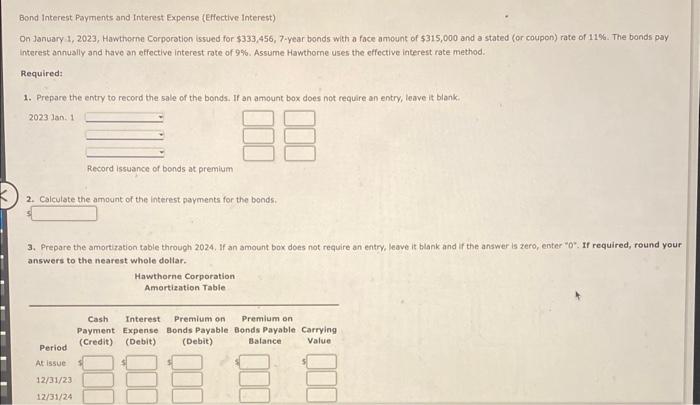

Question: please answer Bond Interest Payments and Interest Expense (Effective Interest) Dn January 1, 2023, Hawthorne Carporation issued for $333,456, 7-year bonds with a face amouns

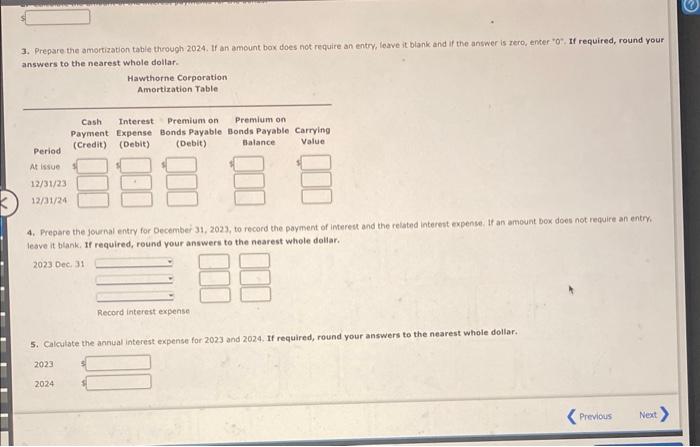

Bond Interest Payments and Interest Expense (Effective Interest) Dn January 1, 2023, Hawthorne Carporation issued for $333,456, 7-year bonds with a face amouns of 5315,000 and a stated (or coupon) rate of 11%. The bonds pay interest annually and have an effective interest rote of 9%. Assume Hawthorne uses the effective interest rate method. Required 1. Prepare the entry to record the sale of the bonds. If an amount box does not require an entry, leave it blank: 20: 2. Calculate the amount of the interest payments for the bonds. 3. Prepare the amortization table through 2024. If an amount bok does not require an entry, leave it blank and if the answer is zero, enter "o". If required, round your answers to the nearest whole dollar. Hawthorne Corporation Amortization Table 3. Prepare the amortization table through 2024, If an amount box does not require an entry, leave it blank and if the answer is zero, encer " 0 ", If required, round your answers to the nearest whole dollar. Hawthorne Corporation Amortization Table 4. Prepare the journal entry for December 31, 2023, to record the payment of intereut and the reiated interest expense. if an amount box does not require an entry. leave it blank. If required, round your answers to the nearest whole dolar. 2023 Dec 5. Calculate the annital interest expense for 2023 and 2024. If required, round your answers to the nearest whole dollar. 20232024

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts