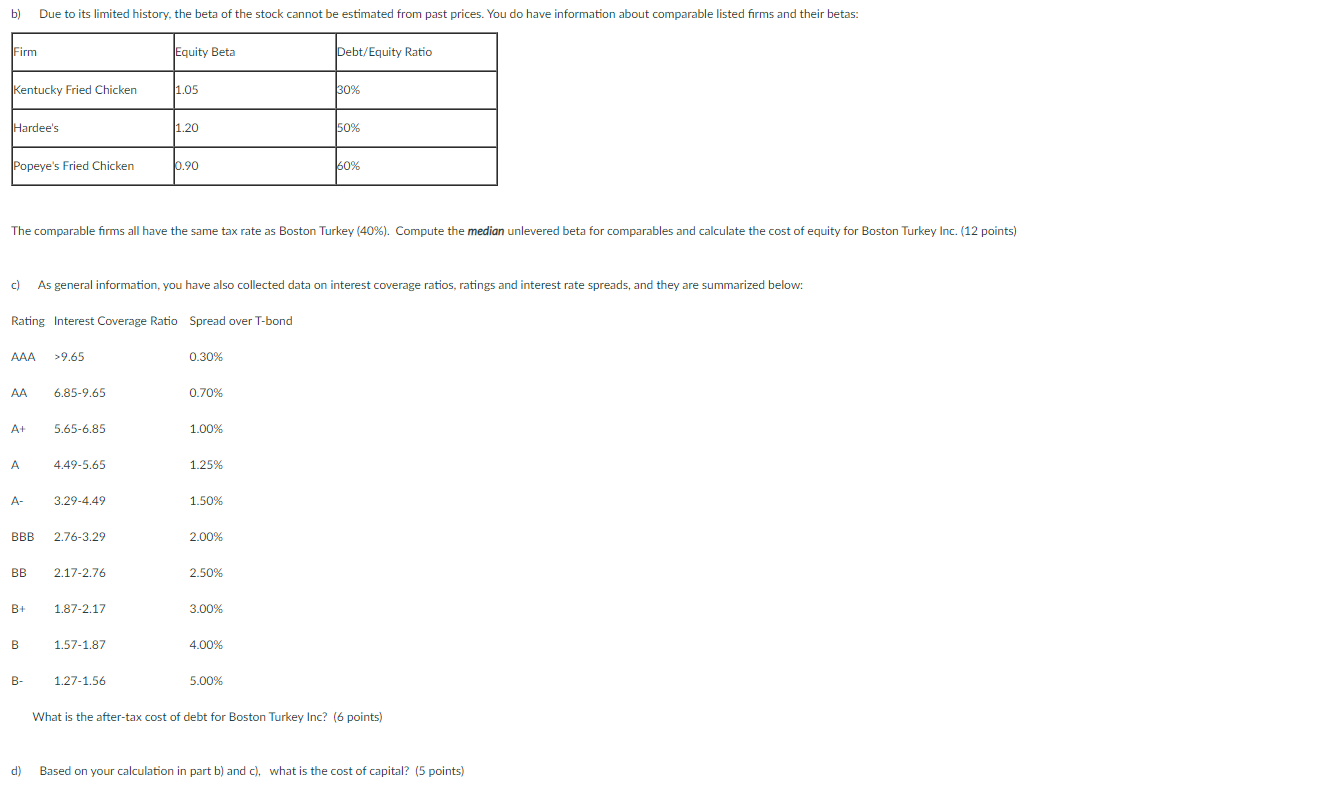

Consider the following 3-year projections for Boston Turkey Inc.: Actual Forecast Year 2007 2008 2009 2010 EBIT 110 120 140 150 Depreciation 39 50 30 40 Increase in deferred taxes 6 4 2 3 Capital expenditures 50 60 75 85 Net working capital change 12 -10 5 -8 Corporate tax rate: 40% The market risk premium is 5.5%. The 3-month Treasury bill rate is 1.00% and the 10-year Treasury bond rate is 4%. The debt ratio is 50% Interest coverage ratio (defined as EBIT-to-interest expense) is 3 After 2010, FCFs are expected to grow at 5% The small company size premium is 0.5% Using the information above, complete the following questions: a) Calculate the free cash flows of Boston Turkey Inc. for the 3 years 2008 to 2010 (8 points) b) Due to its limited history, the beta of the stock cannot be estimated from past prices. You do have information about comparable listed forms and their betas: Firm Equity Beta Debt/Equity Ratio Kentucky Fried Chicken 1.05 30% Hardee's 1.20 50% Popeye's Fried Chicken 0.90 60% The comparable firms all have the same tax rate as Boston Turkey (40%). Compute the median unlevered beta for comparables and calculate the cost of equity for Boston Turkey Inc. (12 points) c) As general information, you have also collected data on interest coverage ratios, ratings and interest rate spreads, and they are summarized below: Rating Interest Coverage Ratio Spread over T-bond AAA >9.65 0.30% AA 6.85-9.65 0.70% A+ 5.65-6.85 1.00% A 4.49-5.65 1.25% A- 3.29-4.49 1.50% BBB 2.76-3.29 2.00% BB 2.17-2.76 2.50% B+ 1.87-2.17 3.00% B 1.57-1.87 4.00% B- 1.27-1.56 5.00% What is the after-tax cost of debt for Boston Turkey Inc? (6 points) d) Based on your calculation in part b) and c), what is the cost of capital? (5 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts