Question: please answer blank boxes and those with red ex's beside them Ryan Ross (111-11-1112), Oscar Omega (222-22-2223), Clark Carey (333-33-3334), and Kim Kardigan (444-44-4445) are

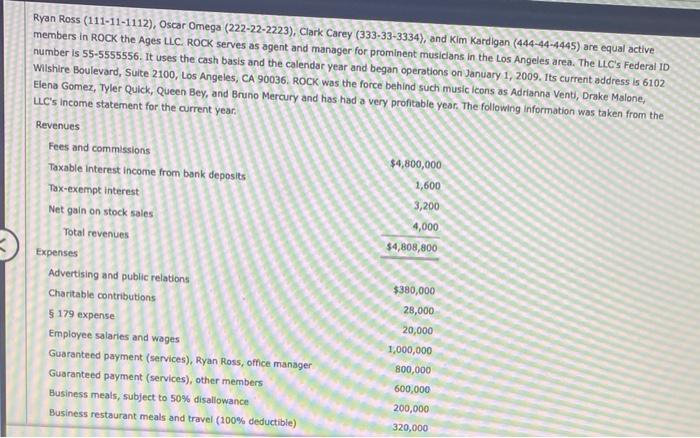

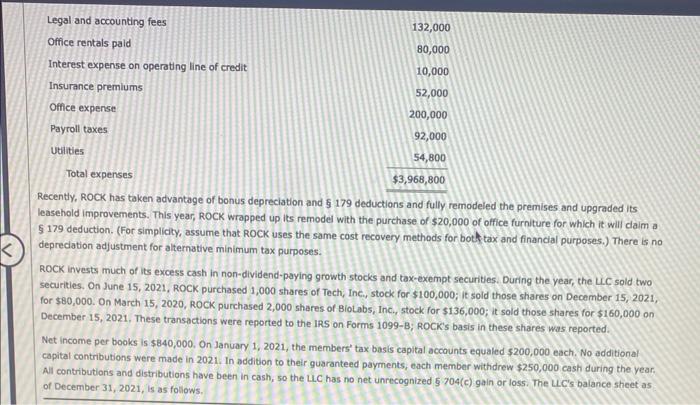

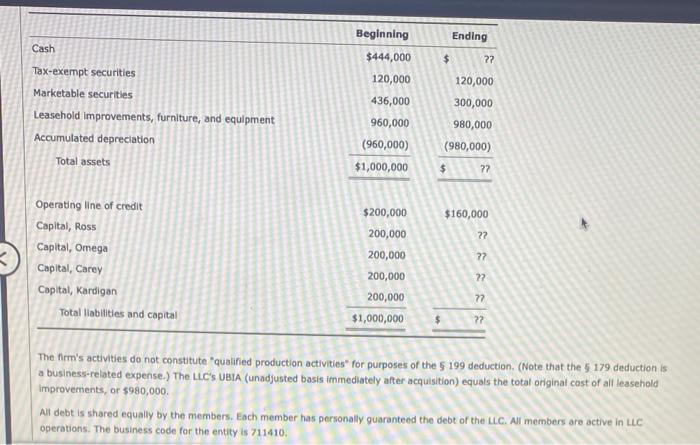

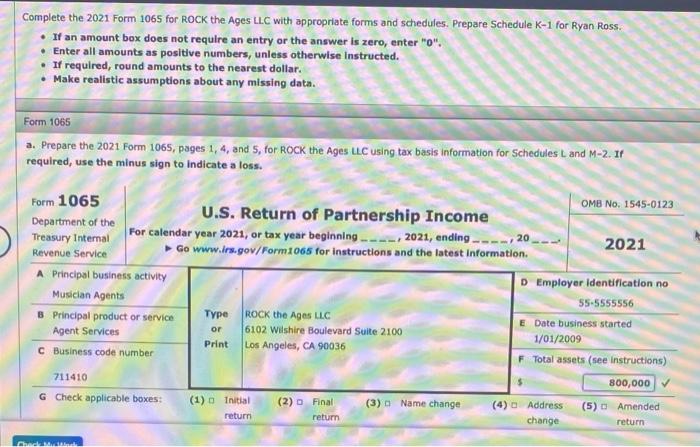

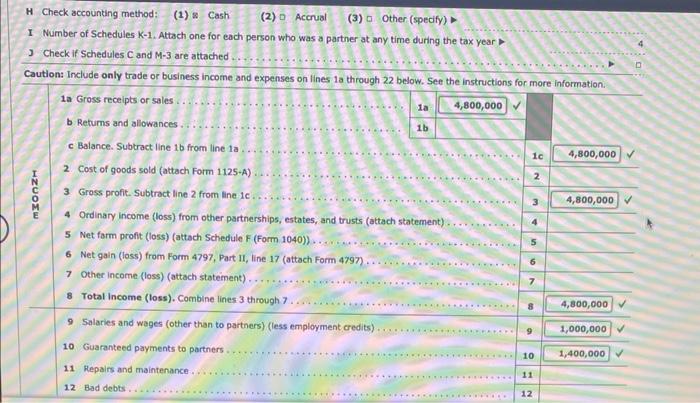

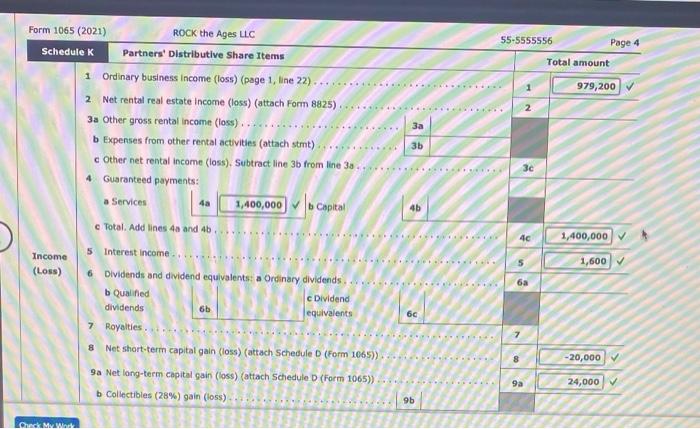

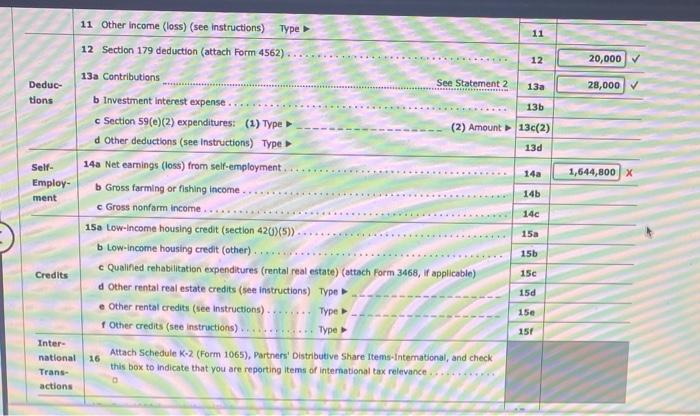

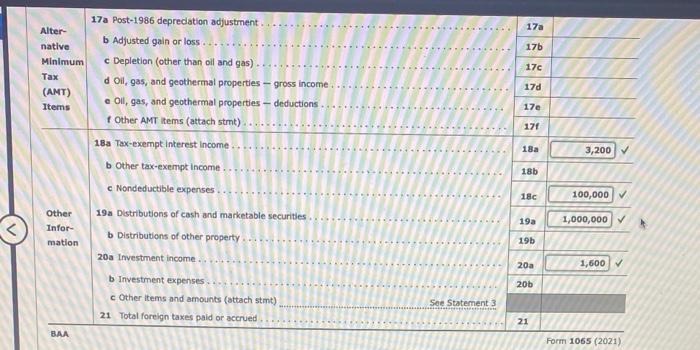

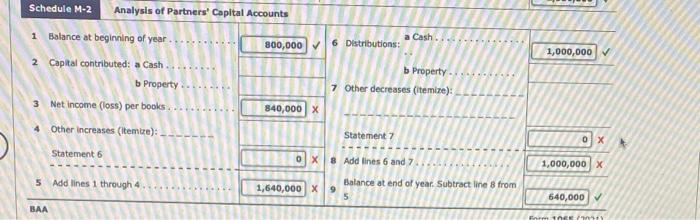

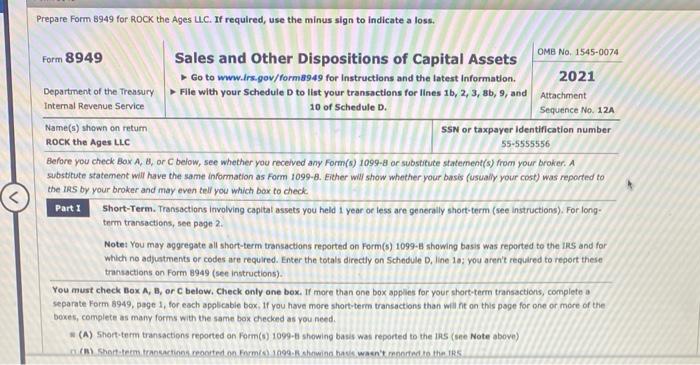

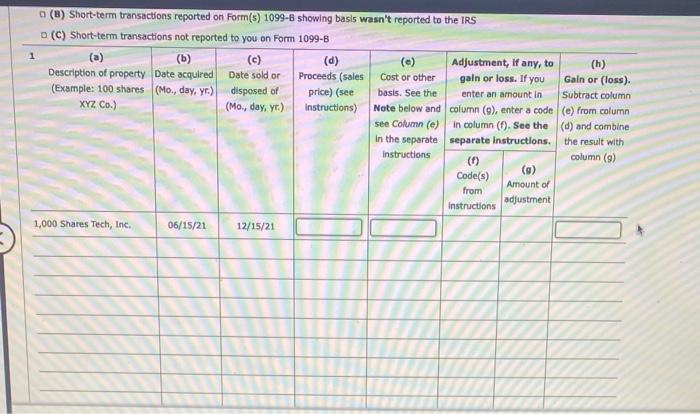

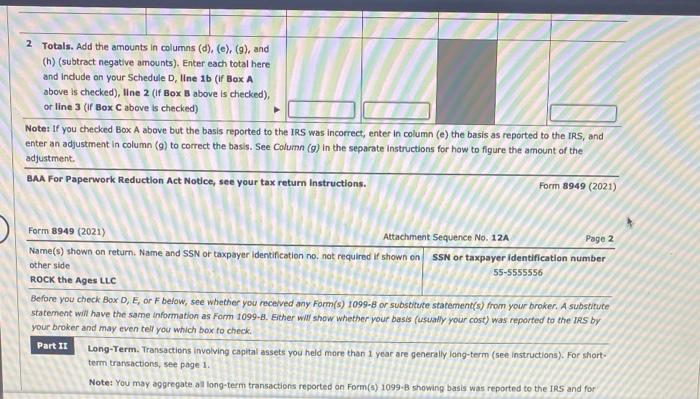

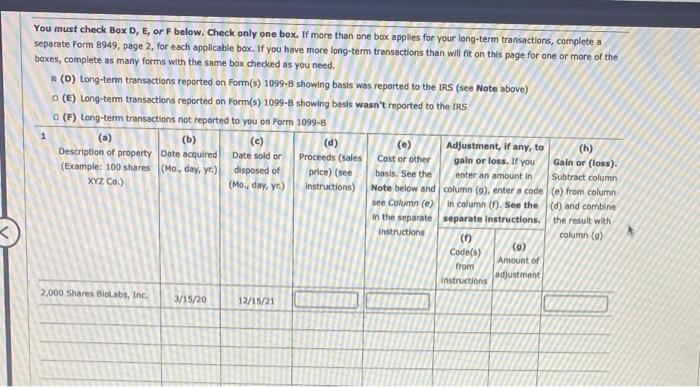

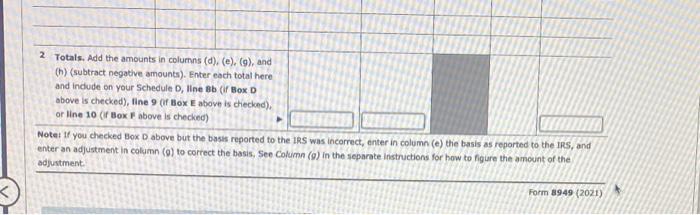

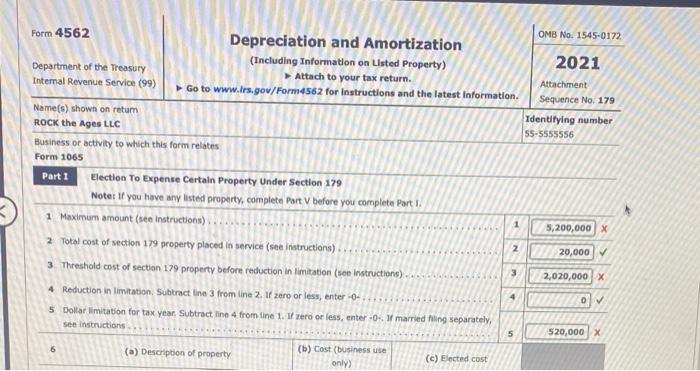

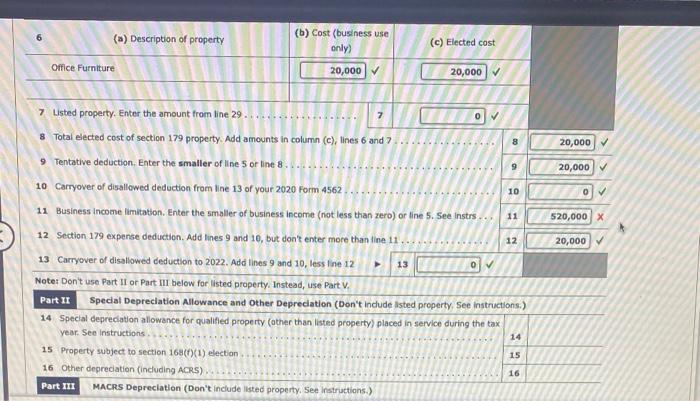

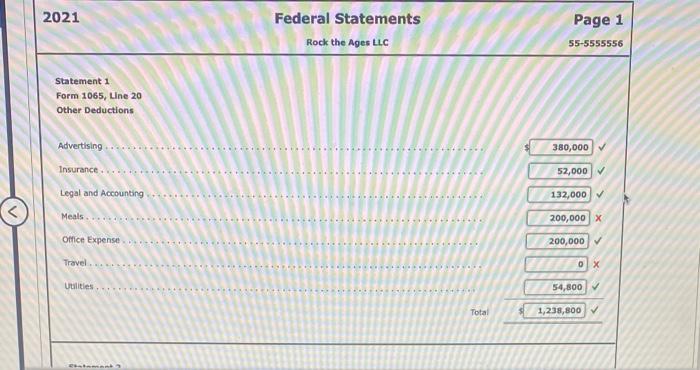

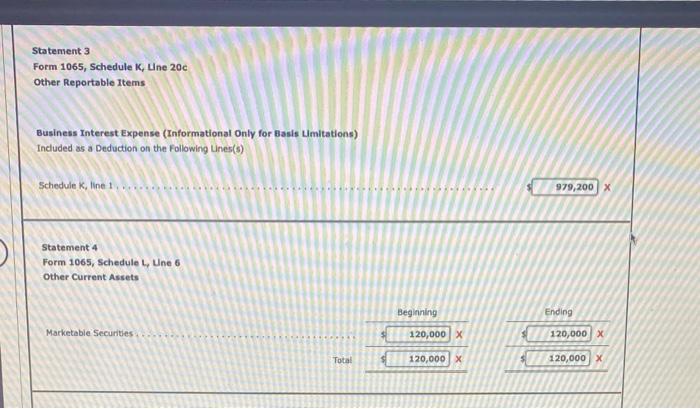

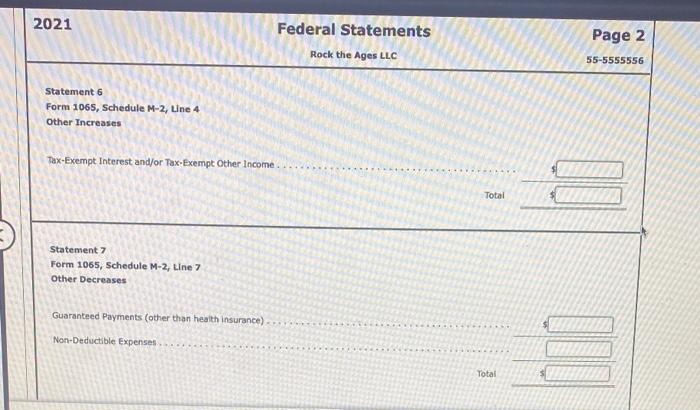

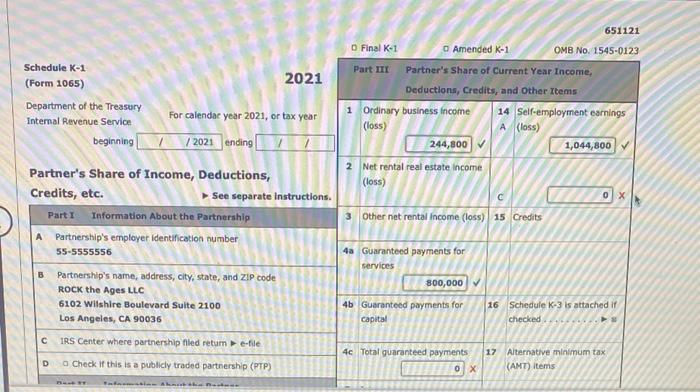

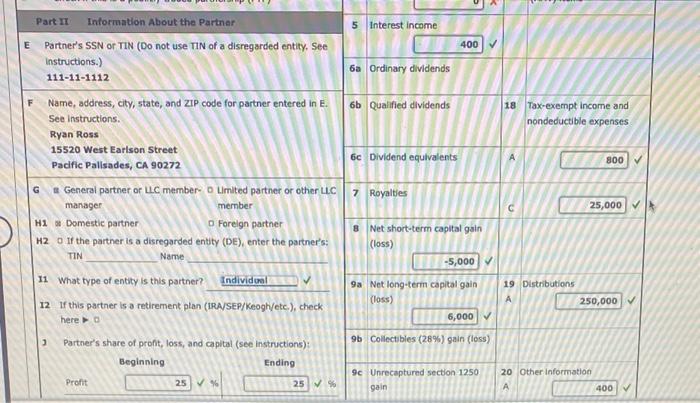

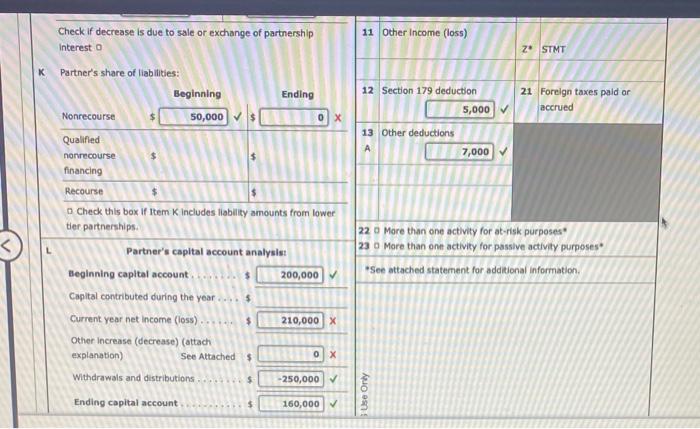

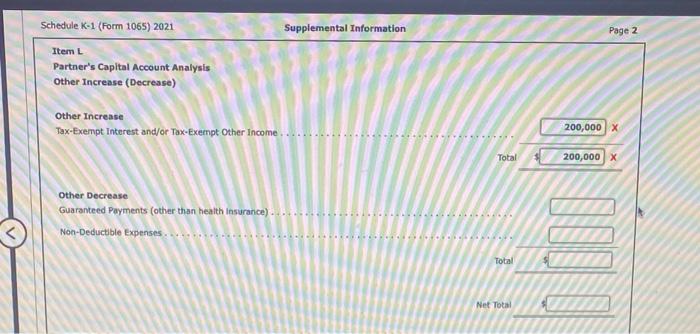

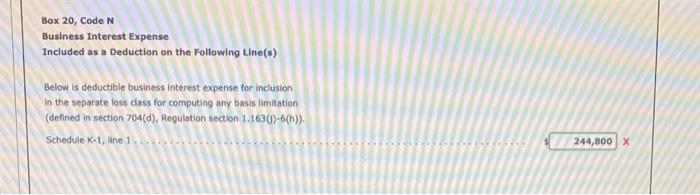

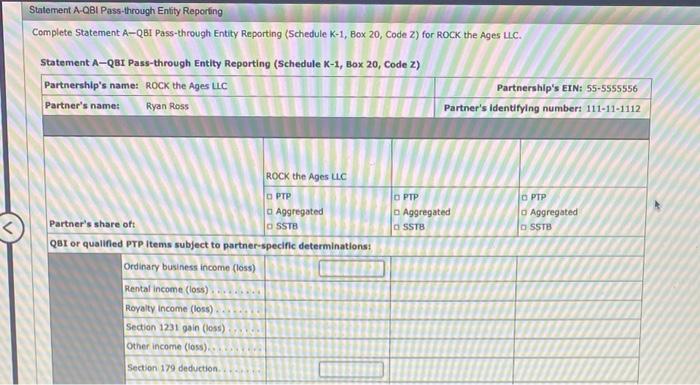

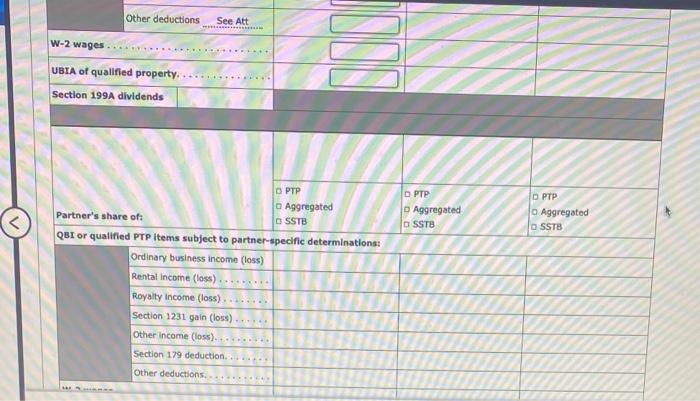

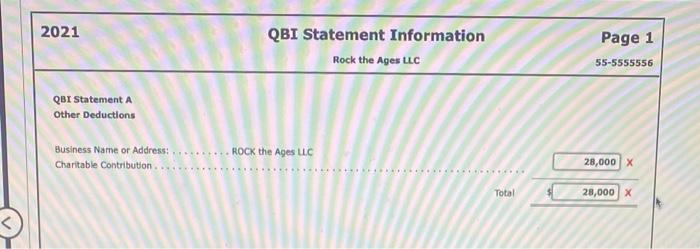

Ryan Ross (111-11-1112), Oscar Omega (222-22-2223), Clark Carey (333-33-3334), and Kim Kardigan (444-44-4445) are equal active members in ROCK the Ages LLC. ROCK serves as agent and manager for prominent musicians in the Los Angeles area. The LLC's Federal ID number is 55-5555556. It uses the cash basis and the calendar year and began operations on January 1, 2009. Its current address is 6102 Wilshire Boulevard, Suite 2100, Los Angeles, CA 90036. ROCK was the force behind such music icons as Adrianna Venti, Drake Malone, Elena Gomez, Tyler Quick, Queen Bey, and Bruno Mercury and has had a very profitable year: The following information was taken from the LC'some statement for the current year. Recently, ROCK has taken advantage of bonus depreciation and $179 deductions and fully remodeled the premises and upgraded its leasehold improvements. This year, ROCK wrapped up its remodel with the purchase of $20,000 of office furniture for which it will claim a 5 179 deduction. (For simplicity, assume that ROCK uses the same cost recovery methods for both tax and financial purposes.) There is no depredation adjustment for alternative minimum tax purposes. ROCK invests much of its excess cash in non-dividend-paying growth stocks and tax-exempt securities. During the year, the LiC sold two securities. On June 15, 2021, ROCK purchased 1,000 shares of Tech, Inc, stock for $100,000; it sold those shares on December 15 , 2021, for $80,000. On March 15, 2020, ROCK purchased 2,000 shares of BioLabs, Inc., stock for $136,000; it sold those shares for $160,000 on December 15, 2021, These transactions were reported to the IRS on Forms 1099-B; ROCK's basis in these shares was reported. Net income per books is $840,000. On January 1, 2021, the members' tax basis capital accounts equaled $200,000 each. No additional capital contribubions were made in 2021. In addition to their guaranteed payments, each member withidrew $250,000 cash during the year. All contributions and distributions have been in cash, 50 the L.C has no net unrecognized 5704(c) gain or los5. The LiC's balance sheet as of December 31,2021 , is as follows. The firm's activities do not constitute "qualified production activities" for purposes of the $199 deduction. (Note that the $179 deduction is a business-related expense.) The LLC's UBIA (unadjusted basis immediately after acquisition) equals the total original cost of all leasehold improvements, or $980,000. All debt is shared equally by the members. Each member has personally guaranteed the debt of the LlC. All members are active in LCC operations. The business code for the entity is 711410 . Complete the 2021 Form 1065 for ROCK the Ages L.C with appropriate forms and schedules. Prepare Schedule K-1 for Ryan Ross. - If an amount box does not require an entry or the answer is zero, enter "0". - Enter all amounts as positive numbers, unless otherwise instructed. - If required, round amounts to the nearest dollar. - Make realistic assumptions about any missing data. Focm 1065 a. Prepare the 2021 Form 1065, pages 1, 4, and 5, for ROCK the Ages LC using tax basis information for Schedules L and M-2. If required, use the minus sign to indicate a loss. H Check accounting method: (1) : Cash (2) D Accrual (3) a Other (specify) I Number of Schedules K1. Attach one for each person who was a parther at any time during the tax year ? 3 Check if Schedules C and M3 are attached Caution: Include only trade or business income and expenses on lines 1 a through 22 below. See the instructions for more information. 13 Rent. 13 G =CC Interest (see instructions) 13a-pepreciation (if required, attach form 4562). b Less depreciation reported on Form 1125A and elsewhere on return \begin{tabular}{|c|} 16a \\ 16b \end{tabular} 17 Depletion (Do not deduct oll and gas depletion.) 18 Retirement plans, etc. 19 Employee benefit programs 20 Other deductions (att stmt) See Statement 1 21 Total deductions. Add the amounts shown in the far right column for lines 9 through 20. 23 Interest due under the look-back method - completed long-term contracts (attach Form 8697) ....... 23 24 Interest due under the-look-back method - income forecast method (attach Form 8866). 25 BBA AAR imputed underpayment (see instructions) 26 Other taxes (see instructions) 27 Total balance due. Add lines 23 throogh 26 28 Payment (see instructions) 29 Amount owed, If line 28 is smaller than line 27, enter amount owed \begin{tabular}{|l|} \hline 24 \\ \hline 25 \\ \hline 26 \\ \hline 27 \\ \hline 28 \\ \hline 29 \\ \hline \end{tabular} \begin{tabular}{l} Schedule M-2 Analysis of Partners' Capital Accounts \\ \hline \end{tabular} Prepare Form 8949 for ROCK the Ages U.C. If required, use the minus sign to indicate a loss. Before you check Bax A,B, or C below, see whether you received any Form(s) 1099- B or substitute statement(s) from your broker. A substitute statement will have the same information as Form 1099-B. Ecther wil show whether your basis (usuaily your cost) was reported to the ins by your broker and may even tell you which box to check. Part I Short-Term. Transoctions involving capital assets you held 1 year oe less are generally short-term (see instructions). For long. term transactions, see page 2. Note: You moy aggregate all short-term tansactions reported on Form(s) 1099-1 showing basis was reported to the 185 and for which no adjuatments or codes are required. Enter the totals directly on Schedule D, line 1o: you aren't required to report these trahsactions on Form 8949 (see instructions). You must check Box A, B, or C below, Check only ane box. If more than one box applies for your short-term transactions, complete a separate Form 8949, page 1, for each applcable box, If you have more short-term transactions than will nt on this page for one or more of the boxes, complete as many forms with the same box checked as you need. w (A) Short-term transactions reported on Form(s) 1099-6 showing basis was reported to the liss (see Note above) a (B) Short-term transactions reported on Form(5) 1099-B showing basis wasn't reported to the IRS Note: If you checked Box A above but the basis reported to the IRS was incorrect, enter in column (e) the basis as reported to the IRS, and enter an adjustment in column (g) to correct the basis. See Column (g) in the separate instructions for how to figure the amount of the adjustment. You must check Box D, E, or F below. Check only one box. If more than one box applles for your long-term transactions, complete a separate form 8949, page 2, for each applicable box. If you have more long-term transactions than will fit on this page for one or more of the boxes, complete as many forms with the same box checked as you need. (D) Long-term tiansactions reported on Form(s) 1099-B showing basis was reported to the IRS (see Note above) (E) Long-term transactions reported on Form(s) 1099-B showing basis wasn't reported to the IRS (F) Long-term transactions not reported to yeu on Form 1099 - thorted to the IRS was incorrect, enter in column (e) the basis as reported to the IRS, and adjutment: Business or activity to which this form relates Form 1065 Part 1 Election To Expense Certain Property Under Section 179 Noter If you have any listed property, complete Part v before you complete Part I. 1 Maximum amount (see instructions) 2 rotal cost of section 179 property placed in service (see instructions) 3 Threshold cost of sectian 179 property before reduction in limitation (see instructions) 4 Reduction in limitation. Subtract ine 3 from line 2. It zero or less, enter -0 - 5 Dollar limitabion for tax year. Subtract line 4 from line 1. If zero or less, enter -0. If married filing separately, see instrictions. 6 (a) Description of property (b) Cost (business use only) (c) Elected cost Note: Don't use Part II or Part III below for listed property. Instead, use Part V. Part II Special Depreciation Allowance and other Depreciation (Don't indude lsted property, See instructions.) 14 Spectal depreciation allowence for qualitied property (other than listed property) placed in service during the tax year. See instructions. 15 Property subject to section 168(f)(1) election. 16 Other depreciation (including ACRS) Part III MACRS Depreciation (Don't include listed property, See instructions.) Statement 3 Form 1065, Schedule K, Une 20c other Reportable Items Business Interest Expense (Informational Only for Basis Limitations) Included as a Deduction on the Following Uines(s) Schedule K, line 1 Statement 4 Form 1065, Schedule L, Une 6 Other Current Assets Marketable Securities. Total. 4120,000xBeginning120,000x 2021 Federal Statements Page 2 Rock the Ages LLC 55-5555556 Statement 6 Form 106S, Schedule M-2, Line 4 Other Increases Tax-Exempt Interest and/or Tax-Exempt Other income . Statement 7 Form 1065, Schedule M-2, Line 7 Other Decreases Guaranteed Payments (other than health insurance). Non-Deductible Expenses. 651121 D Final K1 0 Amended K1 OMB No. 15450123 Schedule K-1 (Form 1065) 2021 Part III Partner's Share of current Year Income, Department of the Treasury internal Revenue Service For calendac year 2021, or tax year 1 Ordinary business income 14 Selfemployment earnings (loss) A (loss) beginning 1/2021 ending 1,044,800 Partner's Share of Income, Deductions, 2 Net rental real estate income (loss) Credits, etc. See separate instructions. Part I Information About the Partnership 3 Other net rental income (loss) 15 Credits A Partnership's employer identification number \begin{tabular}{|l|l} \hline 55-5555556 & 4a Guaranteed payments for \end{tabular} services B Partnership's name, address, city, state, and ZIP code ROCK the Ages LLC 6102 Wilshire Boulevard Sulte 2100 4b Guaranteed payments for 16 Schedule K3 is attached if Los Angeles, CA 90036 capital checked. C IRS Center where partnership flled retum > e-fle 4c Total guaranteed payments 17 Aiternative minimum tax D a Check if this is a publicly traded partnership (PTP) 1 (AMT) items Schedule K-1 (Form 1065) 2021 Supplemental Information Page 2 Item L Partner's Capital Account Analysis Other Increase (Decrease) Other Increase Tax-Exempt Interest and/or Tax-Exempt Other Income Other Decrease Total Net Total Box 20, Code N Business Interest Expense Included as a Deduction on the Following Line(s) Below is deductible business interest expense for inclusion In the separate loss dass for computing any basis limitation (defined in section 704(d), Regulation section 1.163(j)6(h)). Complete Statement A-QB1 Pass-through Entity Reporting (Schedule K-1, Box 20, Code Z) for ROCK. the Ages L.C. Statement A-QBI Pass-through Entity Reporting (Schedule K-1, Box 20, Code Z) QBI or qualified PTP items subject to partner-specific determinations: \begin{tabular}{|l|} \hline Ordinary business income (loss) \\ \hline Rental income (loss) .......... \\ \hline Royalty income (loss) ........ \\ \hline Section 1231 gain (loss) ...... \\ \hline Other income (loss).......... \\ Section 179 deduction......... \\ \hline Other deductions............. \\ \hline \end{tabular} Ryan Ross (111-11-1112), Oscar Omega (222-22-2223), Clark Carey (333-33-3334), and Kim Kardigan (444-44-4445) are equal active members in ROCK the Ages LLC. ROCK serves as agent and manager for prominent musicians in the Los Angeles area. The LLC's Federal ID number is 55-5555556. It uses the cash basis and the calendar year and began operations on January 1, 2009. Its current address is 6102 Wilshire Boulevard, Suite 2100, Los Angeles, CA 90036. ROCK was the force behind such music icons as Adrianna Venti, Drake Malone, Elena Gomez, Tyler Quick, Queen Bey, and Bruno Mercury and has had a very profitable year: The following information was taken from the LC'some statement for the current year. Recently, ROCK has taken advantage of bonus depreciation and $179 deductions and fully remodeled the premises and upgraded its leasehold improvements. This year, ROCK wrapped up its remodel with the purchase of $20,000 of office furniture for which it will claim a 5 179 deduction. (For simplicity, assume that ROCK uses the same cost recovery methods for both tax and financial purposes.) There is no depredation adjustment for alternative minimum tax purposes. ROCK invests much of its excess cash in non-dividend-paying growth stocks and tax-exempt securities. During the year, the LiC sold two securities. On June 15, 2021, ROCK purchased 1,000 shares of Tech, Inc, stock for $100,000; it sold those shares on December 15 , 2021, for $80,000. On March 15, 2020, ROCK purchased 2,000 shares of BioLabs, Inc., stock for $136,000; it sold those shares for $160,000 on December 15, 2021, These transactions were reported to the IRS on Forms 1099-B; ROCK's basis in these shares was reported. Net income per books is $840,000. On January 1, 2021, the members' tax basis capital accounts equaled $200,000 each. No additional capital contribubions were made in 2021. In addition to their guaranteed payments, each member withidrew $250,000 cash during the year. All contributions and distributions have been in cash, 50 the L.C has no net unrecognized 5704(c) gain or los5. The LiC's balance sheet as of December 31,2021 , is as follows. The firm's activities do not constitute "qualified production activities" for purposes of the $199 deduction. (Note that the $179 deduction is a business-related expense.) The LLC's UBIA (unadjusted basis immediately after acquisition) equals the total original cost of all leasehold improvements, or $980,000. All debt is shared equally by the members. Each member has personally guaranteed the debt of the LlC. All members are active in LCC operations. The business code for the entity is 711410 . Complete the 2021 Form 1065 for ROCK the Ages L.C with appropriate forms and schedules. Prepare Schedule K-1 for Ryan Ross. - If an amount box does not require an entry or the answer is zero, enter "0". - Enter all amounts as positive numbers, unless otherwise instructed. - If required, round amounts to the nearest dollar. - Make realistic assumptions about any missing data. Focm 1065 a. Prepare the 2021 Form 1065, pages 1, 4, and 5, for ROCK the Ages LC using tax basis information for Schedules L and M-2. If required, use the minus sign to indicate a loss. H Check accounting method: (1) : Cash (2) D Accrual (3) a Other (specify) I Number of Schedules K1. Attach one for each person who was a parther at any time during the tax year ? 3 Check if Schedules C and M3 are attached Caution: Include only trade or business income and expenses on lines 1 a through 22 below. See the instructions for more information. 13 Rent. 13 G =CC Interest (see instructions) 13a-pepreciation (if required, attach form 4562). b Less depreciation reported on Form 1125A and elsewhere on return \begin{tabular}{|c|} 16a \\ 16b \end{tabular} 17 Depletion (Do not deduct oll and gas depletion.) 18 Retirement plans, etc. 19 Employee benefit programs 20 Other deductions (att stmt) See Statement 1 21 Total deductions. Add the amounts shown in the far right column for lines 9 through 20. 23 Interest due under the look-back method - completed long-term contracts (attach Form 8697) ....... 23 24 Interest due under the-look-back method - income forecast method (attach Form 8866). 25 BBA AAR imputed underpayment (see instructions) 26 Other taxes (see instructions) 27 Total balance due. Add lines 23 throogh 26 28 Payment (see instructions) 29 Amount owed, If line 28 is smaller than line 27, enter amount owed \begin{tabular}{|l|} \hline 24 \\ \hline 25 \\ \hline 26 \\ \hline 27 \\ \hline 28 \\ \hline 29 \\ \hline \end{tabular} \begin{tabular}{l} Schedule M-2 Analysis of Partners' Capital Accounts \\ \hline \end{tabular} Prepare Form 8949 for ROCK the Ages U.C. If required, use the minus sign to indicate a loss. Before you check Bax A,B, or C below, see whether you received any Form(s) 1099- B or substitute statement(s) from your broker. A substitute statement will have the same information as Form 1099-B. Ecther wil show whether your basis (usuaily your cost) was reported to the ins by your broker and may even tell you which box to check. Part I Short-Term. Transoctions involving capital assets you held 1 year oe less are generally short-term (see instructions). For long. term transactions, see page 2. Note: You moy aggregate all short-term tansactions reported on Form(s) 1099-1 showing basis was reported to the 185 and for which no adjuatments or codes are required. Enter the totals directly on Schedule D, line 1o: you aren't required to report these trahsactions on Form 8949 (see instructions). You must check Box A, B, or C below, Check only ane box. If more than one box applies for your short-term transactions, complete a separate Form 8949, page 1, for each applcable box, If you have more short-term transactions than will nt on this page for one or more of the boxes, complete as many forms with the same box checked as you need. w (A) Short-term transactions reported on Form(s) 1099-6 showing basis was reported to the liss (see Note above) a (B) Short-term transactions reported on Form(5) 1099-B showing basis wasn't reported to the IRS Note: If you checked Box A above but the basis reported to the IRS was incorrect, enter in column (e) the basis as reported to the IRS, and enter an adjustment in column (g) to correct the basis. See Column (g) in the separate instructions for how to figure the amount of the adjustment. You must check Box D, E, or F below. Check only one box. If more than one box applles for your long-term transactions, complete a separate form 8949, page 2, for each applicable box. If you have more long-term transactions than will fit on this page for one or more of the boxes, complete as many forms with the same box checked as you need. (D) Long-term tiansactions reported on Form(s) 1099-B showing basis was reported to the IRS (see Note above) (E) Long-term transactions reported on Form(s) 1099-B showing basis wasn't reported to the IRS (F) Long-term transactions not reported to yeu on Form 1099 - thorted to the IRS was incorrect, enter in column (e) the basis as reported to the IRS, and adjutment: Business or activity to which this form relates Form 1065 Part 1 Election To Expense Certain Property Under Section 179 Noter If you have any listed property, complete Part v before you complete Part I. 1 Maximum amount (see instructions) 2 rotal cost of section 179 property placed in service (see instructions) 3 Threshold cost of sectian 179 property before reduction in limitation (see instructions) 4 Reduction in limitation. Subtract ine 3 from line 2. It zero or less, enter -0 - 5 Dollar limitabion for tax year. Subtract line 4 from line 1. If zero or less, enter -0. If married filing separately, see instrictions. 6 (a) Description of property (b) Cost (business use only) (c) Elected cost Note: Don't use Part II or Part III below for listed property. Instead, use Part V. Part II Special Depreciation Allowance and other Depreciation (Don't indude lsted property, See instructions.) 14 Spectal depreciation allowence for qualitied property (other than listed property) placed in service during the tax year. See instructions. 15 Property subject to section 168(f)(1) election. 16 Other depreciation (including ACRS) Part III MACRS Depreciation (Don't include listed property, See instructions.) Statement 3 Form 1065, Schedule K, Une 20c other Reportable Items Business Interest Expense (Informational Only for Basis Limitations) Included as a Deduction on the Following Uines(s) Schedule K, line 1 Statement 4 Form 1065, Schedule L, Une 6 Other Current Assets Marketable Securities. Total. 4120,000xBeginning120,000x 2021 Federal Statements Page 2 Rock the Ages LLC 55-5555556 Statement 6 Form 106S, Schedule M-2, Line 4 Other Increases Tax-Exempt Interest and/or Tax-Exempt Other income . Statement 7 Form 1065, Schedule M-2, Line 7 Other Decreases Guaranteed Payments (other than health insurance). Non-Deductible Expenses. 651121 D Final K1 0 Amended K1 OMB No. 15450123 Schedule K-1 (Form 1065) 2021 Part III Partner's Share of current Year Income, Department of the Treasury internal Revenue Service For calendac year 2021, or tax year 1 Ordinary business income 14 Selfemployment earnings (loss) A (loss) beginning 1/2021 ending 1,044,800 Partner's Share of Income, Deductions, 2 Net rental real estate income (loss) Credits, etc. See separate instructions. Part I Information About the Partnership 3 Other net rental income (loss) 15 Credits A Partnership's employer identification number \begin{tabular}{|l|l} \hline 55-5555556 & 4a Guaranteed payments for \end{tabular} services B Partnership's name, address, city, state, and ZIP code ROCK the Ages LLC 6102 Wilshire Boulevard Sulte 2100 4b Guaranteed payments for 16 Schedule K3 is attached if Los Angeles, CA 90036 capital checked. C IRS Center where partnership flled retum > e-fle 4c Total guaranteed payments 17 Aiternative minimum tax D a Check if this is a publicly traded partnership (PTP) 1 (AMT) items Schedule K-1 (Form 1065) 2021 Supplemental Information Page 2 Item L Partner's Capital Account Analysis Other Increase (Decrease) Other Increase Tax-Exempt Interest and/or Tax-Exempt Other Income Other Decrease Total Net Total Box 20, Code N Business Interest Expense Included as a Deduction on the Following Line(s) Below is deductible business interest expense for inclusion In the separate loss dass for computing any basis limitation (defined in section 704(d), Regulation section 1.163(j)6(h)). Complete Statement A-QB1 Pass-through Entity Reporting (Schedule K-1, Box 20, Code Z) for ROCK. the Ages L.C. Statement A-QBI Pass-through Entity Reporting (Schedule K-1, Box 20, Code Z) QBI or qualified PTP items subject to partner-specific determinations: \begin{tabular}{|l|} \hline Ordinary business income (loss) \\ \hline Rental income (loss) .......... \\ \hline Royalty income (loss) ........ \\ \hline Section 1231 gain (loss) ...... \\ \hline Other income (loss).......... \\ Section 179 deduction......... \\ \hline Other deductions............. \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

To fill out the missing boxes and correct entries for ROCK the Ages LLC lets break down the necessary calculations and entries based on the provided d... View full answer

Get step-by-step solutions from verified subject matter experts